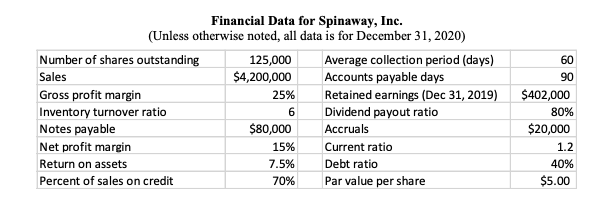

Financial Data for Spinaway, Inc. (Unless otherwise noted, all data is for December 31, 2020) Number of shares outstanding Sales 125,000 Average collection period (days) 60 $4,200,000 Accounts payable days 90 Gross profit margin 25% Retained earnings (Dec 31, 2019) $402,000 Inventory turnover ratio 6 Dividend payout ratio 80% Notes payable $80,000 Accruals $20,000 Net profit margin 15% Current ratio 1.2 Return on assets 7.5% Debt ratio 40% Percent of sales on credit 70% Par value per share $5.00

Q: Presented below is information related to Sheridan Corp. for the year 2020. The information is…

A: Income Statement - It is a financial statement which shows the company's income and expenses over a…

Q: 1. Compute the 2019 basic earnings per share. If required, round your answer to two decimal places.…

A: Earnings per cash (EPS): The amount available as earnings for each of the common shares…

Q: The 2020 income statement of Blossom Corporation showed net income of $1,271,000, which included a…

A: Earnings per share (EPS) which states that how much money which company could make for each and…

Q: At December 31, 2020 and 2021, Funk & Noble Corporation had outstanding 1,000 million shares of…

A: Formula: Earnings per share = (Net Income - Preferred dividends) / No. of common shares outstanding…

Q: The following balances were obtained from the books of Tim Curry plc as at December 31,…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Comparative Earnings per Share Lucas Company reports net income of $2,460 for the year ended…

A: The following computations are done for Lucas Company.

Q: Maggie's Skunk Removal Corp's 2018 income statement listed net sales of $13.8 million, gross profit…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: Hello Guys here is the Income statement, balance sheet for Marriot and average stock price for 20…

A: Please note that we have answered the first question here. Please resubmit the other questions…

Q: Graham, Inc. began 2020 with 25,000 common shares outstanding and issued a 20% stock dividend on…

A: Earnings per share of the company means all earnings available for each and every common…

Q: "ellow Enterprises reported the following ($ in thousands) as of December 31, 2021. All accounts…

A: The shareholders' equity include all the capital and net income related to shareholders.

Q: At December 31, 2020 and 2021, Funk & Noble Corporation had outstanding 840 million shares of…

A: Earnings per Share: Earnings per share help to measure the profitability of a company. Earnings per…

Q: Comparative Earnings per Share Lucas Company reports net income of $2,580 for the year ended…

A: 1. Basic earnings per share for 2019 = Net Income / weighted average number of shares outstanding…

Q: Yellow Enterprises reported the following ($ in thousands) as of December 31, 2021. All accounts…

A: Stockholders' equity refers to the value of assets remaining after the settlement of all the…

Q: The company's total shareholders' equity as of 12/31/2020 is $1,777,000 Common stock; par value of…

A: Multi-step income statement approach is an approach that categorizes the income and expenses as…

Q: The following balances were obtained from the books of Tim Curry plc as at December 31,…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Pineapple Co. reported total assets of P2,100,000 and total liabilities of P1,360,000 in its…

A: Stockholder's equity: It implies to the remaining value of net assets that are owned by the…

Q: Shilling Company reports the following information for its fiscal year-end of March 31, 2019: Common…

A: Paid-in capital in excess of par – Common = Total stockholders’ equity - Common stock - Retained…

Q: A firm reported the following financials for 2021: Sales revenue = $3,060 Accounts receivables =…

A: Earnings per share: Earnings per share is the earnings available for the equity shareholders of the…

Q: Red Hat Company began operations in January 2018 and reported the following results of operations…

A: Book value per common stock = (Total stockholder's equity-(liquidation value of preferred stock+…

Q: Here is the income statement for Teal Mountain Inc. TEAL MOUNTAIN INC. Income Statement For the…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. If you want…

Q: On December 31, 2020 and 2019, Bucks Corporation had 105,000 Ordinary Shares issued, 5,000 shares in…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: As of December 31, 2023, Ajax Corporation reported the following: Salaries payable $25,000; Treasury…

A: Equity share capital refers capital which is raised by a corporation by offering shares.

Q: At December 31, 2021, the financial statements of Hollingsworth Industries included the following: $…

A: Diluted EPS Diluted EPS is used to evaluate the quality of a company's profits per share after all…

Q: Culver Corporation reported net income of $282,540 in 2020 and had 45,000 shares of common stock…

A: Net Income:$282,540 Outstanding shares: 45,000 Convertible instruments: 10,400(5200*2)(for every…

Q: he following information for Smith Inc., for the year 2019, is as follows: Earnings from…

A:

Q: The Red Hat Company began operations in January 2018 and reported the following results of…

A: Preference Share Capital = P 6,000,000 Dividend = 9% Preference share outstanding = 60,000 Ordinary…

Q: Here is the income statement for Windsor, Inc. WINDSOR, INC. Income Statement For the Year Ended…

A: The income statement for Windsor, Inc is given Required Compute the following measures for 20201.…

Q: On January 1, 2020, Blue Company’s board of directors declared a cash dividend of P6,000,000 to…

A: The regular dividend can be defined as the distribution of profits to the shareholders of the…

Q: Keokuk Corp. had the following operating results for 2021 & 2020. Keokuk paid dividends of $100,000…

A: Ratios are the mathematical expressions computed with two figures for comparison. When the figures…

Q: Account balances on December 31, 2020: Inventory $ 72,000 Net sales 450,000 Current assets 150,000…

A: Answer - Formula for, Return on equity = Net income / Shareholders’ equity Here, Shareholders…

Q: Beverly Company provides the following information for the year 2020: January 1 December 31 Total…

A: Beginning retained earnings = total assets - total liabilities - share capital - share premium =…

Q: Headland Corporation had 2020 net income of $1,028,000. During 2020, Headland paid a dividend of $2…

A:

Q: Bramble Inc. began operations in January 2018 and reported the following results for each of its 3…

A: Requirement 1:

Q: Sendee Company's retained earnings on December 31, 2020 was $2,150,000 and its shareholders' equity…

A: NET INCOME = $250,000 LESS : CASH DIVIDEND = $75,000 1. BALANCE INCOME TRANSFERRED TO RETAINED…

Q: Spring Inc. reports the following information: Net income: $750,000 Dividends on common shares:…

A: 7) Earning per share = (Net income - Preferred dividend)/Average number of common shares outstanding…

Q: Culver Corporation reported net income of $338,240 in 2020 and had 50,400 shares of common stock…

A:

Q: Common stock outstanding January 1, 2022, was 24,700 shares, and 37,100 shares were outstanding at…

A: Earning per share is the portion of a company's profit allocated to each outstanding share of common…

Q: Detroit Inc reported the following ($ in thousands) as of December 31, 2021. All accounts have…

A: Shareholder's equity balance on Dec 31, 2021 :- = Common Stock + Paid in capital(excess of Par) +…

Q: Al Hamra Company issues 500,000 shares of common stock on January 1, 2020 trading at RO 0.200 per…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Statement of Financial Position Zooey Corporation December 31, 2020 Cash P4,500 Accounts Payable…

A:

Q: Concord Inc. had net income for 2020 of $5,920,000. The company had 2,200,000 of common shares…

A: Ratio is a tool which is used to measure the firm’s performance and growth by establishing relation…

Q: 1. Compute the basic earnings per share that would be disclosed in the 2019 annual report. $ per…

A: Basic EPS: It is company's net earnings which is allocable to the common stockholders. Basic…

Q: Titanic Corporation's net income for the year ended December 31, 2019, is $380,000. On June 30,…

A: Ending balance of retained earnings can be computed by adding the net income and deducting the…

Q: Crane Inc. began operations in January 2018 and reported the following results for each of its 3…

A: a)Computation of the book value of the common stock at December 31, 2020 as follows:- Computation…

Q: Drake Co. summarized select account balances on December 31, 2020, and activity for 2020 in the…

A: Stockholders' equity: Stockholders' equity means the remaining net assets available to shareholders.…

Q: 9. Pineapple Co. reported total assets of P2,100,000 and total liabilities of P1,360,000 in its…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Marigold Corporation had 2020 net income of $1,066,000. During 2020, Marigold paid a dividend of $2…

A: Formula: Total preferred dividend = Number of preference shares x Dividend per share. EPS = ( Net…

Q: Keokuk Corp. had the following operating results for 2021 & 2020. Keokuk paid dividends of $100,000…

A: Here, Total Shares outstanding in 2021 is 1,050,000 Stock Price of Share in 2021 is $12.00

Q: Here is the condensed 2021 balance sheet for Skye Computer Company (in thousands of dollars):…

A: Given: Particulars Common stock Preferred stock Debt Earning per share $4.10 Stock price…

Q: The 2020 income statement of Wasmeier Corporation showed net income of $480,000 and a loss from…

A: Earnings per share (EPS): The amount of net income available to each shareholder per common share…

Find the Gross fixed assets and

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Stanley Utilities engaged in the following transactions involving its equity accounts: Sold 3,300 shares of common stock for $15 per share. Sold 1,000 shares of 12%, $100 par preferred stock at $105 per share. Declared and paid cash dividends of $8,000. Repurchased 1,000 shares of treasury stock (common) for $38 per share. Sold 400 of the treasury shares for $42 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $87,000. Prepare a statement of stockholders equity at December 31, 2020.Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.

- Common Dividends Thompson Payroll Service began in 2019 with 1,500,000 authorized and 820,000 issued and outstanding S8 par common shares. During 2019, Thompson entered into the following transactions: Declared a S0.20 per-share cash dividend on March 24. Paid the S0.20 per-share dividend on April 6. Repurchased 13,000 common shares for the treasury at a cost of S12 each on May 9. Sold 2,500 unissued common shares for $15 per share on June 19. Declared a $0.40 per-share cash dividend on August 1. Paid the $0.40 per-share dividend on September 14. Declared and paid a 10% stock dividend on October 25 when the market price of the common stock was $15 per share. Declared a 50.45 per-share cash dividend on November 20. Paid the $0.45 per-share dividend on December 20. Required: Prepare journal entries for each of these transactions. (Note: Round to the nearest dollar.) What is the total dollar amount of dividends (cash and stock) for the year? CONCEPTUAL CONNECTION Determine the effect on total assets and total stockholders equity of these dividend transactions.Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?

- Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.