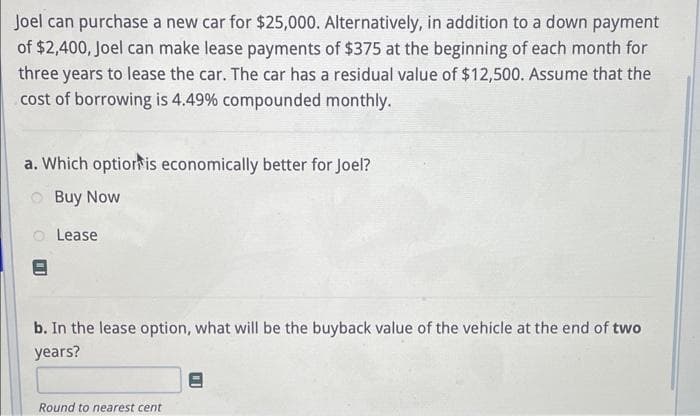

Joel can purchase a new car for $25,000. Alternatively, in addition to a down of $2,400, Joel can make lease payments of $375 at the beginning of each m three years to lease the car. The car has a residual value of $12,500. Assume cost of borrowing is 4.49% compounded monthly. a. Which option is economically better for Joel? Buy Now OC Lease

Q: Company ABC purchased a building on 1/1/2022. The purchase price of the building was $1,000,000. The…

A: Since the question has multiple sub-parts, as per the guidelines only the first three sub-parts will…

Q: custodial fund assets and liabilities are to be recognized: When the earnings process is complete…

A: Custodial funds are used to account for resources held by a government unit in a trustee or…

Q: In 2022, parent company sells inventory costing $60,000 fo to its 90% owned Subsidiary for…

A: The journal entry is posted to record the transaction in the business records. The parent company…

Q: The following transactions occur for Cardinal Music Academy during the month of October: Provide…

A: In accounting, journal entries are a record of financial transactions that a business has made. Each…

Q: why does the customer satisfaction rating decline when the contribution margin of the company…

A: The answer for the question on Contribution margin and Customer satisfaction rating has been given…

Q: Which of the following best describes the current ratio? a) Liquidity ratio b) Debt ratio c)…

A: Investors, analysts, and many other stakeholders utilize financial ratios as tools to assess a…

Q: Presented below is information related to a copyright owned by Pharoah Company at December 31, 2025.…

A: Impairment of Asset An impairment asset has a request value that's lower than the…

Q: Comparative data on three companies in the same service industry are given below: Required: 2. Fill…

A: ROI means return on investment. It is the percentage return earned by the entity on the investment…

Q: the attachement to answer the following Cash outflows in March for purchases will be: a) $240…

A: Gross margin is very important in the business and gross margins can be obtained by deduction of…

Q: Answer the following questions. 1. Dalton Computers makes 5,500 units of a circuit board, CB76 at a…

A: Since you have posted multiple questions, we will provide the solution only to the first questions…

Q: On July 1, Flint Corporation purchases 510 shares of its $5 par value common stock for the treasury…

A: Recording of journal entry for two treasury stock are as follows. Treasury stock are those stock…

Q: Parker Plastic, Incorporated, manufactures plastic mats to use with rolling office chairs. Its…

A: Lets understand the basics. Direct material price variance is a variance between the rate at which…

Q: 2-32 Total costs and unit costs, service setting. The Big Event (TBE) recently started a business…

A: As you have asked multiple sub-parts we can solve only first three sub-parts for you if you want to…

Q: Exercise 10-6A (Algo) Identifying product versus SG&A costs LO 10-2, 10-3 A review of the accounting…

A: Selling Goods &Administration expenses All of a company's running expenses are referred to as…

Q: Bramble Company began operations in 2025 and determined its ending inventory at cost and at LCNRV at…

A: Inventory valuation refers to the process of assigning a monetary value to the inventory of a…

Q: Describe the accounting treatment of inventory in business. What are the different methods used to…

A: Inventory is a critical component of a company's assets, and its accounting treatment is essential…

Q: Exercise 3-8 (Algo) Balance sheet; current versus long-term classification [LO3-2, 3-3] Cone…

A: Long term Investments :- Bond sinking fund

Q: Data table Budgeted total sales, all on account Budgeted direct materials to be purchased and used…

A: Balance Sheet is the financial statement that records all the assets, liabilities and stockholders'…

Q: Blue Spruce Corp. is deciding whether to purchase 40% of Kyla Corp.'s shares for $1.60 million cash,…

A: The investment effect on blue spruce total assets, total liabilities and Shareholder's equity :-…

Q: Question 1 of 5 View Policies You are given the following information for Wildhorse Company for the…

A: FIFO stands for "First In, First Out." It is a method of inventory management or accounting that…

Q: A company paid $212.60 for an item. The original price was $294.90, but this was marked down 35%. If…

A: Answers Formula Break even point = Cost of item + operating expenses Reduced…

Q: Required information [The following information applies to the questions displayed below.] The…

A: Solution :- Joint cost allocated based on sales value at split-off method:- Particulars Product-1…

Q: Allen’s convenience store uses the periodic system to account for inventory and prepares financial…

A: Calculation of cost of goods sold Ending inventory balance reported monthly Financial statement are…

Q: Variable Costing Income Statement for a Service Company The actual and planned data for Broadwater…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: NOVA Sports Inc. has the following data for inventory for June: Units Unit Cost Total Cost June 1…

A: INVENTORY VALUATION Inventory Valuation is a Method of Calculation of Value of Inventory at the End…

Q: Mike Greenberg opened Grouper Window Washing Inc. on July 1, 2025. During July, the following…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: The following equity investment transactions were completed by Vintage Company during a recent year:…

A: Journal Entries to transactions of Vintage Company during a recent year:- Date Journal Entry…

Q: When an estate does not have sufficient assets to satisfy all claims against it, what claim has the…

A: When there aren't enough assets to pay out every claim against an estate, the subject of claims'…

Q: Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2020. To…

A: Consolidated statements are issued by those business enterprises which have one or more operating…

Q: I put the wrong numbers in At a production and sales level of 2,750 units, Bastion Company Incurred…

A: Introduction:- Fixed costs are remain constant irrespective of production volume. Variable cost per…

Q: The ABC Company produced specialized software for a customer. It delivered the software on 1/1/2023.…

A: Since the question has multiple sub-parts, as per the guidelines only the first three sub-parts will…

Q: The marketing department of Jessi Corporation has submitted the following sales forecast for the…

A: Budgeting: It is a process of planning the work to be performed. Under this process a formal plan is…

Q: Determine the unit value that should be used for inventory costing following…

A: Inventory is valued using lower cost or market value. market value is determined by a lower of…

Q: You are the treasurer of Hodashian Suppliers Corporation (HSC), a sporting goods equipment…

A: Cash Budget - Under Budgeting system cash budget is a schedule where company on the basis of past…

Q: Westland Corp. produces industrial light fixtures. For the year, management estimated that total…

A: Cost of goods manufactured: Cost of goods manufactured means total manufacturing costs; including…

Q: How do accounting standards and regulations (such as GAAP or IFRS) impact financial reporting? What…

A: Accounting standards and regulations are a set of guidelines and rules that govern the accounting…

Q: Jaffre Enterprises distributes a single product whose selling price is $13 per unit and whose…

A: Break even point in unit sales are the number of units required to cover the fixed expenses of the…

Q: g Corporation uses the FIFO method in its process costing. The following data pertain to its…

A: The equivalent units are calculated on the basis of percentage of the work completed during the…

Q: Cheesecake Factory Restaurant Company purchased equipment that cost $520,000. It had an estimated…

A: Depreciation Expenses - Depreciation Expense incurred on the Fixed assets of the company. They are…

Q: Required information [The following information applies to the questions displayed below.) At the…

A: Accounting Equation - Accounting Equation is calculated using the following equation - Assets =…

Q: Please draw a diagram on Paper to identify all elements of Return on Investment and to show the…

A: Return on investment is the process which is used to calculate the percentage of return of profit…

Q: Nature’s Garden Inc. produces wood chips, wood pulp, and mulch. These products are produced through…

A: Joint costs should be allocated based on net realizable value. To find out that, calculate sale…

Q: Please see the following data for the ACME company; Estimated overhead costs for the year Estimated…

A: Predetermined overhead rate :— It is the rate used to allocate manufacturing overhead to cost object…

Q: Hexagon reports operating cash flows of $3.50 billion, investing cash flows of $0.50 billion, and…

A: The cash flow statement is one of the financial statements prepared by the companies at the end of…

Q: Defined Plan assets, January 1, 2023 Actual return on plan assets, 2023 Discount rate Service cost,…

A: A retirement benefit is related to the retirement plan. The retirement plan is a kind of insurance…

Q: SFD Beverages makes beer in two stages: brewing and bottling. The following information is from the…

A: Ending inventory is the amount of inventory reported in the books at the end of the period. It is…

Q: a) Prepare the journal entry to record Sarasota's investment in Washi. Assume that any unexplained…

A: Introduction: - Journal entry is the first stage of accounting process. Journal entry used to record…

Q: The financial balances for the Atwood Company and the Franz Company as of December 31, 2020, are…

A: When two or more organizations unite to form one, this is called consolidation. The operating costs…

Q: The following information pertains to Camp Corp's issuance of bonds on July 1, 20X5: Face amount…

A: Solution: Correct answer : (d) $807 Present value of bond for 10 years @ 9% = $ 1000 * 0.422 = $ 422…

Q: A restaurant has three main products: drinks, meals and desserts. Fixed costs are $397,000. Other…

A: Here we need to calculate the sales that are needed to achieve a profit of $200,000 on an assumption…

Step by step

Solved in 2 steps

- Joshua can purchase a new car for $35,000. Alternatively, in addition to a down payment of $1,400, Joshua can make lease payments of $550 at the beginning of each month for three years to lease the car. The car has a residual value of $17,500. Assume that the cost of borrowing is 4.31% compounded monthly. a. Which option is economically better for Joshua? Buy Now Lease b. In the lease option, what will be the buyback value of the vehicle at the end of two years?You must decide whether to buy a new car for $19,000 or lease the same car over a three-year period. Under the terms of the lease, you can make a down payment of 1000$ and have monthly payments of $.150 At the end of the three years, the leased car has a residual value (the amount you pay i 12,000f you choose to buy the car at the end of the lease period) of $. Assume you can sell the new car at the end of the three years at the same residual value. Is it less expensive to buy or to lease? Question content area bottom Part 1 The cost for buying the car and selling it after three years would be $ enter your response here.Ben Halls is trying to decide whether to lease or purchase a new car costing $18,000. If he leases, he’ll have to pay a $600 security deposit and monthly payments of $450 over the 36-month term of the closed-end lease. Ben could earn 1% on the amount of any down payment or security deposit. On the other hand, if he buys the car then he’ll have to make a $2,400 down payment and will finance the balance with a 36-month loan with a 4% interest rate; he’ll also have to pay a 6 percent sales tax ($1,080) on the purchase price, and he expects the car to have a residual value of $6,500 at the end of 3 years. Ben can earn 4 percent interest on his savings

- You are considering leasing a car for 48 months where the advertisement says that monthly payments are $399 with $5,000 due at signing. You have seen elsewhere that the market value of the new car is $35,000 and that the expected market value in 4 years is $25,000. What effective annual rate (EAR) are you paying for this lease?Chris Svenson is trying to decide whether to lease or purchase a new car costing $18,000. If he leases, he’ll have to pay a $600 security deposit and monthly payments of $425 over the 36-month term of the closed-end lease. On the other hand, if he buys the car then he’ll have to make a $2,400 down payment and will finance the balance with a 36-month loan requiring monthly payments of $515; he’ll also have to pay a 6 percent sales tax ($1,080) on the purchase price, and he expects the car to have a residual value of $6,500 at the end of 3 years. Chris can earn 4 percent interest on his savings. Use the automobile lease versus purchase analysis form to find the total cost of both the lease and the purchase and then recommend the best strategy for Chris.Bisa is leasing a vehicle worth $20,000, with a down payment of $1000 and equal payments at the beginning of every two weeks for three years. What is the size of each lease payment if the cost of borrowing is 6.75% compounded monthly and the residual value is $10,500? The Textbook answer says $147.34........

- You are interested in leasing a car for $425 per month, due at the beginning of each month. Using an interest rate of 4% annually, what is the present worth of a one-year lease for this car? a) Slove using Annual Worth b) Solve using Internal Rate of Return Excel is preferredSandy is buying a new chair for $36,425, including a shipping charge of $1300. She is considering the following two credit options: •Financing through the dealership at 4.3%, compounded monthly, for a term of four years, with the incentive that the dealership will Pay the $1300 shipping charge • A bank loan at 4%, compounded monthly, for a term of five years a) what are the monthly payments for each option? b) what is the total payment for each option? c) what are the advantages and disadvantages of each option?Suppose you can buy a new Toyota corolla for $20000 and sell it for $12000 in third year. For simplication, assume you sell the car at the beginning of the third year but can keep driving it until the end of the third year. Alternatively you can lease the car for $300 per month for three years and return it at the end of the three years. For simplication, assume that lease payments are made yearly instead of monthly- i.e,, that they are $3600 per year and are made at the beginning of each of the three years. a. If the interest rate R is 4%, it is better to buy or lease? b. If the interest rate is 10%,it is better to buy or lease? c. At what interest rate would you be indifferent between buying and leasing the car in percent?

- A real estate broker decides to lease a car for 36 months. Suppose the annual interest rate is 7.8%, the negotiated price is $49,000, there is no trade-in, and the down payment is $4,000. Find the monthly lease payment (in dollars). Assume that the residual value is 49% of the MSRP of $51,5000. Round your answer to the nearest cent.After deciding to acquire a new car, you realize you can either lease the car or purchase it with a two-year loan. The car you want costs $34,000. The dealer has a leasing arrangement where you pay $97 today and $497 per month for the next two years. If you purchase the car, you will pay it off in monthly payments over the next two years at an APR of 6 percent. You believe that you will be able to sell the car for $22,000 in two years. What is the present value of purchasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value of lease $ What is the present value of leasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value of purchase $ What break-even resale price in two years would make you indifferent between buying and leasing? (Do not round intermediate calculations and round your answer to 2…Suppose that the seller of a home has accepted your offer of $175,900 to purchase the home.Suppose you are going to make a down payment of $11,000 and take out a 30-year mortgagewith a fixed APR of 3.236% to cover the rest of the cost. (a) Calculate the total of your monthly payments (in dollars) over the 30 years. (b) If closing costs consist of 3 points and a fixed cost of $1562, how much will you pay inclosing costs in total?