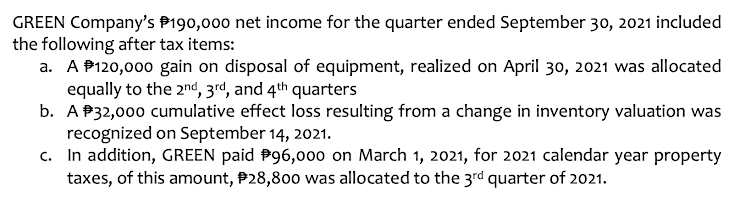

For the quarter ended September 30, 2021, how much should GREEN report as net income?

Q: The Bradford Company issued 10% bonds, dated January 1, with a face amount of $94 million on January…

A: 1. Given, Face amount = $94000000 n = 10 x 2 = 20 i = 10%/2 = 5% Market yield = 12%/2 = 6% Cash…

Q: Jacques is an alien assigned in the Philippines to manage the regional area headquarters of Deli…

A: The Non Resident Aliens in Philippines are subject to income tax on the incomes…

Q: Exercise 2) Elmer's Electronics has the following information for the first three years of business:…

A: Calculation for net income under full costing: Particulars 2019 ($) 2020 ($) 2021($) Sales…

Q: Bol Company's December 31 year-end financial statements had the following errors: December…

A: Understated Expenses are subtracted whereas overstated expense are added back in order correct the…

Q: The cost of an asset is $1,050,000, and its residual value is $280,000. Estimated useful life of the…

A: Depreciation means the amount expense out of cost of assets due to normal usage of assets , normal…

Q: Bank Reconciliation The following bank reconciliation was prepared as of June 30, 20Y7: Poway Co.…

A: We should reduce Outstanding checks to get correct Adjusted bank balance

Q: Allowance method entries The following transactions were completed by Wild Trout Gallery during the…

A: Accounts receivables includes the amount which are yet to be received by the seller of the goods…

Q: Major League Apparel has two classes of stock authorized: 5%, $10 par preferred, and $1 par value…

A: The journal entries are prepared to record day to day transactions of the business. The dividend is…

Q: A corporation bought a machine for RP 8,000 with a commercial useful life of 4 years and a fiscal…

A:

Q: The following information pertains to Blue Diamond Company: 1. Cash balance per bank, July 31,…

A: The bank reconciliation statement at July 31 and the necessary adjusting entries at July 31 on the…

Q: exponent is 0.7 for a

A: Cost of producing 100 units electric starter units = $200,000 Cost of producing 500 units electric…

Q: ABC Company budgeted the following production in units for the second quarter of the year: April…

A: Budget means the expected value for future. Raw material means the goods which is processed to make…

Q: Problem 2 opaze the Journa Entries to record the following transactions on Giants Company'a book…

A: Here terms 2/10, n/30 means 2% discount will be given if payment is made within 10 days of…

Q: Imagine that you work in the accounting department of a university and your boss has asked you to…

A: Revenue and Expenses are the two most important elements of an income statement. Incomes/Revenues…

Q: imah Puddleduck ance Sheet at 31 October 2012 2012 2011 ETS h in hand h at bank 25 40 450 230

A: Net worth is the amount of equity that can you get from the basic accounting equation of assets…

Q: . Prepare an income statement according to the variable costing concept. Gallatin County Motors Inc.…

A: 1. Computation of cost of goods sold under absorption costing systems. Production cost * sales unit…

Q: Prepare a comparative balance sheet and discuss the operational performance of the Bank.

A: Comparative Balance sheet helps investors, shareholders and other users of balance sheet to…

Q: The company sells goods to Jason. The company agreed to send the goods to London with an additional…

A: The business transactions are recorded using journal entries. The business sells goods and the…

Q: Jaybird Company operates in a highly competitive market where the mnarket price for its product is…

A: Any expense incurred by a business during the manufacturing or production process for its goods and…

Q: Purity Ltd bottles and distributes mineral water from the company's natural springs in Hepburn…

A: Number of 1 litre bottles that should be produced =Sales in bottles + Ending inventory -…

Q: FMT Trading Inc. has the following financial data: Annual sales 10,000,000 Cost of goods sold…

A: Cash Conversion Cycle - Cash Conversion cycle is calculated by following formula - Average…

Q: A company must decide between scrapplng or reworking units that do not pass Inspection. The comparry…

A: Incremental income is calculated as difference of net income under both scenarios where the first…

Q: ncrease in receivables 190 Decrease in inven

A: Given: Operating Activities Net Income $ 780 Depreciation 33,405 Increase in…

Q: Use the information below for questions 7-11 $ 380 July 1 Beginning inventory Purchases 20 units at…

A: Inventory Valuation can be done by the First In First Out (FIFO) method and the Last In First…

Q: d. What is Mogi Corp.’s operating profit if all 40,000 gallon of final product can be sold for $55…

A: Transfer price means the price charged by one department from other department of the same company…

Q: amount of P2,500,000 for P4,000,000. The remaining life of the equipment is 5 years. In December…

A: Given: In this question, Jessa companies financial condition is disclosed : - They acquire 40%…

Q: investigative techniques used to uncover the fraud.

A: Fraud is defined as a false portrayal of the facts that cause the victim of the fraud to suffer harm…

Q: If Arwind purchased 25% of the respective capital and profits and losses of Terence and Romeo for P…

A: Ratio Calculation on admission of new partner in partnership firm

Q: The FMT Corporation is trying to determine the effect of its inventory turnover ratio and days sales…

A: Inventory Turnover Ratio = Net Sales / Average Inventory 5 Times = 1,50,000 /Average…

Q: Katie bought a house in 2000 for $300,000. She put 10% down and then financed the remaining balance…

A: EMI = P×r×(1+r)n(1+r)n-1 where; P = Principal = $300,000*90%= $270,000 r = rate of interest = 7.25…

Q: ntages of using different man

A: Software is combination of many program that works together to achieve a desired function. These…

Q: During 2021, Palm Corporation reported pretax book income of $675,000. Tax depreciation exceeded…

A: Deferred Tax Provisions It is important for the business to calculate the income tax expenses and…

Q: On January 13, at the end of the second weekly pay period of the year, a company's payroll register…

A: Payroll includes all employee expenses and taxes and insurance related to employees

Q: If Arwind invested P 130,000 for a 25% interest in the firm and that the assets of the partnership…

A: Partnership Accounting Admission of Partner New Profit sharing Ratio New Profit Sharing with…

Q: Required information [The following information applies to the questions displayed below.] Black…

A: Computation of direct material budget requires the number of units produced during the period and it…

Q: REQUIRED: prepare the Balance Sheet Equation for the following: 1) On 9/1/13, Strand Corp received a…

A: The accounting equation follows the concept that the assets are always equal to the sum of…

Q: Human Resources Accounting Checking Savings Loans Administration $540,000 10 10 30 40 10 Human…

A: Step-method of cost allocation. The second method for dispersing service department costs is the…

Q: On April 1, 2021, MNO Company borrowed $15,000 on an 8% note payable. The maturity date of the note…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Lynch's deferred income tax expense or benefit for the current year would be

A: A deferred tax asset or liability is a line item on a company's balance sheet that reduces or…

Q: ORANGE Company and its divisions are engaged solely in manufacturing. The following data pertain to…

A: IFRS 8 Operating Segments requires particular class of entities to disclose information about their…

Q: The receivales turnover ratio is used to analyze profitability. liquidity. risk a. b. С. nventors d.…

A: Receivable Turnover Ratio = Net Credit Sales / Average Receivable

Q: Prepare the journal entry at commencement of the lease for Sharrer, assuming (1) Sharrer does not…

A: Solution:- Prepare the journal entry at commencement of the lease for Sharrer (1) Sharrer does not…

Q: Keil Company has a single investment property which had an original cost of P5,800,000 on January 1,…

A: In case of Fair value model, assets is measured at fair value and any change in fair value during…

Q: Submit a picture that is related to your field, Accountancy. Give three mathematical terms…

A: Answer:- Picture related to Accountancy:-

Q: Cassels Corp. (a C-Corporation) generated a Net Operating Loss (NOL) in 2021 of ($80,000). Cassels…

A: Net Operating Loss: A net operating loss (NOL) is the outcome of a company's permitted deductions…

Q: Jasmin Company purchased an investment property on January 1, 2017 at a cost of P2,200,000. The…

A: Cost of investment property = 2200000 Use ful life = 40 years Deprecation for 2 years =2200000/40…

Q: 21. Aliza had a tax liability of $6,228 last year. She was entitled to tax credits of $758 and…

A: Refund = Withholding Amount > tax liabilities gets Refunds Tax Due = If Withholding Amount <…

Q: How much is the VAT payable as at January 31, 2020?

A: Vat payable amount is the amount which requires to be paid to the government or tax authority which…

Q: Financial ratios computed for Whittaker Inc. include the following: Current ratio Acid-test ratio…

A: The Income statement is one of three basic financial statements that describe a company's financial…

Q: 19,000 dinars to be made on March 1, 2021 The materials are consumed immediately and recognized as…

A: DICLAIMER:SINCE YOU HAVE POSTED MULTIPLE SUB PART QUESTION, WE WILL SOLVE 3 PARTS .TO GET OTHERS…

For the quarter ended September 30, 2021, how much should GREEN report as net income?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Comprehensive Colt Company reports pretax financial income of 143,000 in 2019. In addition to pretax income from continuing operations (of which revenues are 295,000), the following items are included in this pretax income: Colts taxable income totals 93,000 in 2019. The difference between the pretax financial income and the taxable income is due to the excess of tax depreciation over financial depreciation on assets used in continuing operations. At the beginning of 2019, Colt had a retained earnings balance of 310.000 and a deferred tax liability of 8,100. During 2019, Colt declared and paid dividends of 48,000. It is subject to tax rates of 15% on the first 50,000 of income and 30% on income in excess of 50,000. Based on proper interperiod tax allocation procedures, Colt has determined that its 2019 ending deferred tax liability is 14,100. Required: 1. Prepare a schedule for Colt to allocate the total 2019 income tax expense to the various components of pretax income. 2. Prepare Colts income tax journal entry at the end of 2019. 3. Prepare Colts 2019 income statement. 4. Prepare Colts 2019 statement of retained earnings. 5. Show the related income tax disclosures on Colts December 31, 2019, balance sheet.Prior to and during 2019, Shadrach Company reported tax depreciation at an amount higher than the amount of financial depreciation, resulting in a book value of the depreciable assets of 24,500 for financial reporting purposes and of 20,000 for tax purposes at the end of 2019. In addition, Shadrach recognized a 3,500 estimated liability for legal expenses in the financial statements during 2019; it expects to pay this liability (and deduct it for tax purposes) in 2023. The current tax rate is 30%, no change in the tax rate has been enacted, and the company expects to be profitable in future years. What is the amount of the net deferred tax liability at the end of 2019? a. 300 b. 450 c. 1,050 d. 1,350Brooks Company reported a prior period adjustment of 512,000 in pretax financial "income" and taxable income for 2020. The prior period adjustment was the result of an error in calculating bad debt expense for 2019. The current tax rate is 30%, and no change in the tax rate has been enacted for future years. When the company applies intraperiod income tax allocation, the prior period adjustment will be shown on the: a. income statement at 12,000 b. income statement at 8,400 (net of 3,600 income taxes) c. retained earnings statement at 12,000 d. retained earnings statement at 8,400 (net of 3,600 income taxes)

- Heller Company began operations in 2019 and used the LIFO method to compute its 300,000 cost of goods sold for that year. At the beginning of 2020, Heller changed to the FIFO method. Heller determined that its cost of goods sold under FIFO would have been 250,000 in 2019. For 2020, Hellers cost of goods sold under FIFO was 360,000, while it would have been 410,000 under LIFO. Heller is subject to a 21% income tax rate. Compute the cumulative effect of the retrospective adjustment on prior years income (net of taxes) that Heller would report on its retained earnings statement for 2020.Deferred Tax Liability: Depreciation At the beginning of 2019, its first year of operations, Cooke Company purchased an asset for 100,000. This asset has an 8-year economic life with no residual value, and it is being depreciated by the straight-line method for financial reporting purposes. For tax purposes, however, the asset is being depreciated using the MACRS (200%, 5-year life) method. During 2019, Cooke reported pretax financial income of 51,500 and taxable income of 44,000. The depreciation temporary difference caused the difference between the two income amounts. The tax rate in 2019 was 30%, and no change in the tax rate had been enacted for future years. Required: 1. Prepare a schedule that shows for each year, 2019 through 2026, (a) MACRS depreciation, (b) straight line depreciation, (c) the annual depreciation temporary difference, and (d) the accumulated temporary difference at the end of each year. 2. Prepare a schedule that computes for each year, 2019 through 2026, (a) the ending deferred tax liability and (h) the change in the deferred tax liability. 3. Prepare Cookes income tax journal entry at the end of 2019. 4. Next Level Explain what happens to the balance of the deferred tax liability at the end of 2019 through 2026.At the beginning of 2019, Conley Company purchased an asset at a cost of 10,000. For financial reporting purposes, the asset has a 4-year life with no residual value and is depreciated by the straight-line method beginning in 2019. For tax purposes, the asset is depreciated under MACRS using a 5-year recovery period. Prior to 2019, Conley had no deferred tax liability or asset. The difference between depreciation for financial reporting purposes and income tax purposes is the only temporary difference between pretax financial income and taxable income. The current income tax rate is 30%, and no change in the tax rate has been enacted for future years. In 2019 and 2020, taxable income will be higher or lower than financial income by what amount?

- Incomc Taxes Then Company has been in operation for several years. It has both a deductible and a taxable temporary difference. At the beginning of 2019, its deferred tax asset was 690, and its deferred tax liability was 750. The company expects its lutine deductible amount to be deductible in 2020 and its Inline taxable amount to 1 taxable in 2021. In 2018, Congress enacted income tax rates for future years as follows: 2019, 30%; 2020, 34%; and 2021, 35%. At the end of 2019, Then reported income taxes payable of 25,800, an increase in its deferred tax liability of 300, and an ending balance in its deferred tax asset of 860. Thun has prepared the following schedule of items related to its income taxes for 2019. Required: Fill in the blanks in the preceding schedule. Show your calculations.Interperiod Tax Allocation Peterson Company has computed its pretax financial income to be 66,000 in 2019 after including the effects of the appropriate items from the following information: Petersons accountant has prepared the following schedule showing the future taxable and deductible amounts at the end of 2019 for its three temporary differences: At the beginning of 2019, Peterson had a deferred tax liability of 12,540 related to the depreciation difference and 4,710 related to the accrual-basis sales difference. In addition, it had a deferred tax asset of 14,850 related to the warranty difference. The current tax rate is 30%, and no change in the tax rate has been enacted for future years. Required: 1. Compute Petersons taxable income for 2019. 2. Prepare Petersons income tax journal entry for 2019 (assume no valuation allowance is necessary). 3. Next Level Identify the permanent differences in Items 1 through and explain why you did or did not account for them as deferred tax items in Requirement 2.Turnip Company purchased an asset at a cost of 10,000 with a 10-year life during the current year. Turnip uses differing depreciation methods for financial reporting and income tax purposes. The depreciation expense during the current year for financial reporting is 1,000 and for income tax purposes is 2,000. Turnip is subject to a 30% enacted future tax rate. Prepare a schedule to compute Turnips (a) ending future taxable amount, (b) ending deferred tax liability, and (c) change in deferred tax liability (deferred tax expense) for the current year.

- Ironwood Corporation has ordinary taxable income of $65,000 in 2019, and a short-term capital loss of $15,000. What is the corporation's tax liability for 2019? $7,500 $5,250 $10,500 $13,650 None of the aboveGray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.