Presented below is information related to Vaughn Inc.'s inventory, assuming Vaughn uses lower-of-LIFO cost-or- market. (per unit) Historical cost Selling price Cost to distribute Cupeni eest Skis $247.00 275.60 24.70 262.00 Boots $137.80 188.50 10.40 10% 50 Parkas $68.90 95.88 3.25 16.00

Presented below is information related to Vaughn Inc.'s inventory, assuming Vaughn uses lower-of-LIFO cost-or- market. (per unit) Historical cost Selling price Cost to distribute Cupeni eest Skis $247.00 275.60 24.70 262.00 Boots $137.80 188.50 10.40 10% 50 Parkas $68.90 95.88 3.25 16.00

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 2RE: Black Corporation uses the LIFO cost flow assumption. Each unit of its inventory has a net...

Related questions

Question

Please Provide Explanation And Don`t Give Image Format

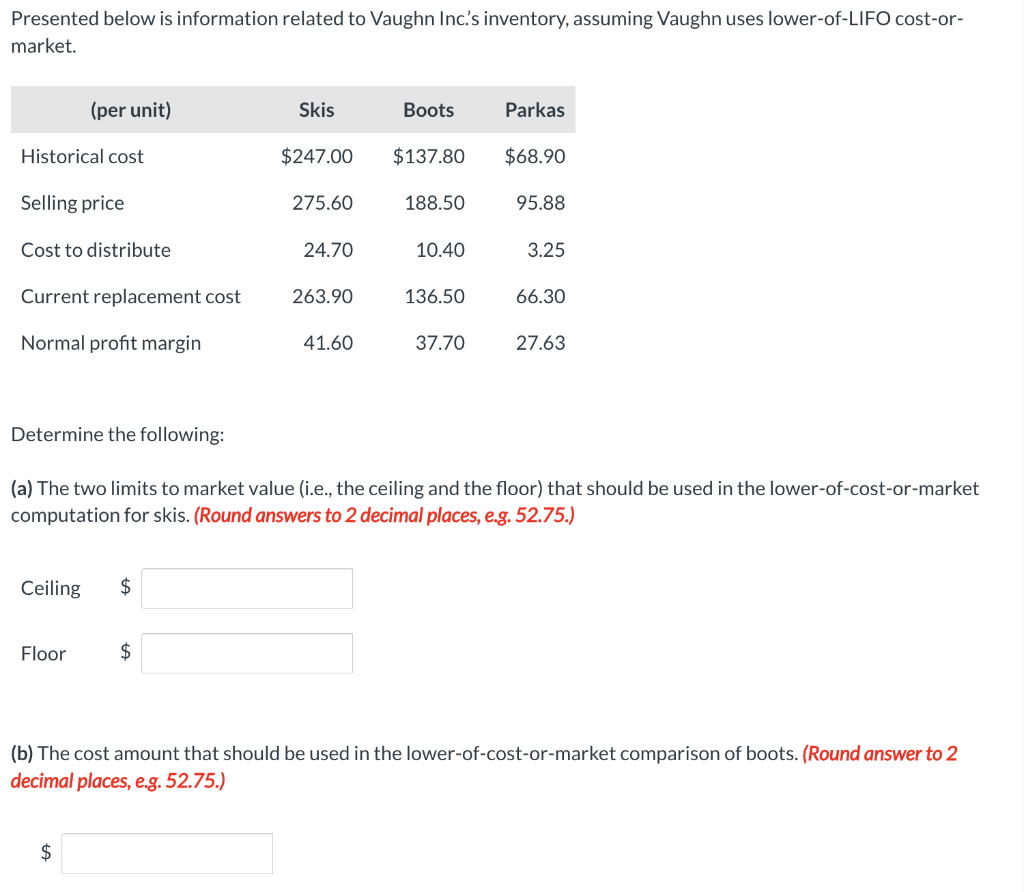

Transcribed Image Text:Presented below is information related to Vaughn Inc.'s inventory, assuming Vaughn uses lower-of-LIFO cost-or-

market.

Historical cost

Selling price

Cost to distribute

(per unit)

Current replacement cost

Normal profit margin

Determine the following:

Ceiling

Floor

$

$

Skis

$

$247.00

275.60

24.70

263.90

41.60

Boots

$137.80

188.50

10.40

136.50

37.70

Parkas

$68.90

(a) The two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of-cost-or-market

computation for skis. (Round answers to 2 decimal places, e.g. 52.75.)

95.88

3.25

66.30

27.63

(b) The cost amount that should be used in the lower-of-cost-or-market comparison of boots. (Round answer to 2

decimal places, e.g. 52.75.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning