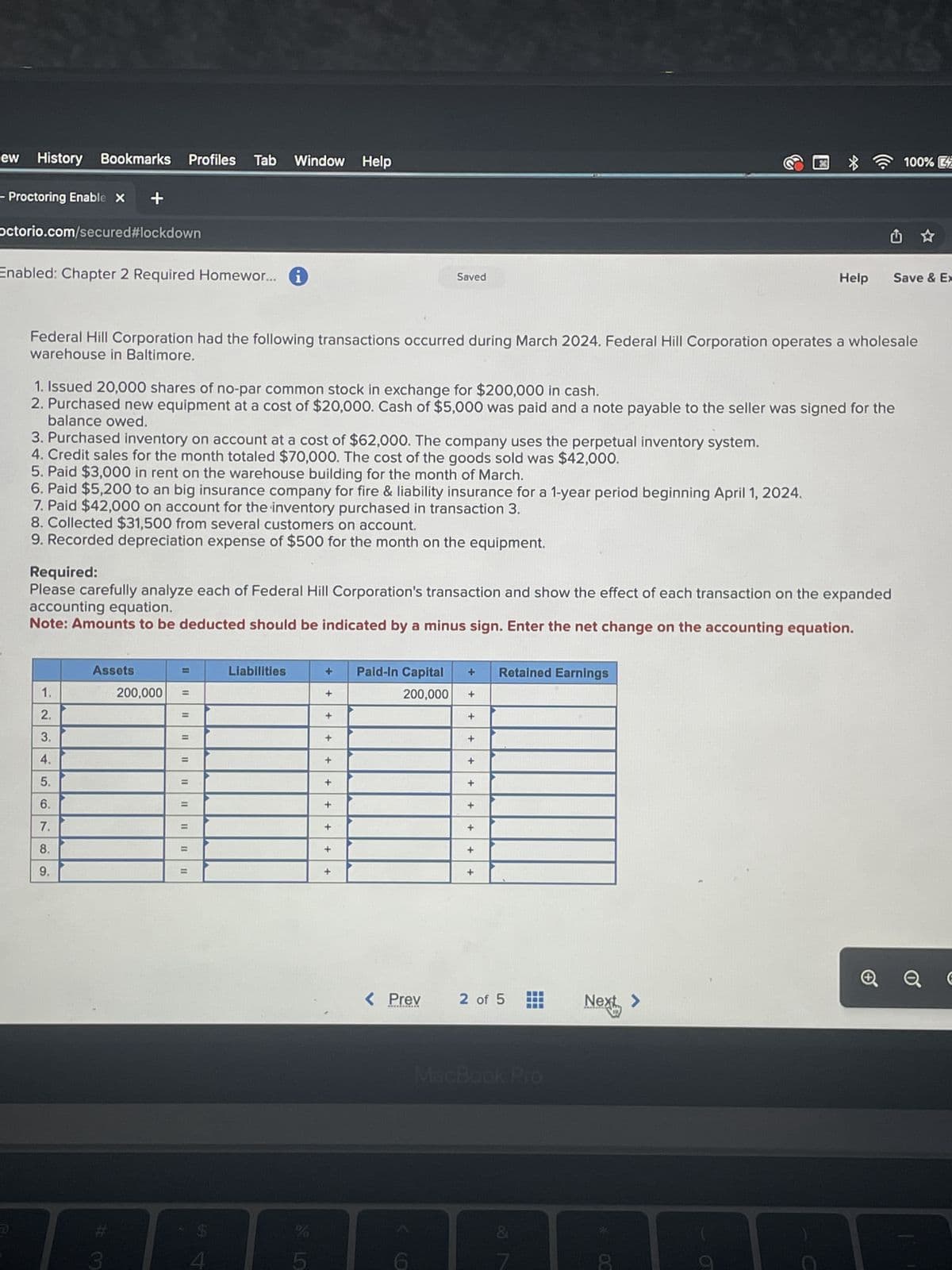

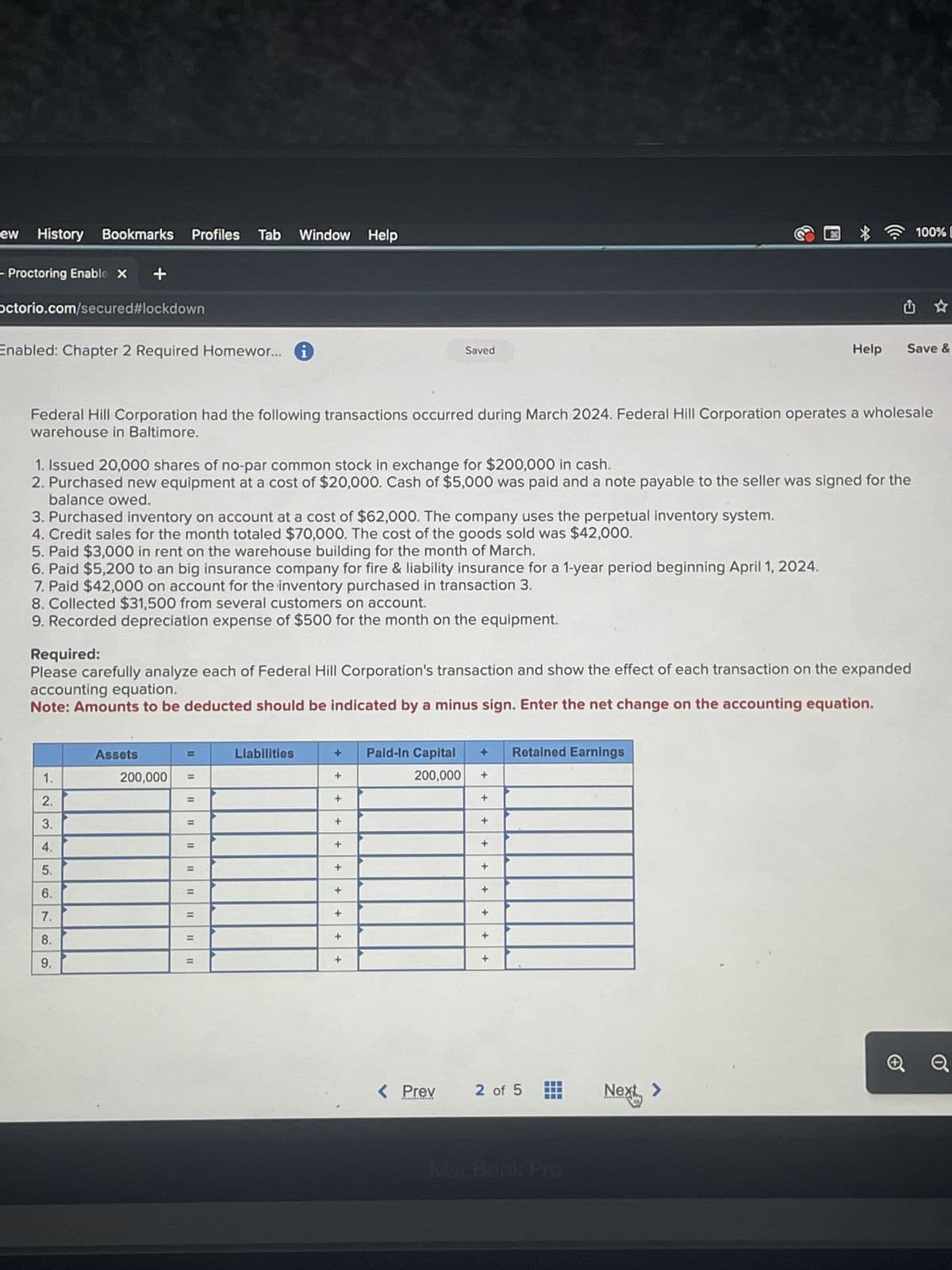

Federal Hill Corporation had the following transactions occurred during March 2024. Federal Hill Corporation operates a wholesale warehouse in Baltimore. 1. Issued 20,000 shares of no-par common stock in exchange for $200,000 in cash. 2. Purchased new equipment at a cost of $20,000. Cash of $5,000 was paid and a note payable to the seller was signed for the balance owed. 3. Purchased inventory on account at a cost of $62,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $70,000. The cost of the goods sold was $42,000. 5. Paid $3,000 in rent on the warehouse building for the month of March. 6. Paid $5,200 to an big insurance company for fire & liability insurance for a 1-year period beginning April 1, 2024. 7. Paid $42,000 on account for the inventory purchased in transaction 3. 8. Collected $31,500 from several customers on account. 9. Recorded depreciation expense of $500 for the month on the equipment. Required: Please carefully analyze each of Federal Hill Corporation's transaction and show the effect of each transaction on the expanded accounting equation. Note: Amounts to be deducted should be indicated by a minus sign. Enter the net change on the accounting equation. 1. 2. 3. 4. 5. 6. 7. 8. 9. Assets 200,000 = = = = = = = = = Liabilities + Paid-In Capital + Retained Earnings 200,000 + + + + + + + + + + + + + + + + + +

Federal Hill Corporation had the following transactions occurred during March 2024. Federal Hill Corporation operates a wholesale warehouse in Baltimore. 1. Issued 20,000 shares of no-par common stock in exchange for $200,000 in cash. 2. Purchased new equipment at a cost of $20,000. Cash of $5,000 was paid and a note payable to the seller was signed for the balance owed. 3. Purchased inventory on account at a cost of $62,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $70,000. The cost of the goods sold was $42,000. 5. Paid $3,000 in rent on the warehouse building for the month of March. 6. Paid $5,200 to an big insurance company for fire & liability insurance for a 1-year period beginning April 1, 2024. 7. Paid $42,000 on account for the inventory purchased in transaction 3. 8. Collected $31,500 from several customers on account. 9. Recorded depreciation expense of $500 for the month on the equipment. Required: Please carefully analyze each of Federal Hill Corporation's transaction and show the effect of each transaction on the expanded accounting equation. Note: Amounts to be deducted should be indicated by a minus sign. Enter the net change on the accounting equation. 1. 2. 3. 4. 5. 6. 7. 8. 9. Assets 200,000 = = = = = = = = = Liabilities + Paid-In Capital + Retained Earnings 200,000 + + + + + + + + + + + + + + + + + +

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter9: Accounting For Purchases And Cash Payments

Section9.2: Accounting For Merchandise Purchases

Problem 1OYO

Related questions

Question

100%

Please help

Transcribed Image Text:ew History Bookmarks Profiles Tab Window Help

Proctoring Enable X +

octorio.com/secured#lockdown

Enabled: Chapter 2 Required Homewor..

D

3. Purchased inventory on account at a cost of $62,000. The company uses the perpetual inventory system.

4. Credit sales for the month totaled $70,000. The cost of the goods sold was $42,000.

5. Paid $3,000 in rent on the warehouse building for the month of March.

6. Paid $5,200 to an big insurance company for fire & liability insurance for a 1-year period beginning April 1, 2024.

7. Paid $42,000 on account for the inventory purchased in transaction 3.

8. Collected $31,500 from several customers on account.

9. Recorded depreciation expense of $500 for the month on the equipment.

1.

Federal Hill Corporation had the following transactions occurred during March 2024. Federal Hill Corporation operates a wholesale

warehouse in Baltimore.

1. Issued 20,000 shares of no-par common stock in exchange for $200,000 in cash.

2. Purchased new equipment at a cost of $20,000. Cash of $5,000 was paid and a note payable to the seller was signed for the

balance owed.

N34567

2.

Required:

Please carefully analyze each of Federal Hill Corporation's transaction and show the effect of each transaction on the expanded

accounting equation.

Note: Amounts to be deducted should be indicated by a minus sign. Enter the net change on the accounting equation.

3.

4.

5.

6.

7.

8.

9.

Assets

#

3

200,000 =

=

11

=

=

i

||

11 11

$

4

Liabilities

& LO

%

5

+

+

+

+

Saved

+

+

+

Paid-In Capital

200,000

< Prev

+

+

+

+

+

+

+

+

Retained Earnings

2 of 5

‒‒‒

X

MacBook Pro

Help

Next >

MACED

OC

100% Z

Save & Ex

Transcribed Image Text:ew

History Bookmarks Profiles Tab Window Help

Proctoring Enable X +

Octorio.com/secured#lockdown

Enabled: Chapter 2 Required Homewor... i

3. Purchased inventory on account at a cost of $62,000. The company uses the perpetual inventory system.

4. Credit sales for the month totaled $70,000. The cost of the goods sold was $42,000.

5. Paid $3,000 in rent on the warehouse building for the month of March.

6. Paid $5,200 to an big insurance company for fire & liability insurance for a 1-year period beginning April 1, 2024.

7. Paid $42,000 on account for the inventory purchased in transaction 3.

8. Collected $31,500 from several customers on account.

9. Recorded depreciation expense of $500 for the month on the equipment.

Federal Hill Corporation had the following transactions occurred during March 2024. Federal Hill Corporation operates a wholesale

warehouse in Baltimore.

1. Issued 20,000 shares of no-par common stock in exchange for $200,000 in cash.

2. Purchased new equipment at a cost of $20,000. Cash of $5,000 was paid and a note payable to the seller was signed for the

balance owed.

1.

2.

869 SAWN

3.

Required:

Please carefully analyze each of Federal Hill Corporation's transaction and show the effect of each transaction on the expanded

accounting equation.

Note: Amounts to be deducted should be indicated by a minus sign. Enter the net change on the accounting equation.

4.

5.

6.

7.

8.

9.

Assets

200,000

=

=

||

=

Liabilities

Saved

+ Paid-In Capital

200,000

+

+

+

< Prev

Shania TRAD

+

+

+

+

Retained Earnings

*

2 of 5

Help

MacBook Pro

Next >

Save &

100% [

Q

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning