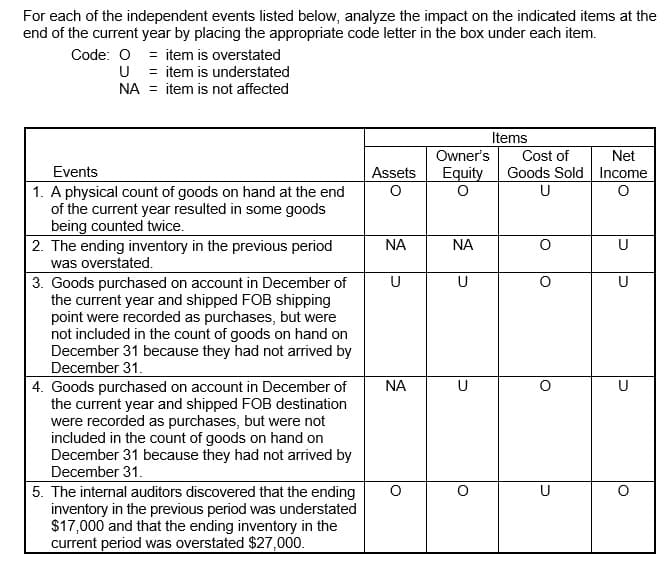

For each of the independent events listed below, analyze the impact on the indicated items at the end of the current year by placing the appropriate code letter in the box under each item. Code: O = item is overstated U = item is understated NA = item is not affected Events 1. A physical count of goods on hand at the end of the current year resulted in some goods being counted twice. 2. The ending inventory in the previous period was overstated. 3. Goods purchased on account in December of the current year and shipped FOB shipping point were recorded as purchases, but were not included in the count of goods on hand on December 31 because they had not arrived by December 31. 4. Goods purchased on account in December of the current year and shipped FOB destination were recorded as purchases, but were not included in the count of goods on hand on December 31 because they had not arrived by December 31. 5. The internal auditors discovered that the ending inventory in the previous period was understated $17,000 and that the ending inventory in the current period was overstated $27,000. Assets O ΝΑ U ΝΑ O Owner's Equity ΝΑ U U Items Cost of Goods Sold U O U Net Income U U

For each of the independent events listed below, analyze the impact on the indicated items at the end of the current year by placing the appropriate code letter in the box under each item. Code: O = item is overstated U = item is understated NA = item is not affected Events 1. A physical count of goods on hand at the end of the current year resulted in some goods being counted twice. 2. The ending inventory in the previous period was overstated. 3. Goods purchased on account in December of the current year and shipped FOB shipping point were recorded as purchases, but were not included in the count of goods on hand on December 31 because they had not arrived by December 31. 4. Goods purchased on account in December of the current year and shipped FOB destination were recorded as purchases, but were not included in the count of goods on hand on December 31 because they had not arrived by December 31. 5. The internal auditors discovered that the ending inventory in the previous period was understated $17,000 and that the ending inventory in the current period was overstated $27,000. Assets O ΝΑ U ΝΑ O Owner's Equity ΝΑ U U Items Cost of Goods Sold U O U Net Income U U

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 21GI: Indicate the effect of each of the following errors on the following balance sheet and income...

Related questions

Question

I appreciate your help. Sorry, because I copied and pasted the question, its format was messed up. It should have the Assets column too. However, the solutions I found in the test bank for numbers 2 and 4 were NA (Not Affected). But I don't know why overstated ending inventory in the previous period does not affect inventory in the current period?

Transcribed Image Text:For each of the independent events listed below, analyze the impact on the indicated items at the

end of the current year by placing the appropriate code letter in the box under each item.

Code: O = item is overstated

U

= item is understated

NA = item is not affected

Events

1. A physical count of goods on hand at the end

of the current year resulted in some goods

being counted twice.

2. The ending inventory in the previous period

was overstated.

3. Goods purchased on account in December of

the current year and shipped FOB shipping

point were recorded as purchases, but were

not included in the count of goods on hand on

December 31 because they had not arrived by

December 31.

4. Goods purchased on account in December of

the current year and shipped FOB destination

were recorded as purchases, but were not

included in the count of goods on hand on

December 31 because they had not arrived by

December 31.

5. The internal auditors discovered that the ending

inventory in the previous period was understated

$17,000 and that the ending inventory in the

current period was overstated $27,000.

Assets

O

ΝΑ

U

ΝΑ

Owner's

Equity

O

ΝΑ

U

U

O

Items

Cost of

Goods Sold

U

כן

U

Net

Income

O

U

U

U

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning