For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expectations for future growth?

For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expectations for future growth?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 40E: Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for...

Related questions

Question

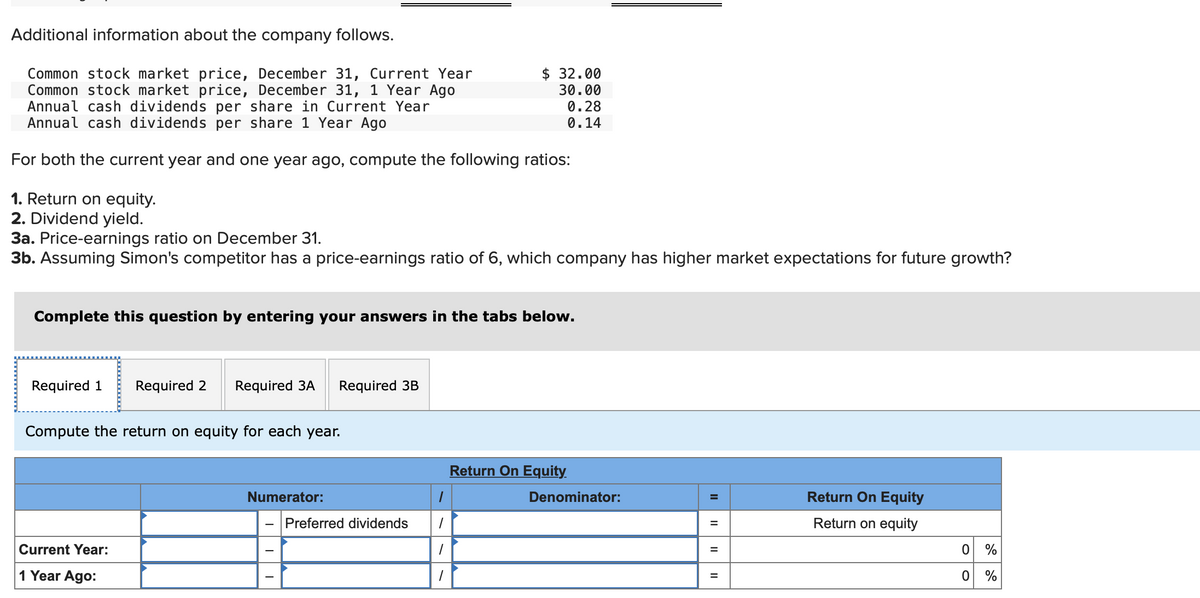

Transcribed Image Text:Additional information about the company follows.

Common stock market price, December 31, Current Year

Common stock market price, December 31, 1 Year Ago

Annual cash dividends per share in Current Year

Annual cash dividends per share 1 Year Ago

For both the current year and one year ago, compute the following ratios:

1. Return on equity.

2. Dividend yield.

3a. Price-earnings ratio on December 31.

3b. Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expectations for future growth?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3A Required 3B

Compute the return on equity for each year.

Current Year:

1 Year Ago:

Numerator:

$ 32.00

30.00

0.28

0.14

Preferred dividends

1

1

1

1

Return On Equity

Denominator:

II

=

=

=

Return On Equity

Return on equity

0 %

%

O

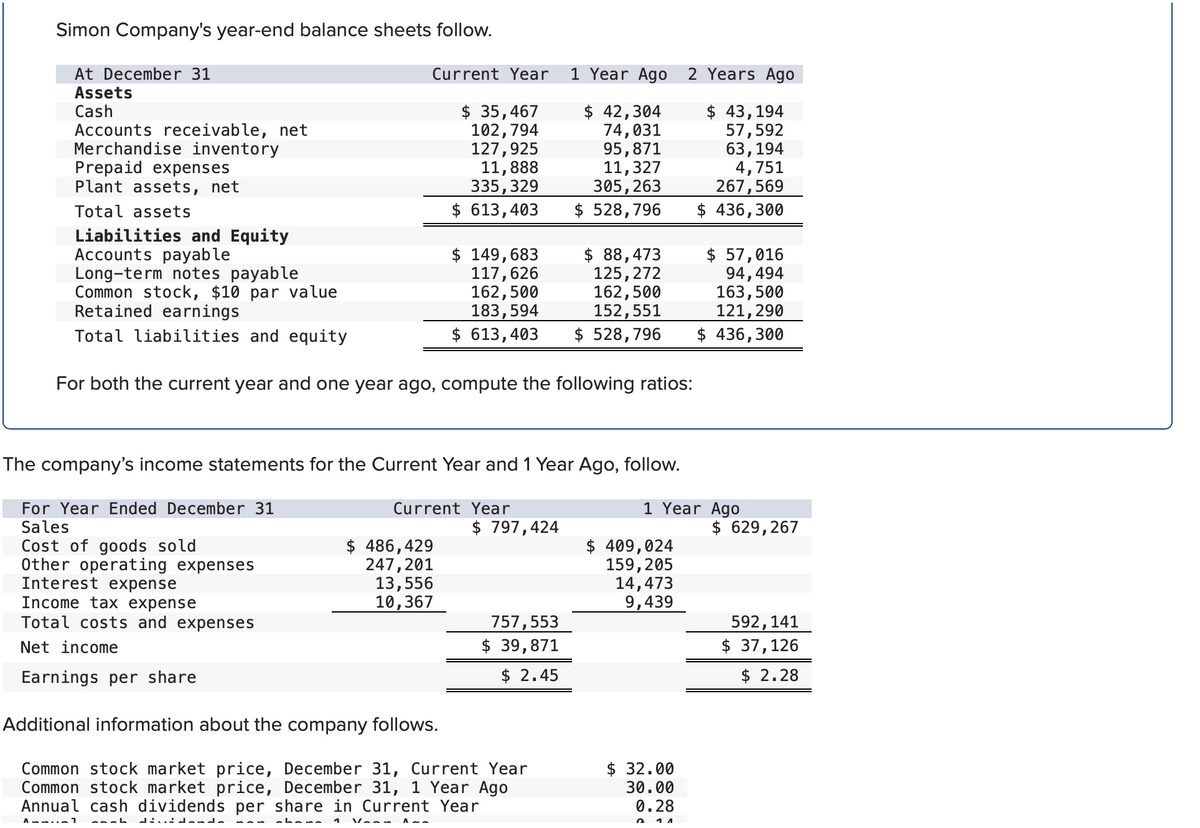

Transcribed Image Text:Simon Company's year-end balance sheets follow.

At December 31

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Liabilities and Equity

Accounts payable

Long-term notes payable

Common stock, $10 par value

Retained earnings

Total liabilities and equity

Interest expense

Income tax expense

Total costs and expenses

Net income

Current Year

$ 35,467

102,794

127,925

11,888

335,329

$ 613,403

For both the current year and one year ago, compute the following ratios:

ه له مه له :. .: له

The company's income statements for the Current Year and 1 Year Ago, follow.

For Year Ended December 31

Sales

Cost of goods sold

Other operating expenses

$ 149,683

117,626

162,500

183,594

$ 613,403

$ 486,429

247,201

Current Year

13,556

10,367

Vanu

$ 797,424

Earnings per share

Additional information about the company follows.

Common stock market price, December 31, Current Year

Common stock market price, December 31, 1 Year Ago

Annual cash dividends per share in Current Year

Ammin1

1 Year Ago 2 Years Ago

$ 42,304

74,031

95,871

11,327

305,263

$ 528,796

757, 553

$ 39,871

$ 2.45

$ 88,473

125,272

162,500

152, 551

$ 528,796

$ 409,024

159, 205

14,473

9,439

$ 43,194

57,592

$ 32.00

30.00

0.28

11

63, 194

4,751

267,569

$ 436,300

1 Year Ago

$ 57,016

94,494

163,500

121,290

$ 436,300

$ 629,267

592,141

$ 37, 126

$ 2.28

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning