Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 4EB

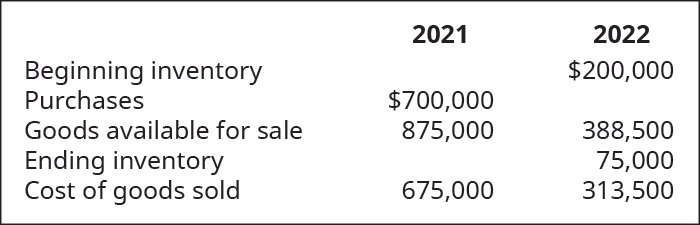

Complete the missing piece of information involving the changes in inventory, and their relationship to goods available for sale, for the two years shown.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Principles of Accounting Volume 1

Ch. 10 - If a company has four lots of products for sale,...Ch. 10 - If a company has three lots of products for sale,...Ch. 10 - When inventory items are highly specialized, the...Ch. 10 - If goods are shipped FOB destination, which of the...Ch. 10 - On which financial statement would the merchandise...Ch. 10 - When would using the FIFO inventory costing method...Ch. 10 - Which accounting rule serves as the primary basis...Ch. 10 - Which type or types of inventory timing system...Ch. 10 - Which of these statements is false? A. If cost of...Ch. 10 - Which inventory costing method is almost always...

Ch. 10 - Which of the following describes features of a...Ch. 10 - Which of the following financial statements would...Ch. 10 - Which of the following would cause periodic ending...Ch. 10 - Which of the following indicates a positive trend...Ch. 10 - What is meant by the term gross margin?Ch. 10 - Can a business change from one inventory costing...Ch. 10 - Why do consignment arrangements present a...Ch. 10 - Explain the difference between the terms FOB...Ch. 10 - When would a company use the specific...Ch. 10 - Explain why a company might want to utilize the...Ch. 10 - Describe the goal of the lower-of-cost-or-market...Ch. 10 - Describe two separate and distinct ways to...Ch. 10 - Describe costing inventory using first-in,...Ch. 10 - Describe costing inventory using last-in,...Ch. 10 - Describe costing inventory using weighted average....Ch. 10 - How long does it take an inventory error affecting...Ch. 10 - What type of issues would arise that might cause...Ch. 10 - Explain the difference between the flow of cost...Ch. 10 - What insights can be gained from inventory ratio...Ch. 10 - Calculate the goods available for sale for...Ch. 10 - Company accepts goods on consignment from R...Ch. 10 - The following information is taken from a companys...Ch. 10 - Complete the missing piece of information...Ch. 10 - Akira Company had the following transactions for...Ch. 10 - Akira Company had the following transactions for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Prepare Journal entries to record the following...Ch. 10 - If a group of inventory items costing $15,000 had...Ch. 10 - If Wakowski Companys ending inventory was actually...Ch. 10 - Shetland Company reported net income on the...Ch. 10 - Compute Altoona Companys (a) inventory turnover...Ch. 10 - Complete the missing pieces of McCarthy Companys...Ch. 10 - Calculate the goods available for sale for Soros...Ch. 10 - X Company accepts goods on consignment from C...Ch. 10 - Considering the following information, and...Ch. 10 - Complete the missing piece of information...Ch. 10 - Bleistine Company had the following transactions...Ch. 10 - Bleistine Company had the following transactions...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - If a group of inventory items costing $3,200 had...Ch. 10 - If Barcelona Companys ending inventory was...Ch. 10 - Tanke Company reported net income on the year-end...Ch. 10 - Compute Westtown Companys (A) inventory turnover...Ch. 10 - Complete the missing pieces of Delgado Companys...Ch. 10 - When prices are rising (inflation), which costing...Ch. 10 - Trini Company had the following transactions for...Ch. 10 - Trini Company had the following transactions for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Use the first-in, first-out (FIFO) cost allocation...Ch. 10 - Use the last-in, first-out (LIFO) cost allocation...Ch. 10 - Use the weighted-average (AVG) cost allocation...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Compare the calculations for gross margin for A76...Ch. 10 - Company Elmira reported the following cost of...Ch. 10 - Assuming a companys year-end inventory were...Ch. 10 - Use the following information relating to Shana...Ch. 10 - Use the following information relating to Clover...Ch. 10 - When prices are falling (deflation), which costing...Ch. 10 - DeForest Company had the following transactions...Ch. 10 - DeForest Company had the following transactions...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Use the first-in, first-out method (FIFO) cost...Ch. 10 - Use the last-in, first-out method (LIFO) cost...Ch. 10 - Use the weighted-average (AVG) cost allocation...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Compare the calculations for gross margin for B76...Ch. 10 - Company Edgar reported the following cost of goods...Ch. 10 - Assuming a companys year-end inventory were...Ch. 10 - Use the following information relating to Singh...Ch. 10 - Use the following information relating to Medinas...Ch. 10 - Assume your company uses the periodic inventory...Ch. 10 - Consider the dilemma you might someday face if you...Ch. 10 - Use a spreadsheet and the following excerpts from...

Additional Business Textbook Solutions

Find more solutions based on key concepts

In the article from Hear from Entrepreneurs, one respondent called motivation garbage? Would you agree or disag...

Principles of Management

Define cost object and give three examples.

Cost Accounting (15th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (4th Edition)

A piece of equipment is purchased for $40,000 and has an estimated salvage value of $1,000 at the end of the re...

Construction Accounting And Financial Management (4th Edition)

Journal entries, T-accounts, and source documents. Visual Company produces gadgets for the coveted small applia...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following describes features of a perpetual inventory system? A. Technology is normally used to record inventory changes. B. Merchandise bought is recorded as purchases. C. An adjusting journal entry is required at year end, to match physical counts to the asset account. D. Inventory is updated at the end of the period.arrow_forwardWhich of the following financial statements would be impacted by a current-year ending inventory error, when using a periodic inventory updating system? A. balance sheet B. income statement C. neither statement D. both statementsarrow_forwardUnder the periodic inventory system, what account is debited when an estimate is made for the cost of merchandise inventory sold this year, but expected to be returned next year? (a) Estimated Returns Inventory (b) Sales Returns and Allowances (c) Merchandise Inventory (d) Customer Refunds Payablearrow_forward

- Beginning inventory, purchases, and sales for Item Gidget are as follows: Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on September 27 and (b) the inventory on September 30.arrow_forwardThe beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 7-1B. Instructions 1. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the first-in, first-out method and the periodic inventory system. 2. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the last-in, first-out method and the periodic inventory system. 3. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the dollar. 4. Compare the gross profit and June 30 inventories using the following column headings:arrow_forwardIndicate the effect of each of the following errors on the following balance sheet and income statement items for the current and succeeding years: beginning inventory, ending inventory, accounts payable, retained earnings, purchases, cost of goods sold, net income, and earnings per share. a. The ending inventory is overstated. b. Merchandise purchased on account and received was not recorded in the purchases account until the succeeding year although the item was included in inventory of the current year. c. Merchandise purchased on account and shipped FOB shipping point was not recorded in either the purchases account or the ending inventory. d. The ending inventory was understated as a result of the exclusion of goods sent out on consignment.arrow_forward

- Beginning inventory, purchases, and sales for Item Widget are as follows: Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on March 25 and (b) the inventory on March 31.arrow_forwardThe beginning inventory for Funky Party Supplies and data on purchases and sales for a three-month period are shown in Problem 7-1A. Instructions 1. Determine the inventory on March 31, 2016, and the cost of goods sold for the three-month period, using the first-in, first-out method and the periodic inventory system. 2. Determine the inventory on March 31, 2016, and the cost of goods sold for the three-month period, using the last-in, first-out method and the periodic inventory system. 3. Determine the inventory on March 31, 2016, and the cost of goods sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the nearest cent. 4. Compare the gross profit and the March 31, 2016, inventories, using the following column headings:arrow_forwardUnder the periodic inventory system, what account is credited when an estimate is made for sales made this year, but expected to be returned next year? (a) Merchandise Inventory (b) Customer Refunds Payable (c) Sales (d) Sales Returns and Allowancesarrow_forward

- Under the periodic inventory system, what account is debited when an estimate is made for sales made this year, but expected to be returned next year? (a) Sales Returns and Allowances (b) Merchandise Inventory (c) Customer Refunds Payable (d) Salesarrow_forwardData on the physical inventory of Ashwood Products Company as of December 31 follow: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the inventory at cost as well as at the lower of cost or market, using the first-in, first-out method. Record the appropriate unit costs on the inventory sheet and complete the pricing of the inventory. When there are two different unit costs applicable to an item, proceed as follows: 1. Draw a line through the quantity and insert the quantity and unit cost of the last purchase. 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase. 3. Total the cost and market columns and insert the lower of the two totals in the Lower of C or M column. The first item on the inventory sheet has been completed as an example.arrow_forwardBeginning inventory, purchases, and sales for Item Delta are as follows: Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on July 24 and (b) the inventory on July 31.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License