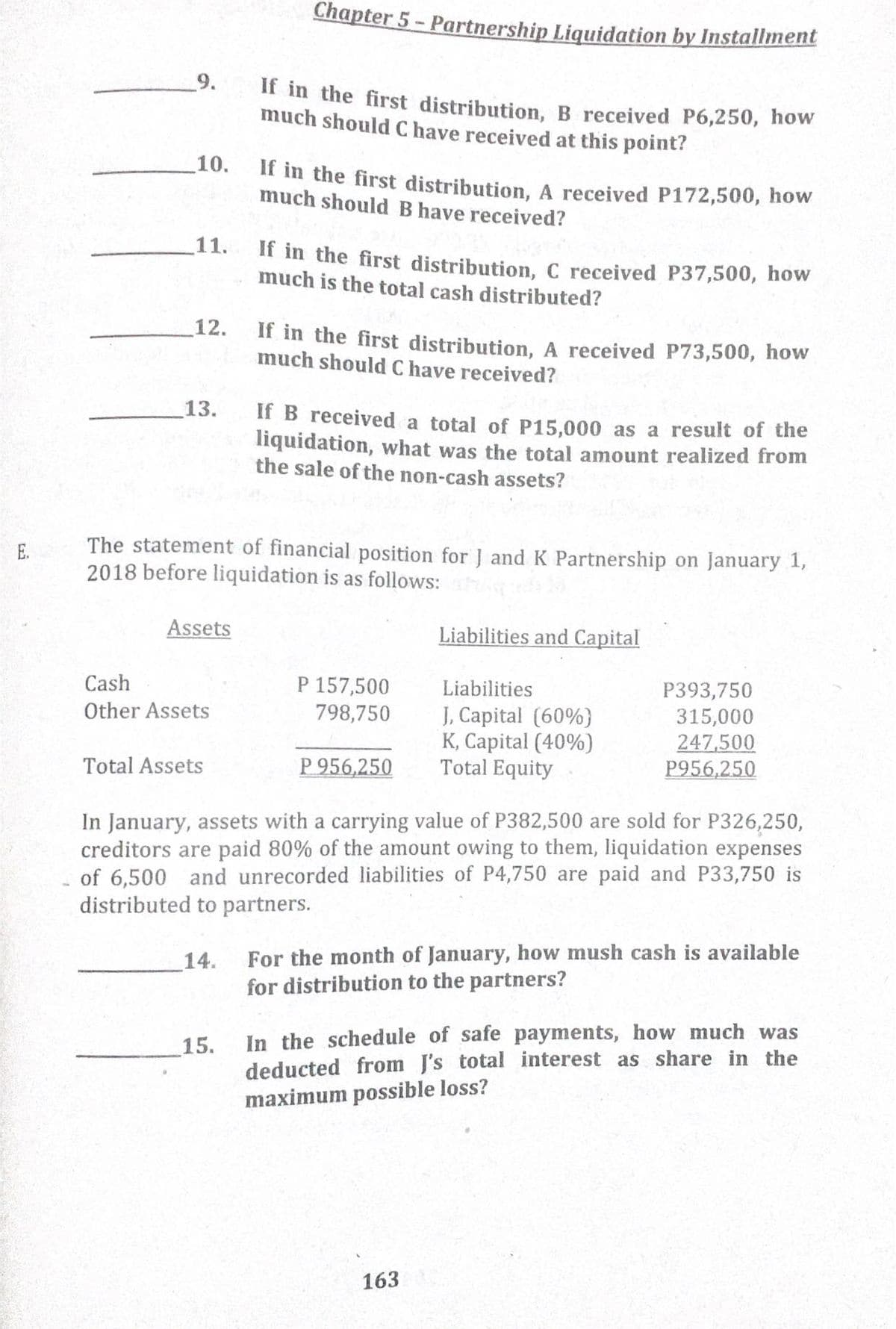

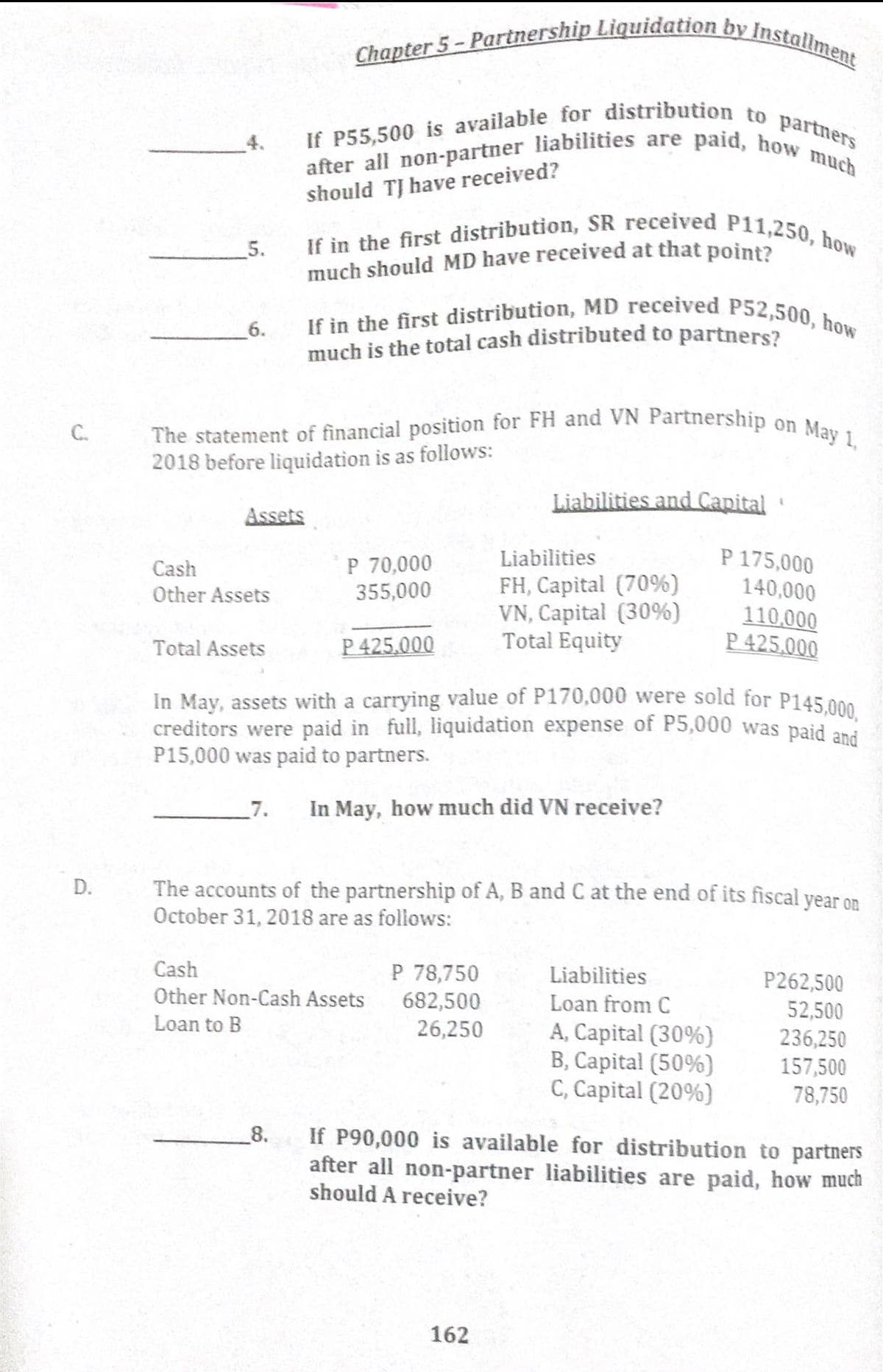

Chapter 5 - Partnership Liquidation by Installment 9. If in the first distribution, B received P6,250, how much should C have received at this point? 10. If in the first distribution, A received P172,500, how much should B have received? 11. If in the first distribution, C received P37,500, how much is the total cash distributed? 12. If in the first distribution, A received P73,500, how much should C have received? 13. If B received a total of P15,000 as a result of the liquidation, what was the total amount realized from the sale of the non-cash assets? The statement of financial position for J andK Partnership on January 1, 2018 before liquidation is as follows: E. Assets Liabilities and Capital P 157,500 798,750 Cash Liabilities P393,750 315,000 247,500 P956,250 Other Assets J, Capital (60%} K, Capital (40%) Total Equity Total Assets P 956,250 In January, assets with a carrying value of P382,500 are sold for P326,250, creditors are paid 80% of the amount owing to them, liquidation expenses of 6,500 and unrecorded liabilities of P4,750 are paid and P33,750 is distributed to partners. For the month of January, how mush cash is available for distribution to the partners? 14. In the schedule of safe payments, how much was deducted from J's total interest as share in the maximum possible loss? 15. 163 much should MD have received at that point? The statement of financial position for FH and VN Partnership on May 1, Chapter 5 - Partnership Liquidation by Installment If in the first distribution, MD received P52,500, how If P55,500 is available for distribution to partners after all non-partner liabilities are paid, how much If in the first distribution, SR received P11,250, how should TJ have received? 5. 6. much is the total cash distributed to partners? C. 2018 before liquidation is as follows: Liabilities and Capital Assets P 175,000 140,000 Liabilities P 70,000 355,000 Cash FH, Capital (70%) VN, Capital (30%) Total Equity Other Assets 110,000 P 425,000 Total Assets P 425,000 In May, assets with a carrying value of P170,000 were sold for P145.000 creditors were paid in full, liquidation expense of P5,000 was paid ani P15,000 was paid to partners. 7. In May, how much did VN receive? The accounts of the partnership of A, B and C at the end of its fiscal year on October 31, 2018 are as follows: Cash P 78,750 Liabilities P262,500 Other Non-Cash Assets 682,500 26,250 Loan from C 52,500 236,250 157,500 78,750 Loan to B A, Capital (30%) B, Capital (50%) C, Capital (20%) If P90,000 is available for distribution to partners after all non-partner liabilities are paid, how much should A receive? 8. 162 D.

Chapter 5 - Partnership Liquidation by Installment 9. If in the first distribution, B received P6,250, how much should C have received at this point? 10. If in the first distribution, A received P172,500, how much should B have received? 11. If in the first distribution, C received P37,500, how much is the total cash distributed? 12. If in the first distribution, A received P73,500, how much should C have received? 13. If B received a total of P15,000 as a result of the liquidation, what was the total amount realized from the sale of the non-cash assets? The statement of financial position for J andK Partnership on January 1, 2018 before liquidation is as follows: E. Assets Liabilities and Capital P 157,500 798,750 Cash Liabilities P393,750 315,000 247,500 P956,250 Other Assets J, Capital (60%} K, Capital (40%) Total Equity Total Assets P 956,250 In January, assets with a carrying value of P382,500 are sold for P326,250, creditors are paid 80% of the amount owing to them, liquidation expenses of 6,500 and unrecorded liabilities of P4,750 are paid and P33,750 is distributed to partners. For the month of January, how mush cash is available for distribution to the partners? 14. In the schedule of safe payments, how much was deducted from J's total interest as share in the maximum possible loss? 15. 163 much should MD have received at that point? The statement of financial position for FH and VN Partnership on May 1, Chapter 5 - Partnership Liquidation by Installment If in the first distribution, MD received P52,500, how If P55,500 is available for distribution to partners after all non-partner liabilities are paid, how much If in the first distribution, SR received P11,250, how should TJ have received? 5. 6. much is the total cash distributed to partners? C. 2018 before liquidation is as follows: Liabilities and Capital Assets P 175,000 140,000 Liabilities P 70,000 355,000 Cash FH, Capital (70%) VN, Capital (30%) Total Equity Other Assets 110,000 P 425,000 Total Assets P 425,000 In May, assets with a carrying value of P170,000 were sold for P145.000 creditors were paid in full, liquidation expense of P5,000 was paid ani P15,000 was paid to partners. 7. In May, how much did VN receive? The accounts of the partnership of A, B and C at the end of its fiscal year on October 31, 2018 are as follows: Cash P 78,750 Liabilities P262,500 Other Non-Cash Assets 682,500 26,250 Loan from C 52,500 236,250 157,500 78,750 Loan to B A, Capital (30%) B, Capital (50%) C, Capital (20%) If P90,000 is available for distribution to partners after all non-partner liabilities are paid, how much should A receive? 8. 162 D.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 29P

Related questions

Question

Can you help me with no.8,9,10,11,12,13

Transcribed Image Text:Chapter 5 - Partnership Liquidation by Installment

9.

If in the first distribution, B received P6,250, how

much should C have received at this point?

10.

If in the first distribution, A received P172,500, how

much should B have received?

11.

If in the first distribution, C received P37,500, how

much is the total cash distributed?

12.

If in the first distribution, A received P73,500, how

much should C have received?

13.

If B received a total of P15,000 as a result of the

liquidation, what was the total amount realized from

the sale of the non-cash assets?

The statement of financial position for J andK Partnership on January 1,

2018 before liquidation is as follows:

E.

Assets

Liabilities and Capital

P 157,500

798,750

Cash

Liabilities

P393,750

315,000

247,500

P956,250

Other Assets

J, Capital (60%}

K, Capital (40%)

Total Equity

Total Assets

P 956,250

In January, assets with a carrying value of P382,500 are sold for P326,250,

creditors are paid 80% of the amount owing to them, liquidation expenses

of 6,500 and unrecorded liabilities of P4,750 are paid and P33,750 is

distributed to partners.

For the month of January, how mush cash is available

for distribution to the partners?

14.

In the schedule of safe payments, how much was

deducted from J's total interest as share in the

maximum possible loss?

15.

163

Transcribed Image Text:much should MD have received at that point?

The statement of financial position for FH and VN Partnership on May 1,

Chapter 5 - Partnership Liquidation by Installment

If in the first distribution, MD received P52,500, how

If P55,500 is available for distribution to partners

after all non-partner liabilities are paid, how much

If in the first distribution, SR received P11,250, how

should TJ have received?

5.

6.

much is the total cash distributed to partners?

C.

2018 before liquidation is as follows:

Liabilities and Capital

Assets

P 175,000

140,000

Liabilities

P 70,000

355,000

Cash

FH, Capital (70%)

VN, Capital (30%)

Total Equity

Other Assets

110,000

P 425,000

Total Assets

P 425,000

In May, assets with a carrying value of P170,000 were sold for P145.000

creditors were paid in full, liquidation expense of P5,000 was paid ani

P15,000 was paid to partners.

7.

In May, how much did VN receive?

The accounts of the partnership of A, B and C at the end of its fiscal year on

October 31, 2018 are as follows:

Cash

P 78,750

Liabilities

P262,500

Other Non-Cash Assets

682,500

26,250

Loan from C

52,500

236,250

157,500

78,750

Loan to B

A, Capital (30%)

B, Capital (50%)

C, Capital (20%)

If P90,000 is available for distribution to partners

after all non-partner liabilities are paid, how much

should A receive?

8.

162

D.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College