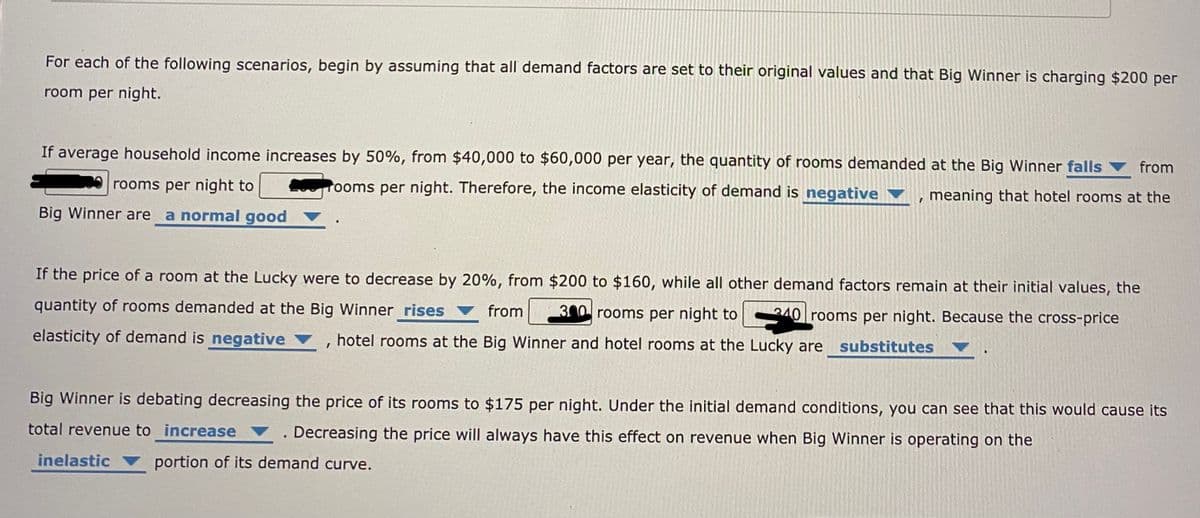

For each of the following scenarios, begin by assuming that all demand factors are set to their original values and that Big Winner is charging $200 per room per night. If average household income increases by 50%, from $40,000 to $60,000 per year, the quantity of rooms demanded at the Big Winner falls ▼ from rooms per night to ooms per night. Therefore, the income elasticity of demand is negative ▼, meaning that hotel rooms at the Big Winner are a normal good If the price of a room at the Lucky were to decrease by 20%, from $200 to $160, while all other demand factors remain at their initial values, the quantity of rooms demanded at the Big Winner rises v from 300 rooms per night to -240 rooms per night. Because the cross-price elasticity of demand is negative ▼ hotel rooms at the Big Winner and hotel rooms at the Lucky are substitutes Big Winner is debating decreasing the price of its rooms to $175 per night. Under the initial demand conditions, you can see that this would cause its total revenue to increase v. Decreasing the price will always have this effect on revenue when Big Winner is operating on the inelastic portion of its demand curve.

For each of the following scenarios, begin by assuming that all demand factors are set to their original values and that Big Winner is charging $200 per room per night. If average household income increases by 50%, from $40,000 to $60,000 per year, the quantity of rooms demanded at the Big Winner falls ▼ from rooms per night to ooms per night. Therefore, the income elasticity of demand is negative ▼, meaning that hotel rooms at the Big Winner are a normal good If the price of a room at the Lucky were to decrease by 20%, from $200 to $160, while all other demand factors remain at their initial values, the quantity of rooms demanded at the Big Winner rises v from 300 rooms per night to -240 rooms per night. Because the cross-price elasticity of demand is negative ▼ hotel rooms at the Big Winner and hotel rooms at the Lucky are substitutes Big Winner is debating decreasing the price of its rooms to $175 per night. Under the initial demand conditions, you can see that this would cause its total revenue to increase v. Decreasing the price will always have this effect on revenue when Big Winner is operating on the inelastic portion of its demand curve.

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

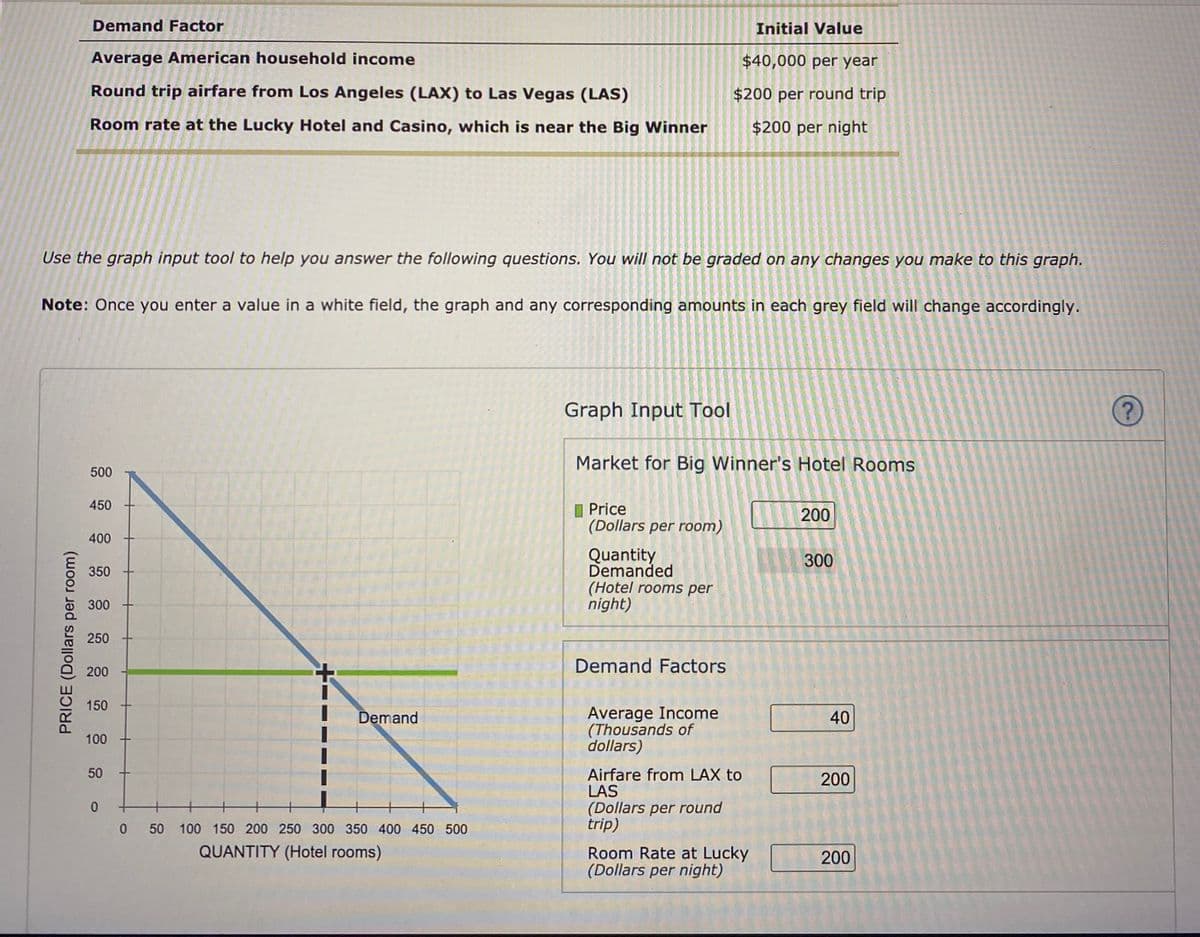

Transcribed Image Text:Demand Factor

Initial Value

Average American household income

$40,000 per year

Round trip airfare from Los Angeles (LAX) to Las Vegas (LAS)

$200 per round trip

Room rate at the Lucky Hotel and Casino, which is near the Big Winner

$200 per night

Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph.

Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly.

Graph Input Tool

Market for Big Winner's Hotel Rooms

500

I Price

(Dollars per room)

450

200

400

Quantity

Demanded

(Hotel rooms per

night)

300

350

300

250

Demand Factors

200

150

Average Income

(Thousands of

dollars)

Demand

40

100

50

Airfare from LAX to

LAS

(Dollars per round

trip)

200

0 50 100 150 200 250 300 350 400 450 500

QUANTITY (Hotel rooms)

Room Rate at Lucky

(Dollars per night)

200

PRICE (Dollars per room)

Transcribed Image Text:For each of the following scenarios, begin by assuming that all demand factors are set to their original values and that Big Winner is charging $200 per

room per night.

If average household income increases by 50%, from $40,000 to $60,000 per year, the quantity of rooms demanded at the Big Winner falls ▼ from

rooms per night to

Pooms per night. Therefore, the income elasticity of demand is negative ▼ , meaning that hotel rooms at the

Big Winner are a normal good

If the price of a room at the Lucky were to decrease by 20%, from $200 to $160, while all other demand factors remain at their initial values, the

quantity of rooms demanded at the Big Winner rises

300 rooms per night to

from

240 rooms per night. Because the cross-price

elasticity of demand is negative

hotel rooms at the Big Winner and hotel rooms at the Lucky are

substitutes ▼

Big Winner is debating decreasing the price of its rooms to $175 per night. Under the initial demand conditions, you can see that this would cause its

total revenue to increase

Decreasing the price will always have this effect on revenue when Big Winner is operating on the

inelastic

portion of its demand curve.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education