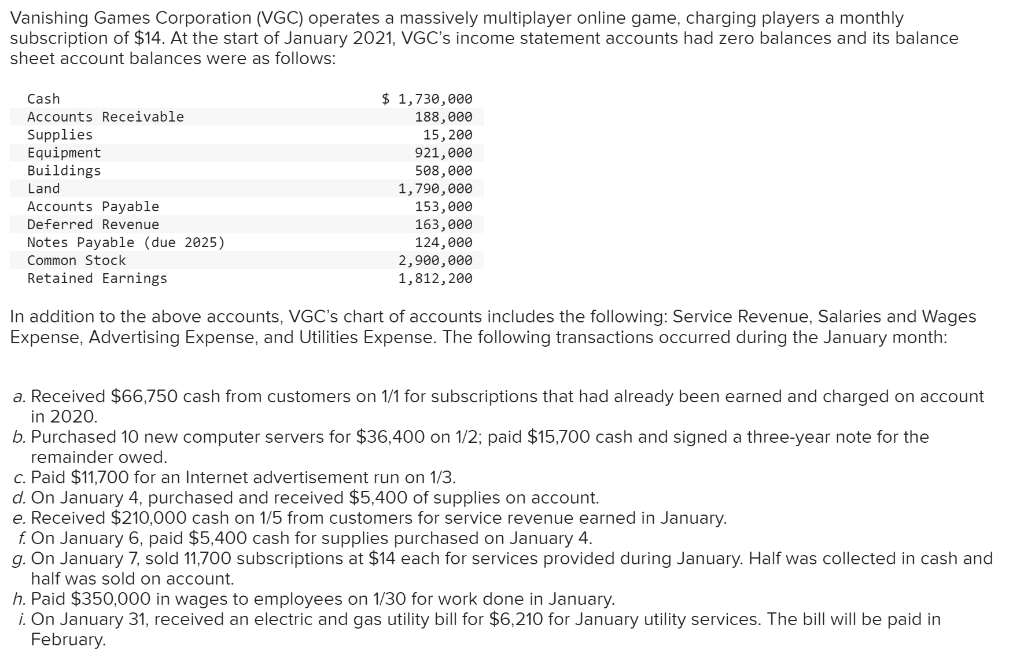

Vanishing Games Corporation (VGC) operates a massively multiplayer online game, charging players a monthly subscription of $14. At the start of January 2021, VGC's income statement accounts had zero balances and its balance sheet account balances were as follows: Cash Accounts Receivable Supplies Equipment Buildings Land Accounts Payable Deferred Revenue Notes Payable (due 2025) Common Stock Retained Earnings $ 1,730,000 188,000 15,200 921,000 508,000 1,790,000 153,000 163,000 124,000 2,900,000 1,812, 200 In addition to the above accounts, VGC's chart of accounts includes the following: Service Revenue, Salaries and Wages Expense, Advertising Expense, and Utilities Expense. The following transactions occurred during the January month: a. Received $66,750 cash from customers on 1/1 for subscriptions that had already been earned and charged on account in 2020. b. Purchased 10 new computer servers for $36,400 on 1/2; paid $15,700 cash and signed a three-year note for the remainder owed. c. Paid $11,700 for an Internet advertisement run on 1/3. d. On January 4, purchased and received $5,400 of supplies on account. e. Received $210,000 cash on 1/5 from customers for service revenue earned in January. f. On January 6, paid $5,400 cash for supplies purchased on January 4. g. On January 7, sold 11,700 subscriptions at $14 each for services provided during January. Half was collected in cash and half was sold on account. h. Paid $350,000 in wages to employees on 1/30 for work done in January. i. On January 31, received an electric and gas utility bill for $6,210 for January utility services. The bill will be paid in February.

Vanishing Games Corporation (VGC) operates a massively multiplayer online game, charging players a monthly subscription of $14. At the start of January 2021, VGC's income statement accounts had zero balances and its balance sheet account balances were as follows: Cash Accounts Receivable Supplies Equipment Buildings Land Accounts Payable Deferred Revenue Notes Payable (due 2025) Common Stock Retained Earnings $ 1,730,000 188,000 15,200 921,000 508,000 1,790,000 153,000 163,000 124,000 2,900,000 1,812, 200 In addition to the above accounts, VGC's chart of accounts includes the following: Service Revenue, Salaries and Wages Expense, Advertising Expense, and Utilities Expense. The following transactions occurred during the January month: a. Received $66,750 cash from customers on 1/1 for subscriptions that had already been earned and charged on account in 2020. b. Purchased 10 new computer servers for $36,400 on 1/2; paid $15,700 cash and signed a three-year note for the remainder owed. c. Paid $11,700 for an Internet advertisement run on 1/3. d. On January 4, purchased and received $5,400 of supplies on account. e. Received $210,000 cash on 1/5 from customers for service revenue earned in January. f. On January 6, paid $5,400 cash for supplies purchased on January 4. g. On January 7, sold 11,700 subscriptions at $14 each for services provided during January. Half was collected in cash and half was sold on account. h. Paid $350,000 in wages to employees on 1/30 for work done in January. i. On January 31, received an electric and gas utility bill for $6,210 for January utility services. The bill will be paid in February.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.3E: The Effect of Transactions on the Accounting Equation For each of the following transactions,...

Related questions

Topic Video

Question

do not give solution in image format

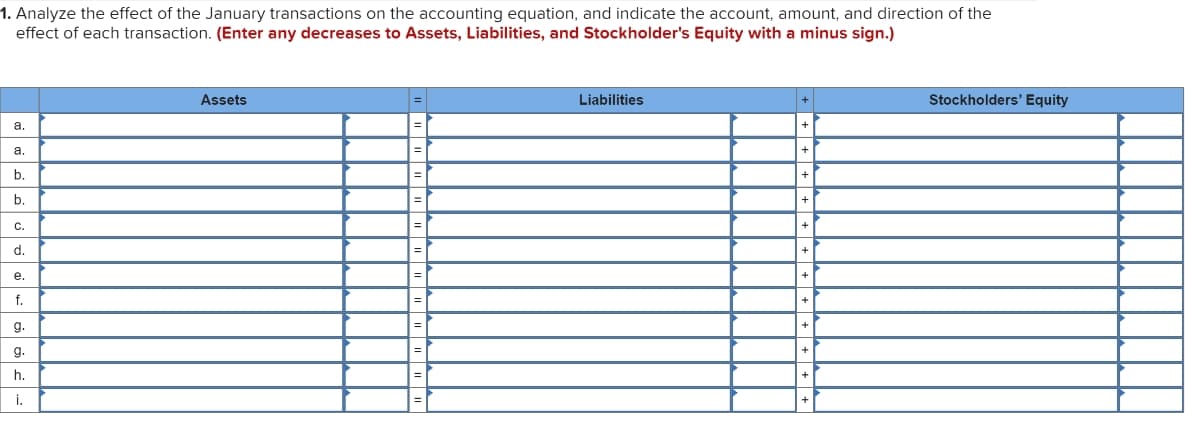

Transcribed Image Text:1. Analyze the effect of the January transactions on the accounting equation, and indicate the account, amount, and direction of the

effect of each transaction. (Enter any decreases to Assets, Liabilities, and Stockholder's Equity with a minus sign.)

a.

a.

b.

b.

C.

d.

e.

f.

g.

g.

h.

i.

Assets

=

=

=

=

=

=

Liabilities

+

+

+

+

+

Stockholders' Equity

Transcribed Image Text:Vanishing Games Corporation (VGC) operates a massively multiplayer online game, charging players a monthly

subscription of $14. At the start of January 2021, VGC's income statement accounts had zero balances and its balance

sheet account balances were as follows:

Cash

Accounts Receivable

Supplies

Equipment

Buildings

Land

Accounts Payable

Deferred Revenue

Notes Payable (due 2025)

Common Stock

Retained Earnings

$ 1,730,000

188,000

15, 200

921,000

508,000

1,790,000

153,000

163,000

124,000

2,900,000

1,812, 200

In addition to the above accounts, VGC's chart of accounts includes the following: Service Revenue, Salaries and Wages

Expense, Advertising Expense, and Utilities Expense. The following transactions occurred during the January month:

a. Received $66,750 cash from customers on 1/1 for subscriptions that had already been earned and charged on account

in 2020.

b. Purchased 10 new computer servers for $36,400 on 1/2; paid $15,700 cash and signed a three-year note for the

remainder owed.

c. Paid $11,700 for an Internet advertisement run on 1/3.

d. On January 4, purchased and received $5,400 of supplies on account.

e. Received $210,000 cash on 1/5 from customers for service revenue earned in January.

f. On January 6, paid $5,400 cash for supplies purchased on January 4.

g. On January 7, sold 11,700 subscriptions at $14 each for services provided during January. Half was collected in cash and

half was sold on account.

h. Paid $350,000 in wages to employees on 1/30 for work done in January.

i. On January 31, received an electric and gas utility bill for $6,210 for January utility services. The bill will be paid in

February.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning