8:44 PM O ll 83 Answered: Here is the .. bartleby.com = bartleby E Q&A Sign In Business / Finance / Q&A Library / Here is the problem: F... Here is the problem: Famas's LLamas h... Famas's LLamas has a weighted average cost of capital of 7.9%. The company's cost of equity is 11% and its pretaxt cost of debt is 5.8%. The taxt rate is 25%. What is the company's target debt- equity ratio? Here is the solution: Here we have the WACC and need to find the debt-equity ratio of the company. Setting up the WACC equation, we find: WACC = .0790 =.11(E/M) + .058(D/)(1 – .25) Rearranging the equation, we find: .0790(V/E) = .11+.058(.75)(D/E) %3D Now we must realize that the V/E is just the equity multiplier, which is equal to:

8:44 PM O ll 83 Answered: Here is the .. bartleby.com = bartleby E Q&A Sign In Business / Finance / Q&A Library / Here is the problem: F... Here is the problem: Famas's LLamas h... Famas's LLamas has a weighted average cost of capital of 7.9%. The company's cost of equity is 11% and its pretaxt cost of debt is 5.8%. The taxt rate is 25%. What is the company's target debt- equity ratio? Here is the solution: Here we have the WACC and need to find the debt-equity ratio of the company. Setting up the WACC equation, we find: WACC = .0790 =.11(E/M) + .058(D/)(1 – .25) Rearranging the equation, we find: .0790(V/E) = .11+.058(.75)(D/E) %3D Now we must realize that the V/E is just the equity multiplier, which is equal to:

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter17: Financial Markets

Section: Chapter Questions

Problem 40P: Many retirement funds charge an administrative fee each year equal to 0.25% on managed assets....

Related questions

Question

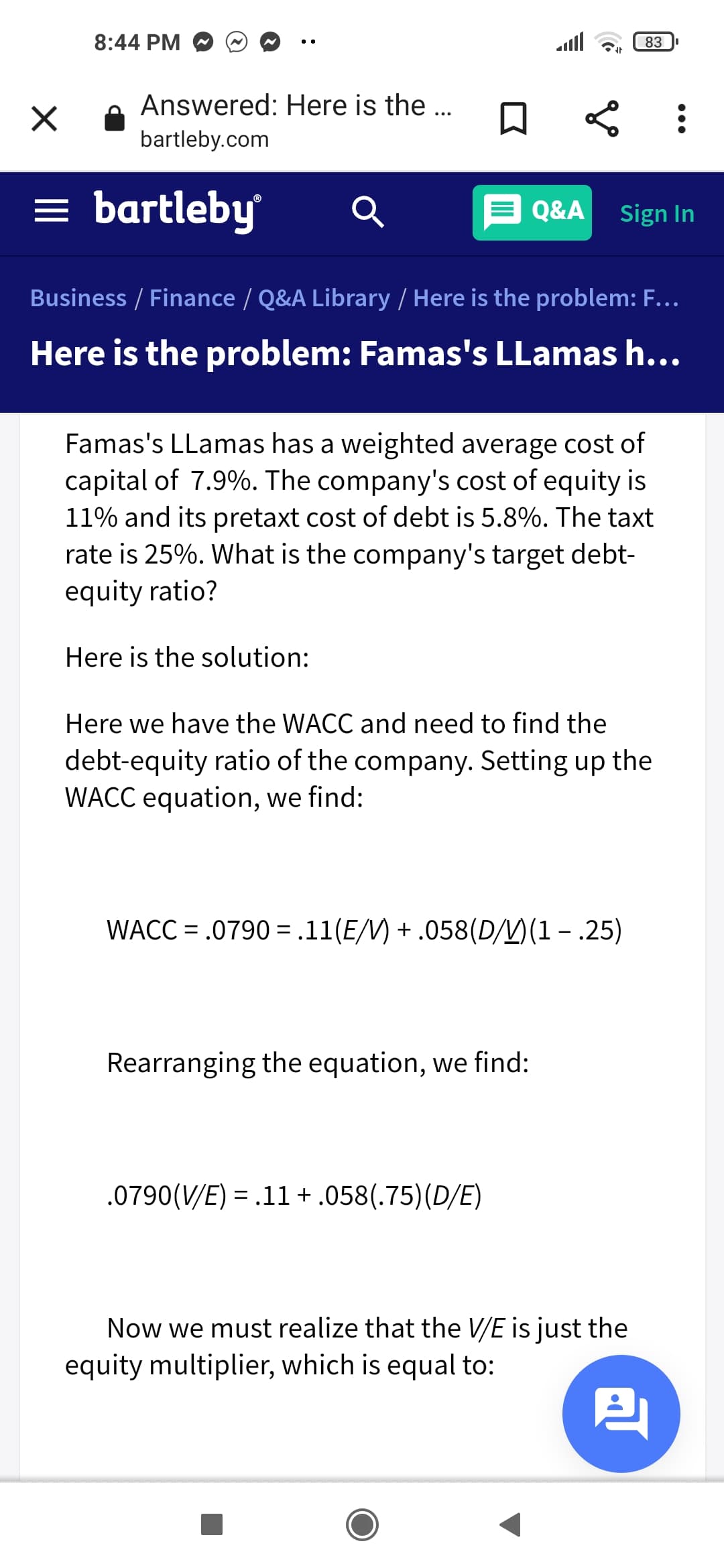

I need help especifically with the part where they rearrange the equation as:

.0790(V/E) = .11 + .058(.75)(D/E).

How do they get an inverse (V/E) on the left side without the .11. And how do they get a (D/E) ratio.

Transcribed Image Text:8:44 PM O

ll

83

Answered: Here is the ..

bartleby.com

= bartleby

E Q&A

Sign In

Business / Finance / Q&A Library / Here is the problem: F...

Here is the problem: Famas's LLamas h...

Famas's LLamas has a weighted average cost of

capital of 7.9%. The company's cost of equity is

11% and its pretaxt cost of debt is 5.8%. The taxt

rate is 25%. What is the company's target debt-

equity ratio?

Here is the solution:

Here we have the WACC and need to find the

debt-equity ratio of the company. Setting up the

WACC equation, we find:

WACC = .0790 =.11(E/M) + .058(D/)(1 – .25)

Rearranging the equation, we find:

.0790(V/E) = .11+.058(.75)(D/E)

%3D

Now we must realize that the V/E is just the

equity multiplier, which is equal to:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning