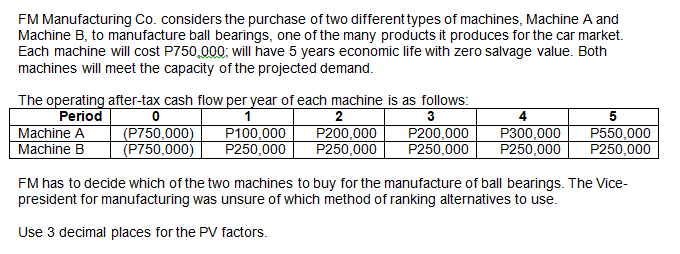

FM Manufacturing Co. considers the purchase of two different types of machines, Machine A and Machine B, to manufacture ball bearings, one of the many products it produces for the car market. Each machine will cost P750,000; will have 5 years economic life with zero salvage value. Both machines will meet the capacity of the projected demand. The operating after-tax cash flow per year of each machine is as follows: Period Machine A Machine B 2 P200,000 P250,000 3 P200,000 P250,000 (P750,000) (P750,000) P100,000 P250,000 P300,000 P250,000 P550,000 P250,000 FM has to decide which of the two machines to buy for the manufacture of ball bearings. The Vice- president for manufacturing was unsure of which method of ranking alternatives to use. Use 3 decimal places for the PV factors.

FM Manufacturing Co. considers the purchase of two different types of machines, Machine A and Machine B, to manufacture ball bearings, one of the many products it produces for the car market. Each machine will cost P750,000; will have 5 years economic life with zero salvage value. Both machines will meet the capacity of the projected demand. The operating after-tax cash flow per year of each machine is as follows: Period Machine A Machine B 2 P200,000 P250,000 3 P200,000 P250,000 (P750,000) (P750,000) P100,000 P250,000 P300,000 P250,000 P550,000 P250,000 FM has to decide which of the two machines to buy for the manufacture of ball bearings. The Vice- president for manufacturing was unsure of which method of ranking alternatives to use. Use 3 decimal places for the PV factors.

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

Which machine should be selected using the Payback period method?

Machine A

Machine B

Which machine should be selected using the Accounting

Machine A

Machine B

Which machine should be selected using the

Machine A

Machine B

Transcribed Image Text:FM Manufacturing Co. considers the purchase of two differenttypes of machines, Machine A and

Machine B, to manufacture ball bearings, one of the many products it produces for the car market.

Each machine will cost P750,000; will have 5 years economic life with zero salvage value. Both

machines will meet the capacity of the projected demand.

The operating after-tax cash flow per year of each machine is as follows:

1

P100,000

P250,000

Period

Machine A

Machine B

2

P200,000

P250,000

3

P200,000

P250,000

(P750,000)

(P750,000)

P300,000

P250,000

P550,000

P250,000

FM has to decide which of the two machines to buy for the manufacture of ball bearings. The Vice-

president for manufacturing was unsure of which method of ranking alternatives to use.

Use 3 decimal places for the PV factors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning