the books of BACOLOD CORP. for the period ended December 31, You were TER 11-PROBLEM 8: 2018. The bookkeeper of the client provided you the following summarized data taken directly from its records: Sales for cash Total cash collected from charge customers Cash purchases of merchandise Credit purchases of merchandise Expenses paid in cash Accounts receivable, January 1 Accounts receivable, December 31 Bad debt expense Recovery of bad debts Allowance for doubtful accounts, January 1 Allowance for doubtful accounts, December 31 Accounts payable, January 1 Accounts payable, December 31 Merchandise inventory, January 1 Merchandise inventory, December 31 Accrued expenses, December 31 Prepaid expenses, December 31 Furniture and equipment, at cost Interest received Accrued interest income, January 1 Purchase returns Purchase discounts us the P7,500,000 2,550,000 5,100,000 1,200,000 2,250,000 4. What is the net income for the year? 750,000 1,200,000 100,000 25,000 125,000 175,000 450,000 600,000 1,500,000 1,800,000 60,000 90,000 Additional information: The furniture and equipment which had an estimated useful life of 10 years were acquired on July 1, 2015 and were estimated to have a 10% salvage value based on cost. The company uses the double declining balance method in computing the depreciation. Requirements: 3,000,000 120,000 30,000 120,000 210,000

the books of BACOLOD CORP. for the period ended December 31, You were TER 11-PROBLEM 8: 2018. The bookkeeper of the client provided you the following summarized data taken directly from its records: Sales for cash Total cash collected from charge customers Cash purchases of merchandise Credit purchases of merchandise Expenses paid in cash Accounts receivable, January 1 Accounts receivable, December 31 Bad debt expense Recovery of bad debts Allowance for doubtful accounts, January 1 Allowance for doubtful accounts, December 31 Accounts payable, January 1 Accounts payable, December 31 Merchandise inventory, January 1 Merchandise inventory, December 31 Accrued expenses, December 31 Prepaid expenses, December 31 Furniture and equipment, at cost Interest received Accrued interest income, January 1 Purchase returns Purchase discounts us the P7,500,000 2,550,000 5,100,000 1,200,000 2,250,000 4. What is the net income for the year? 750,000 1,200,000 100,000 25,000 125,000 175,000 450,000 600,000 1,500,000 1,800,000 60,000 90,000 Additional information: The furniture and equipment which had an estimated useful life of 10 years were acquired on July 1, 2015 and were estimated to have a 10% salvage value based on cost. The company uses the double declining balance method in computing the depreciation. Requirements: 3,000,000 120,000 30,000 120,000 210,000

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter6: Losses And Loss Limitations

Section: Chapter Questions

Problem 1BD

Related questions

Question

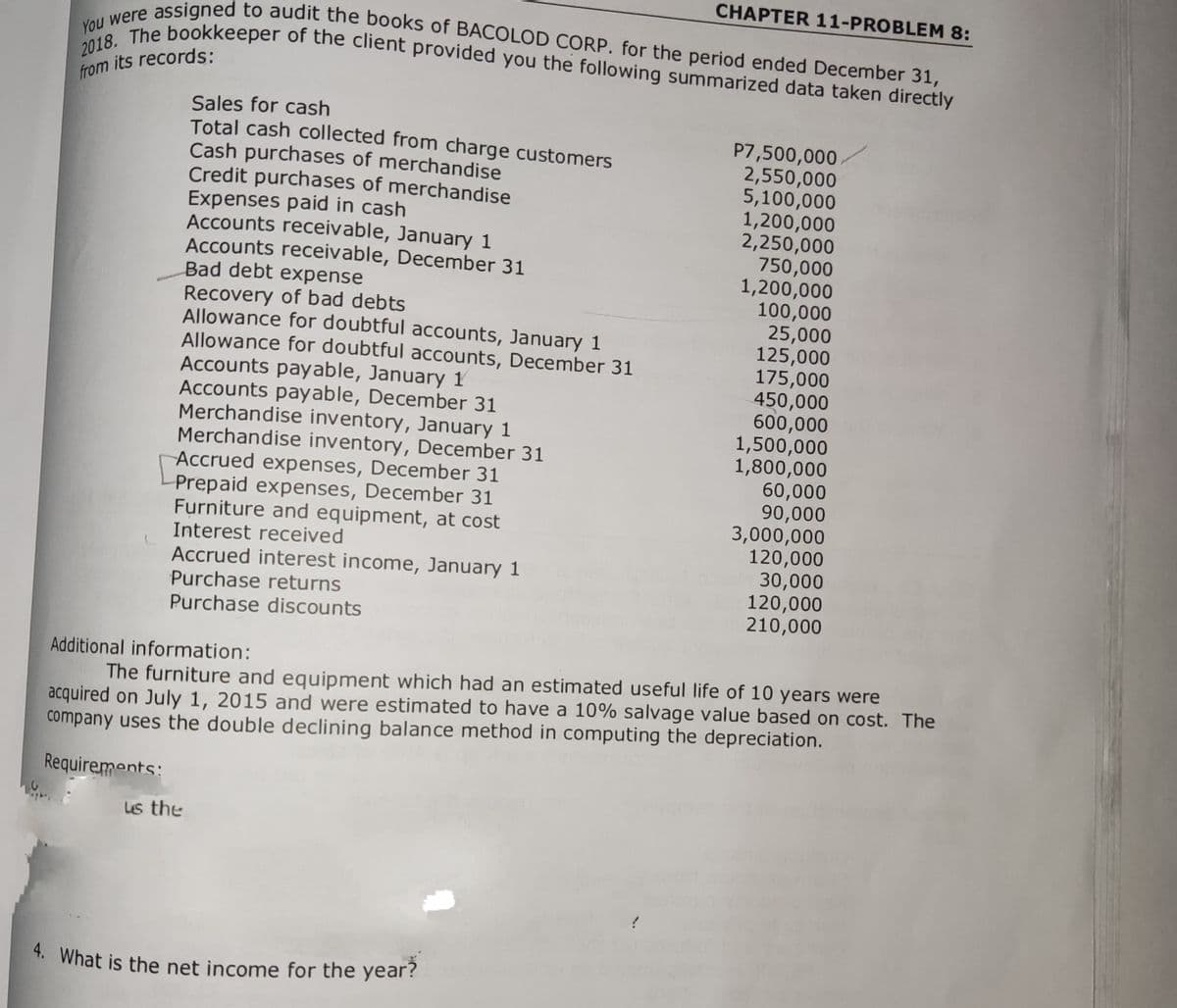

Transcribed Image Text:2018. The bookkeeper of the client provided you the following summarized data taken directly

You were assigned to audit the books of BACOLOD CORP. for the period ended December 31,

from its records:

Sales for cash

Total cash collected from charge customers

Cash purchases of merchandise

Credit purchases of merchandise

Expenses paid in cash

Accounts receivable, January 1

Accounts receivable, December 31

Bad debt expense

Recovery of bad debts

Allowance for doubtful accounts, January 1

Allowance for doubtful accounts, December 31

Accounts payable, January 1

Accounts payable, December 31

Merchandise inventory, January 1

Merchandise inventory, December 31

Accrued expenses, December 31

Prepaid expenses, December 31

Furniture and equipment, at cost

Interest received

Accrued interest income, January 1

Purchase returns

Purchase discounts

us the

CHAPTER 11-PROBLEM 8:

4. What is the net income for the year?

P7,500,000

2,550,000

5,100,000

1,200,000

2,250,000

750,000

1,200,000

100,000

25,000

125,000

175,000

450,000

600,000

1,500,000

1,800,000

60,000

90,000

Additional information:

The furniture and equipment which had an estimated useful life of 10 years were

acquired on July 1, 2015 and were estimated to have a 10% salvage value based on cost. The

company uses the double declining balance method in computing the depreciation.

Requirements:

3,000,000

120,000

30,000

120,000

210,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,