For each of the following unrelated situations, determine the financial statement effect using the Transaction Analysis Template: a. Equipment purchased at the beginning of the month for $31,200 on account has an estimated useful life of 4 years. One-month's depreciation on the equipment is unrecorded. b. An estimated utilities expense of $1,235 has been incurred in the current month, but the utility bill has not been received. c. On the first day of the current month, payment was made for four months rent in advance in the amount of $31,200. Monthly statements are now being prepared. d. Taylor Medical Equipment provides medical equipment for rent. A local nursing home pays $21,840 in advance for three-months rental rental of hospital beds. At the end of the current period, one month has passed. Note: Use negative signs with answers, when appropriate. Balance Sheet Income Statement Stockholders' Transaction Assets Liabilities + Equity Revenues Expenses = Net Income a. To record depreciation. b. To record utilities. c. To record rent. d. To record revenue. oㅇㅇㅇ o o o o O o oo O o o o o o o o

For each of the following unrelated situations, determine the financial statement effect using the Transaction Analysis Template: a. Equipment purchased at the beginning of the month for $31,200 on account has an estimated useful life of 4 years. One-month's depreciation on the equipment is unrecorded. b. An estimated utilities expense of $1,235 has been incurred in the current month, but the utility bill has not been received. c. On the first day of the current month, payment was made for four months rent in advance in the amount of $31,200. Monthly statements are now being prepared. d. Taylor Medical Equipment provides medical equipment for rent. A local nursing home pays $21,840 in advance for three-months rental rental of hospital beds. At the end of the current period, one month has passed. Note: Use negative signs with answers, when appropriate. Balance Sheet Income Statement Stockholders' Transaction Assets Liabilities + Equity Revenues Expenses = Net Income a. To record depreciation. b. To record utilities. c. To record rent. d. To record revenue. oㅇㅇㅇ o o o o O o oo O o o o o o o o

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter5: Closing Entries And The Post-closing Trial Balance

Section: Chapter Questions

Problem 4PA: The account balances of Bryan Company as of June 30, the end of the current fiscal year, are as...

Related questions

Topic Video

Question

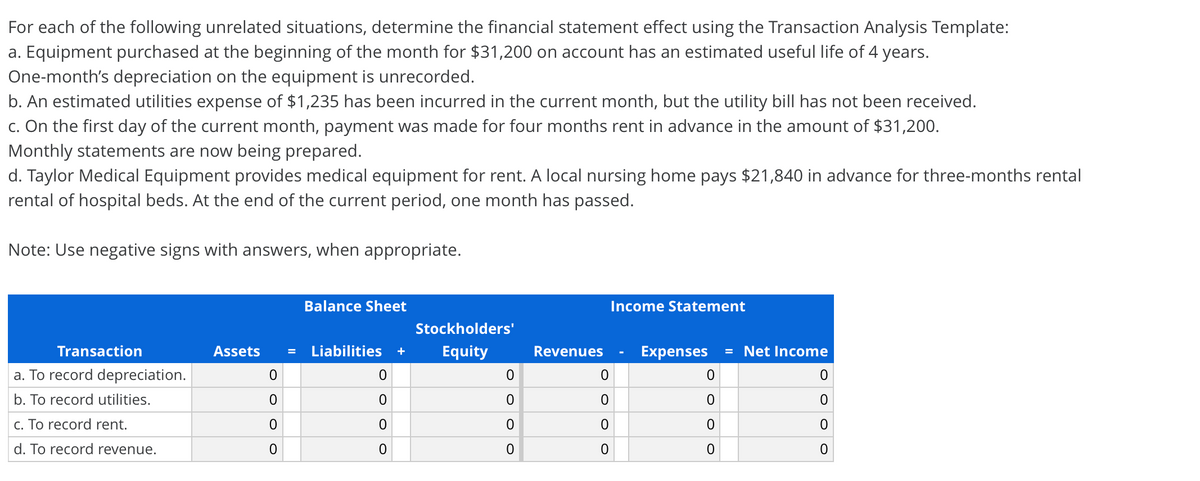

Transcribed Image Text:For each of the following unrelated situations, determine the financial statement effect using the Transaction Analysis Template:

a. Equipment purchased at the beginning of the month for $31,200 on account has an estimated useful life of 4 years.

One-month's depreciation on the equipment is unrecorded.

b. An estimated utilities expense of $1,235 has been incurred in the current month, but the utility bill has not been received.

c. On the first day of the current month, payment was made for four months rent in advance in the amount of $31,200.

Monthly statements are now being prepared.

d. Taylor Medical Equipment provides medical equipment for rent. A local nursing home pays $21,840 in advance for three-months rental

rental of hospital beds. At the end of the current period, one month has passed.

Note: Use negative signs with answers, when appropriate.

Balance Sheet

Income Statement

Stockholders'

Transaction

Assets

Liabilities

Equity

Revenues

Expenses

= Net Income

a. To record depreciation.

b. To record utilities.

c. To record rent.

d. To record revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning