Mike Greenberg opened Grouper Window Washing Inc. on July 1, 2025. During July, the following transactions were completed. July 1 1 (a) 3 5 12 18 20 21 25 31 31 Issued 10,300 shares of common stock for $10,300 cash. Purchased used truck for $6,880, paying $1,720 cash and the balance on account. Purchased cleaning supplies for $770 on account. Paid $1,560 cash on a 1-year insurance policy effective July 1. Billed customers $3,180 for cleaning services performed. Paid $860 cash on amount owed on truck and $430 on amount owed on cleaning supplies. Paid $1,720 cash for employee salaries. Collected $1,380 cash from customers billed on July 12. Billed customers $2,150 for cleaning services performed. Paid $250 for maintenance of the truck during month. Declared and paid $520 cash dividend. The chart of accounts for Grouper Window Washing contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Equipment, Accumulated Depreciation-Equipment, Accounts Payable, Salaries and Wages Payable, Common Stock, Retained Earnings, Dividends, Income Summary, Service Revenue, Maintenance and Repairs Expense, Supplies Expense, Depreciation Expense, Insurance Expense, and Salaries and Wages Expense. Journalize the July transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Mike Greenberg opened Grouper Window Washing Inc. on July 1, 2025. During July, the following transactions were completed. July 1 1 (a) 3 5 12 18 20 21 25 31 31 Issued 10,300 shares of common stock for $10,300 cash. Purchased used truck for $6,880, paying $1,720 cash and the balance on account. Purchased cleaning supplies for $770 on account. Paid $1,560 cash on a 1-year insurance policy effective July 1. Billed customers $3,180 for cleaning services performed. Paid $860 cash on amount owed on truck and $430 on amount owed on cleaning supplies. Paid $1,720 cash for employee salaries. Collected $1,380 cash from customers billed on July 12. Billed customers $2,150 for cleaning services performed. Paid $250 for maintenance of the truck during month. Declared and paid $520 cash dividend. The chart of accounts for Grouper Window Washing contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Equipment, Accumulated Depreciation-Equipment, Accounts Payable, Salaries and Wages Payable, Common Stock, Retained Earnings, Dividends, Income Summary, Service Revenue, Maintenance and Repairs Expense, Supplies Expense, Depreciation Expense, Insurance Expense, and Salaries and Wages Expense. Journalize the July transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter2: T Accounts, Debits And Credits, Trial Balance, And Financial Statements

Section: Chapter Questions

Problem 4PB: On July 1, K. Resser opened Ressers Business Services. Ressers accountant listed the following chart...

Related questions

Topic Video

Question

Do not give answer in image

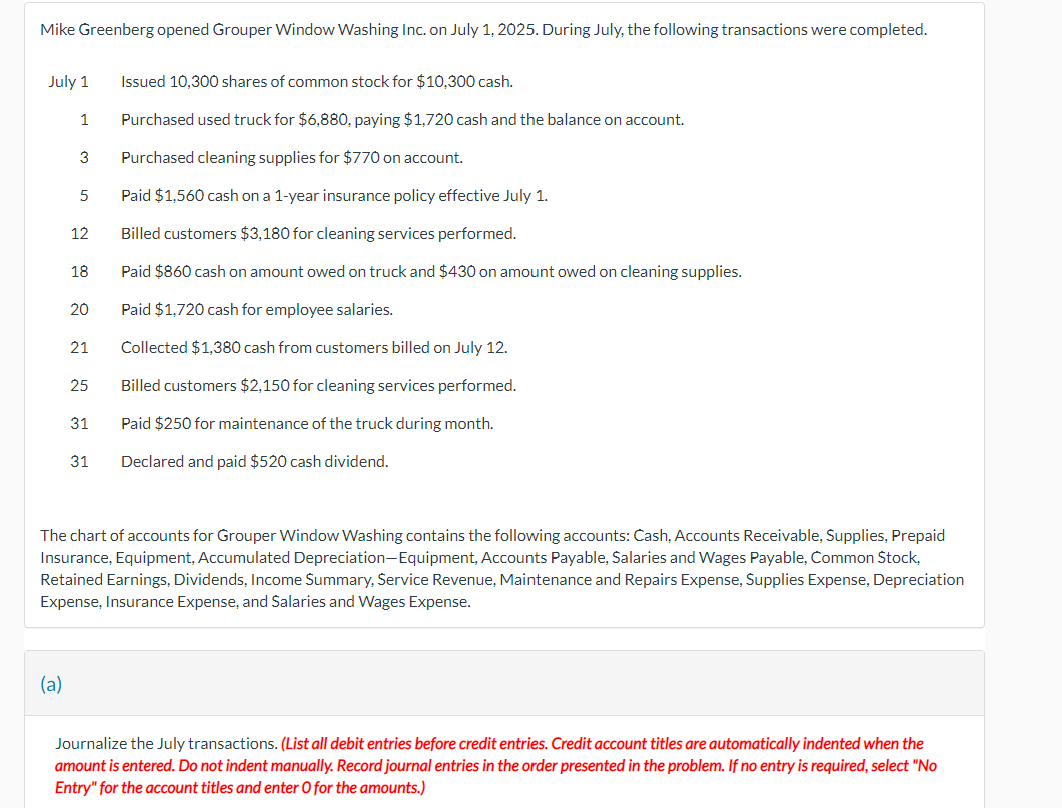

Transcribed Image Text:Mike Greenberg opened Grouper Window Washing Inc. on July 1, 2025. During July, the following transactions were completed.

July 1

1

(a)

3

5

12

18

20

21

25

31

31

Issued 10,300 shares of common stock for $10,300 cash.

Purchased used truck for $6,880, paying $1,720 cash and the balance on account.

Purchased cleaning supplies for $770 on account.

Paid $1,560 cash on a 1-year insurance policy effective July 1.

Billed customers $3,180 for cleaning services performed.

Paid $860 cash on amount owed on truck and $430 on amount owed on cleaning supplies.

Paid $1,720 cash for employee salaries.

Collected $1,380 cash from customers billed on July 12.

Billed customers $2,150 for cleaning services performed.

Paid $250 for maintenance of the truck during month.

Declared and paid $520 cash dividend.

The chart of accounts for Grouper Window Washing contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid

Insurance, Equipment, Accumulated Depreciation-Equipment, Accounts Payable, Salaries and Wages Payable, Common Stock,

Retained Earnings, Dividends, Income Summary, Service Revenue, Maintenance and Repairs Expense, Supplies Expense, Depreciation

Expense, Insurance Expense, and Salaries and Wages Expense.

Journalize the July transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the

amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No

Entry" for the account titles and enter O for the amounts.)

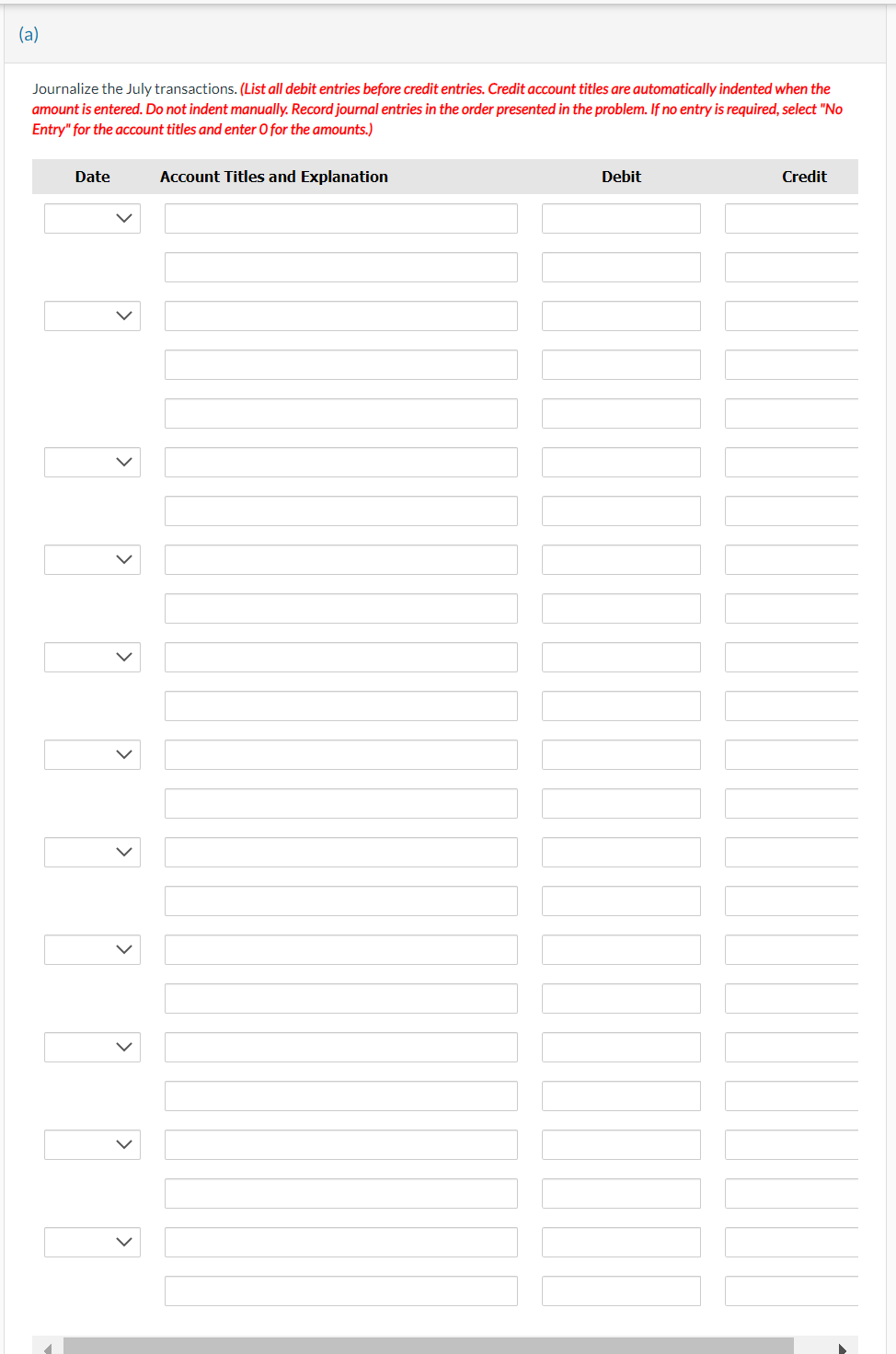

Transcribed Image Text:(a)

Journalize the July transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the

amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No

Entry" for the account titles and enter O for the amounts.)

Date

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning