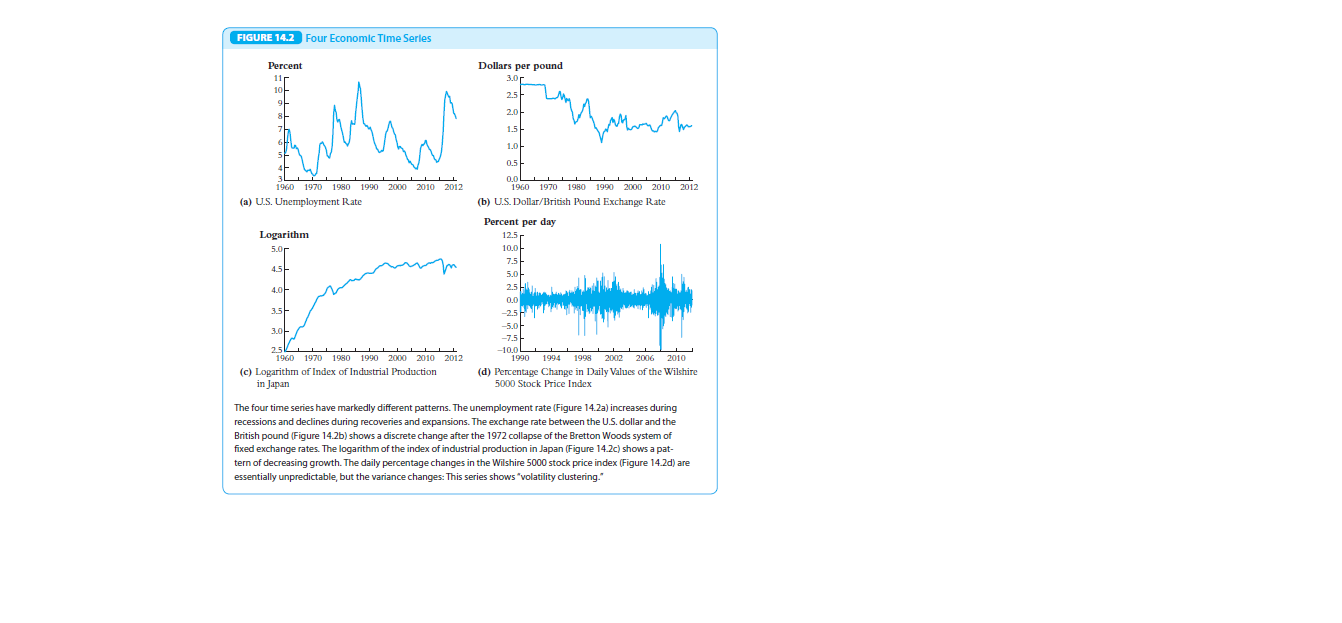

FIGURE 14.2 Four Economic Time Serles Percent Dollars per pound 11r 1아 3.0r 2.5 2.아 1.5- 1.0 0.5 - 0.0L 1960 1970 1980 1990 2000 2010 2012 1960 1970 1980 1990 2000 2010 2012 (a) U.S. Unemployment Rate (b) U.S. Dollar/British Pound Exchange Rate Percent per day Logarithm 12.5 5.0r 10.0 7.5 4.5- 5.0 2.5 4.0- 0.0 3.5- -2.5 -5.0 3.0- -7.5 25 1960 1970 1980 1990 2000 2010 2012 -10.0 1990 1994 1998 2002 2006 2010 (c) Logarithm of Index of Industrial Production in Japan (d) Percentage Change in Daily Values of the Wilshire 5000 Stock Price Index The four time series have markedly different patterns. The unemployment rate (Figure 14.2a) increases during recessions and declines during recoveries and expansions. The exchange rate between the U.S. dollar and the British pound (Figure 14.2b) shows a discrete change after the 1972 collapse of the Bretton Woods system of fixed exchange rates. The logarithm of the index of industrial production in Japan (Figure 14.2c) shows a pat- tern of decreasing growth. The daily percentage changes in the Wilshire 5000 stock price index (Figure 14.2d) are essentially unpredictable, but the variance changes: This series shows "volatility clustering."

FIGURE 14.2 Four Economic Time Serles Percent Dollars per pound 11r 1아 3.0r 2.5 2.아 1.5- 1.0 0.5 - 0.0L 1960 1970 1980 1990 2000 2010 2012 1960 1970 1980 1990 2000 2010 2012 (a) U.S. Unemployment Rate (b) U.S. Dollar/British Pound Exchange Rate Percent per day Logarithm 12.5 5.0r 10.0 7.5 4.5- 5.0 2.5 4.0- 0.0 3.5- -2.5 -5.0 3.0- -7.5 25 1960 1970 1980 1990 2000 2010 2012 -10.0 1990 1994 1998 2002 2006 2010 (c) Logarithm of Index of Industrial Production in Japan (d) Percentage Change in Daily Values of the Wilshire 5000 Stock Price Index The four time series have markedly different patterns. The unemployment rate (Figure 14.2a) increases during recessions and declines during recoveries and expansions. The exchange rate between the U.S. dollar and the British pound (Figure 14.2b) shows a discrete change after the 1972 collapse of the Bretton Woods system of fixed exchange rates. The logarithm of the index of industrial production in Japan (Figure 14.2c) shows a pat- tern of decreasing growth. The daily percentage changes in the Wilshire 5000 stock price index (Figure 14.2d) are essentially unpredictable, but the variance changes: This series shows "volatility clustering."

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

Look at the four plots in Figure 14.2—the US unemployment rate, the

dollar-pound exchange rate, the logarithm of the index of industrial production, and the percentage change in stock prices. Which of these series

appears to be non-stationary? Which of them appears to resemble a random

walk?

Transcribed Image Text:FIGURE 14.2 Four Economic Time Serles

Percent

Dollars per pound

11r

1아

3.0r

2.5

2.아

1.5-

1.0

0.5

-

0.0L

1960 1970 1980 1990 2000 2010 2012

1960 1970 1980 1990 2000 2010 2012

(a) U.S. Unemployment Rate

(b) U.S. Dollar/British Pound Exchange Rate

Percent per day

Logarithm

12.5

5.0r

10.0

7.5

4.5-

5.0

2.5

4.0-

0.0

3.5-

-2.5

-5.0

3.0-

-7.5

25

1960 1970 1980 1990 2000 2010 2012

-10.0

1990 1994

1998 2002

2006

2010

(c) Logarithm of Index of Industrial Production

in Japan

(d) Percentage Change in Daily Values of the Wilshire

5000 Stock Price Index

The four time series have markedly different patterns. The unemployment rate (Figure 14.2a) increases during

recessions and declines during recoveries and expansions. The exchange rate between the U.S. dollar and the

British pound (Figure 14.2b) shows a discrete change after the 1972 collapse of the Bretton Woods system of

fixed exchange rates. The logarithm of the index of industrial production in Japan (Figure 14.2c) shows a pat-

tern of decreasing growth. The daily percentage changes in the Wilshire 5000 stock price index (Figure 14.2d) are

essentially unpredictable, but the variance changes: This series shows "volatility clustering."

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman