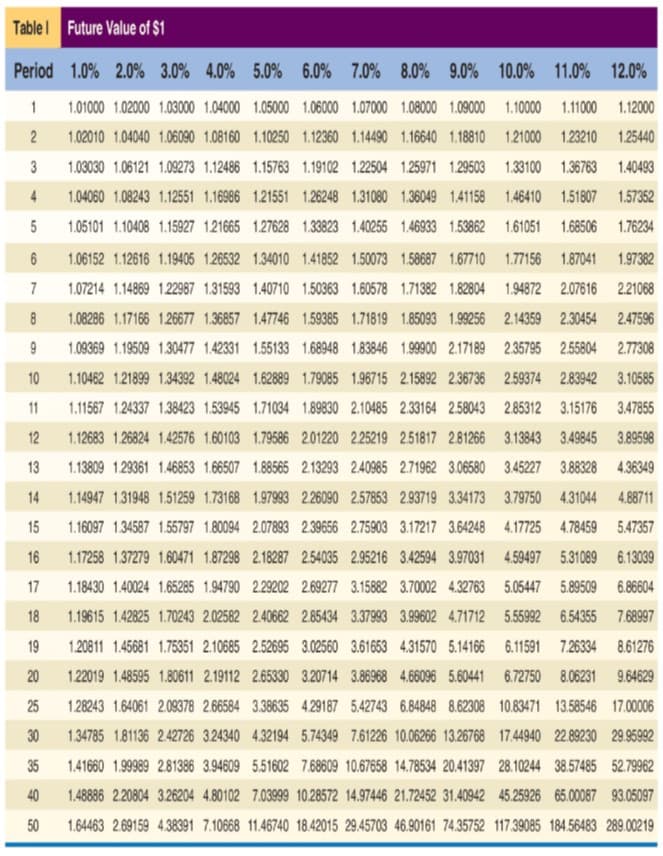

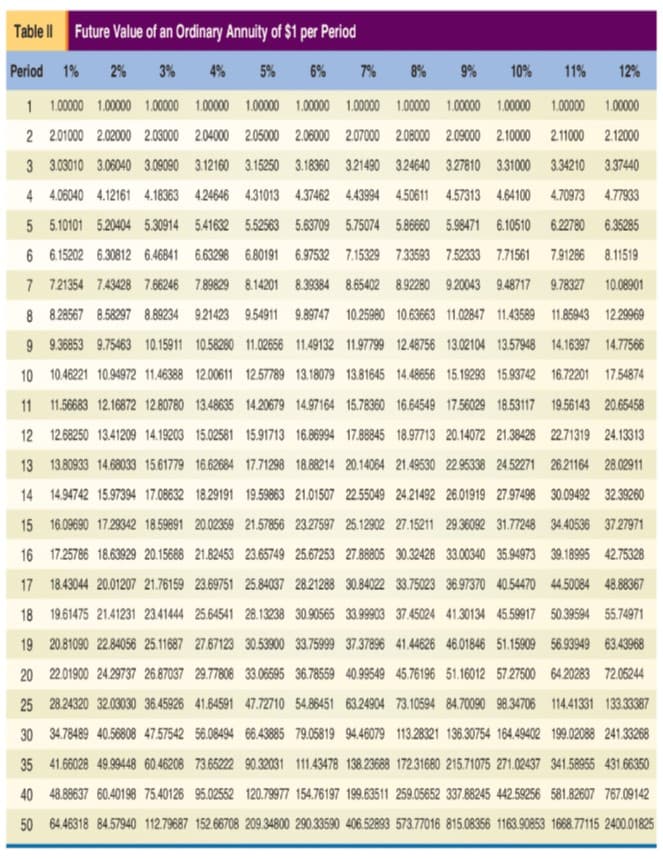

Inc. has additional cash available for investment and considers replacing the old factory equipment with a new one. There are two options for Scription. One option is to purchase a new equipment from Supplier A for $100,000. Supplier A equipment has a useful life of 10 years with after-tax residual value, $5,000 and can save $60,000 annually. The other option is with Supplier B. Supplier B would charge $120,000 for a new equipment. Supplier B equipment would generate $50,000 annual cost saving. Its useful life is 12 years and the after-tax residual value of $6,000. Assume the required rate of return for both options is 8%. Using NPV method, determine which option is the more attractive. Must show your computation steps. Use the appro

Scription Inc. has additional cash available for investment and considers replacing the old factory equipment with a new one. There are two options for Scription. One option is to purchase a new equipment from Supplier A for $100,000. Supplier A equipment has a useful life of 10 years with after-tax residual value, $5,000 and can save $60,000 annually. The other option is with Supplier B. Supplier B would charge $120,000 for a new equipment. Supplier B equipment would generate $50,000 annual cost saving. Its useful life is 12 years and the after-tax residual value of $6,000.

Assume the required

Step by step

Solved in 2 steps