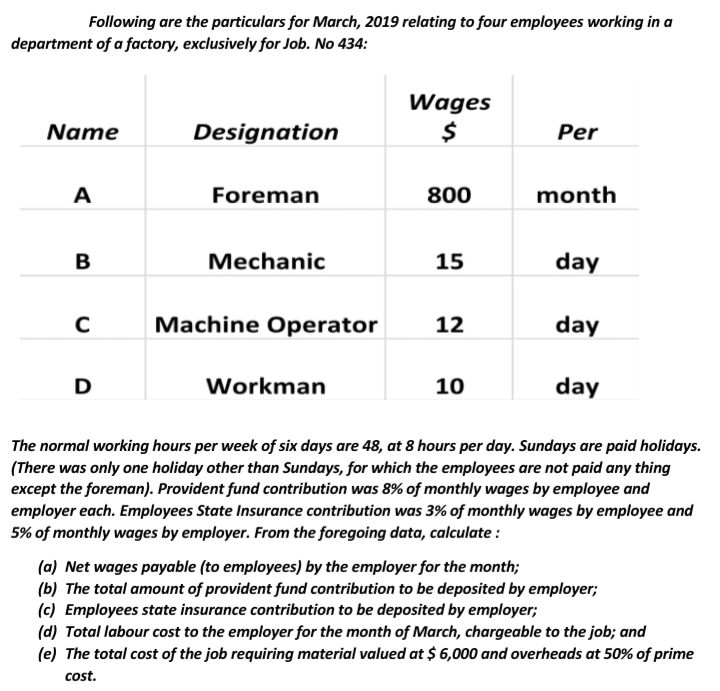

Following are the particulars for March, 2019 relating to four employees working in a department of a factory, exclusively for Job. No 434: Wages $ Name Designation Per A Foreman 800 month B Mechanic 15 day C Machine Operator 12 day D Workman 10 day The normal working hours per week of six days are 48, at 8 hours per day. Sundays are paid holidays. (There was only one holiday other than Sundays, for which the employees are not paid any thing except the foreman). Provident fund contribution was 8% of monthly wages by employee and employer each. Employees State Insurance contribution was 3% of monthly wages by employee and 5% of monthly wages by employer. From the foregoing data, calculate : (a) Net wages payable (to employees) by the employer for the month; (b) The total amount of provident fund contribution to be deposited by employer; (c) Employees state insurance contribution to be deposited by employer; (d) Total labour cost to the employer for the month of March, chargeable to the job; and (e) The total cost of the job requiring material valued at $ 6,000 and overheads at 50% of prime cost.

Following are the particulars for March, 2019 relating to four employees working in a department of a factory, exclusively for Job. No 434: Wages $ Name Designation Per A Foreman 800 month B Mechanic 15 day C Machine Operator 12 day D Workman 10 day The normal working hours per week of six days are 48, at 8 hours per day. Sundays are paid holidays. (There was only one holiday other than Sundays, for which the employees are not paid any thing except the foreman). Provident fund contribution was 8% of monthly wages by employee and employer each. Employees State Insurance contribution was 3% of monthly wages by employee and 5% of monthly wages by employer. From the foregoing data, calculate : (a) Net wages payable (to employees) by the employer for the month; (b) The total amount of provident fund contribution to be deposited by employer; (c) Employees state insurance contribution to be deposited by employer; (d) Total labour cost to the employer for the month of March, chargeable to the job; and (e) The total cost of the job requiring material valued at $ 6,000 and overheads at 50% of prime cost.

Chapter5: Unemployment Compensation Taxes

Section: Chapter Questions

Problem 14PA

Related questions

Question

Transcribed Image Text:Following are the particulars for March, 2019 relating to four employees working in a

department of a factory, exclusively for Job. No 434:

Wages

$

Name

Designation

Per

A

Foreman

800

month

B

Mechanic

15

day

Machine Operator

12

day

D

Workman

10

day

The normal working hours per week of six days are 48, at 8 hours per day. Sundays are paid holidays.

(There was only one holiday other than Sundays, for which the employees are not paid any thing

except the foreman). Provident fund contribution was 8% of monthly wages by employee and

employer each. Employees State Insurance contribution was 3% of monthly wages by employee and

5% of monthly wages by employer. From the foregoing data, calculate :

(a) Net wages payable (to employees) by the employer for the month;

(b) The total amount of provident fund contribution to be deposited by employer;

(c) Employees state insurance contribution to be deposited by employer;

(d) Total labour cost to the employer for the month of March, chargeable to the job; and

(e) The total cost of the job requiring material valued at $ 6,000 and overheads at 50% of prime

cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning