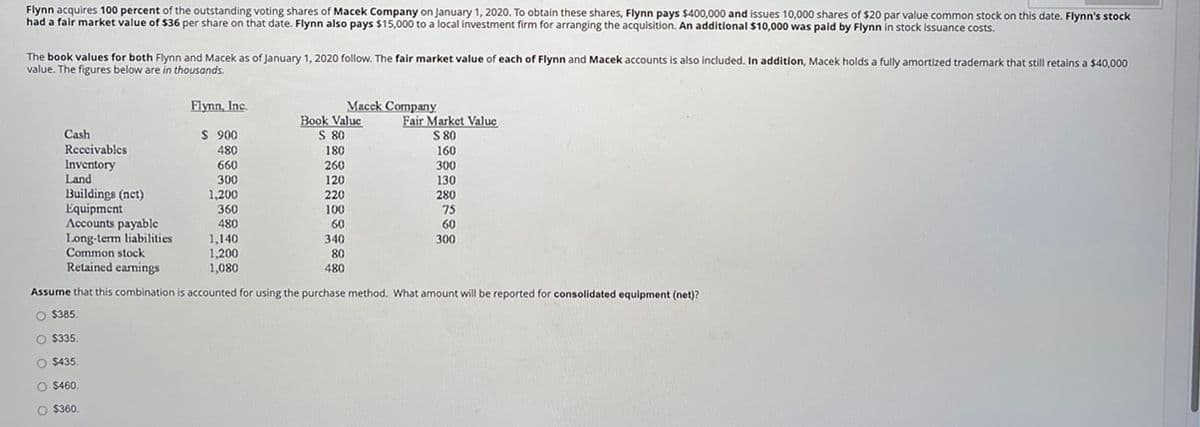

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2020. To obtain these shares, Flynn pays $400,000 and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair market value of $36 per share on that date. Flynn also pays $15,000 to a local investment firm for arranging the acquisition. An additional $10,000 was paid by Flynn in stock issuance costs. The book values for both Flynn and Macek as of January 1, 2020 follow. The fair market value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40,000 value. The figures below are in thousands. Cash Receivables Inventory Land Flynn, Inc. $ 900 480 660 300 1,200 360 480 1,140. 1,200 1,080 Macck Company Book Value S 80 180 260 120 220 100 60 340 80 480 Fair Market Value S 80 160 300 130 280 75 60 300 Buildings (net) Equipment Accounts payable Long-term liabilities Common stock Retained earnings Assume that this combination is accounted for using the purchase method. What amount will be reported for consolidated equipment (net)? O $385. O $335. O $435. O $460. O $360.

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2020. To obtain these shares, Flynn pays $400,000 and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair market value of $36 per share on that date. Flynn also pays $15,000 to a local investment firm for arranging the acquisition. An additional $10,000 was paid by Flynn in stock issuance costs. The book values for both Flynn and Macek as of January 1, 2020 follow. The fair market value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40,000 value. The figures below are in thousands. Cash Receivables Inventory Land Flynn, Inc. $ 900 480 660 300 1,200 360 480 1,140. 1,200 1,080 Macck Company Book Value S 80 180 260 120 220 100 60 340 80 480 Fair Market Value S 80 160 300 130 280 75 60 300 Buildings (net) Equipment Accounts payable Long-term liabilities Common stock Retained earnings Assume that this combination is accounted for using the purchase method. What amount will be reported for consolidated equipment (net)? O $385. O $335. O $435. O $460. O $360.

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 24CE

Related questions

Question

Please help solve

Transcribed Image Text:Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2020. To obtain these shares, Flynn pays $400,000 and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock

had a fair market value of $36 per share on that date. Flynn also pays $15,000 to a local investment firm for arranging the acquisition. An additional $10,000 was paid by Flynn in stock issuance costs.

The book values for both Flynn and Macek as of January 1, 2020 follow. The fair market value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40,000

value. The figures below are in thousands.

Flynn, Inc.

$ 900

480

660

300

1,200

360

480

1,140

Macck Company

1,200

1,080

Book Value

S 80

180

260

120

220

100

60

340

80

480

Cash

Receivables

Inventory

Land

Buildings (net)

Equipment

Accounts payable

Long-term liabilities

Common stock

Retained earnings

Assume that this combination is accounted for using the purchase method. What amount will be reported for consolidated equipment (net)?

O $385.

O $335.

O $435.

O $460.

O $360.

Fair Market Value

S 80

160

300

130

280

75

60

300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning