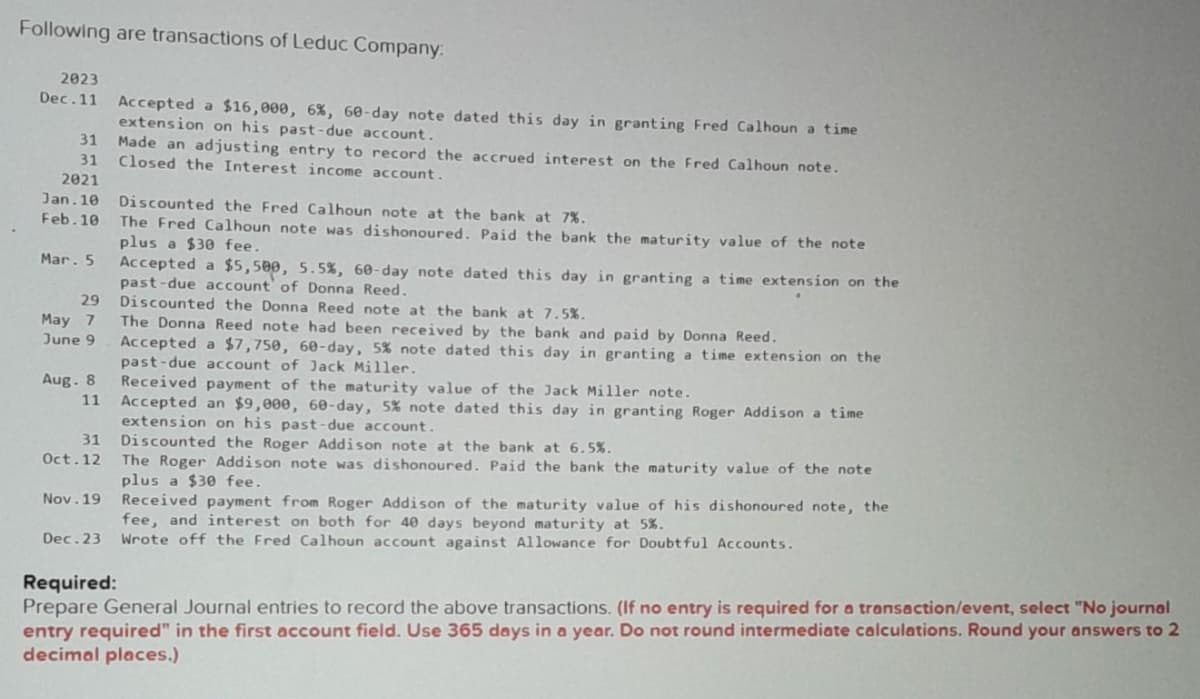

Following are transactions of Leduc Company: 2023 Dec.11 Accepted a $16,000, 6%, 60-day note dated this day in granting Fred Calhoun a time extension on his past-due account. Made an adjusting entry to record the accrued interest on the Fred Calhoun note. Closed the Interest income account. 31 31 2021 Jan. 10 Feb. 10 Mar. 5 29 May 7 June 9 Aug. 8 11 31 Discounted the Fred Calhoun note at the bank at 7%. The Fred Calhoun note was dishonoured. Paid the bank the maturity value of the note plus a $30 fee. Accepted a $5,500, 5.5%, 60-day note dated this day in granting a time extension on the past-due account of Donna Reed. Discounted the Donna Reed note at the bank at 7.5%. The Donna Reed note had been received by the bank and paid by Donna Reed. Accepted a $7,750, 60-day, 5% note dated this day in granting a time extension on the past-due account of Jack Miller. Received payment of the maturity value of the Jack Miller note. Accepted an $9,000, 60-day, 5% note dated this day in granting Roger Addison a time extension on his past-due account. Discounted the Roger Addison note at the bank at 6.5%

Following are transactions of Leduc Company: 2023 Dec.11 Accepted a $16,000, 6%, 60-day note dated this day in granting Fred Calhoun a time extension on his past-due account. Made an adjusting entry to record the accrued interest on the Fred Calhoun note. Closed the Interest income account. 31 31 2021 Jan. 10 Feb. 10 Mar. 5 29 May 7 June 9 Aug. 8 11 31 Discounted the Fred Calhoun note at the bank at 7%. The Fred Calhoun note was dishonoured. Paid the bank the maturity value of the note plus a $30 fee. Accepted a $5,500, 5.5%, 60-day note dated this day in granting a time extension on the past-due account of Donna Reed. Discounted the Donna Reed note at the bank at 7.5%. The Donna Reed note had been received by the bank and paid by Donna Reed. Accepted a $7,750, 60-day, 5% note dated this day in granting a time extension on the past-due account of Jack Miller. Received payment of the maturity value of the Jack Miller note. Accepted an $9,000, 60-day, 5% note dated this day in granting Roger Addison a time extension on his past-due account. Discounted the Roger Addison note at the bank at 6.5%

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

Transcribed Image Text:Following are transactions of Leduc Company:

2023

Dec.11 Accepted a $16,000, 6%, 60-day note dated this day in granting Fred Calhoun a time

extension on his past-due account.

Made an adjusting entry to record the accrued interest on the Fred Calhoun note.

Closed the Interest income account.

31

31

2021

Jan. 10

Feb. 10

Mar. 5

29

May 7

June 9

Aug. 8

11

31

Oct. 12

Nov.19

Discounted the Fred Calhoun note at the bank at 7%.

The Fred Calhoun note was dishonoured. Paid the bank the maturity value of the note

plus a $30 fee.

Accepted a $5,500, 5.5%, 60-day note dated this day in granting a time extension on the

past-due account of Donna Reed.

Discounted the Donna Reed note at the bank at 7.5%.

The Donna Reed note had been received by the bank and paid by Donna Reed.

Accepted a $7,750, 60-day, 5% note dated this day in granting a time extension on the

past-due account of Jack Miller.

Received payment of the maturity value of the Jack Miller note.

Accepted an $9,000, 60-day, 5% note dated this day in granting Roger Addison a time

extension on his past-due account.

Discounted the Roger Addison note at the bank at 6.5%.

The Roger Addiso note was dishonoured. Paid the bank the maturity value of the note

plus a $30 fee.

Received payment from Roger Addison of the maturity value of his dishonoured note, the

fee, and interest on both for 40 days beyond maturity at 5%.

Dec. 23 Wrote off the Fred Calhoun account against Allowance for Doubtful Accounts.

Required:

Prepare General Journal entries to record the above transactions. (If no entry is required for a transaction/event, select "No journal

entry required" in the first account field. Use 365 days in a year. Do not round intermediate calculations. Round your answers to 2

decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning