enefit 0,000

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 24CE

Related questions

Question

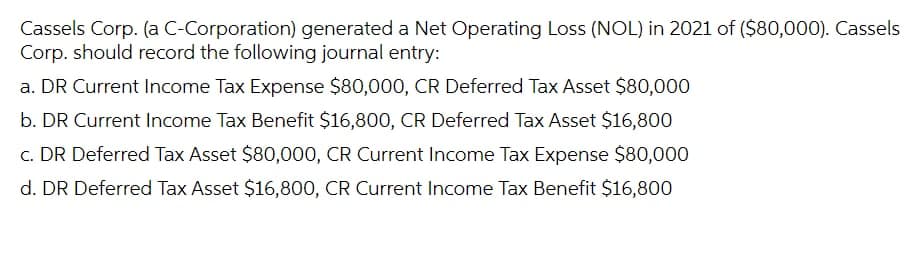

Transcribed Image Text:Cassels Corp. (a C-Corporation) generated a Net Operating Loss (NOL) in 2021 of ($80,000). Cassels

Corp. should record the following journal entry:

a. DR Current Income Tax Expense $80,000, CR Deferred Tax Asset $80,000

b. DR Current Income Tax Benefit $16,800, CR Deferred Tax Asset $16,800

c. DR Deferred Tax Asset $80,000, CR Current Income Tax Expense $80,000

d. DR Deferred Tax Asset $16,800, CR Current Income Tax Benefit $16,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you