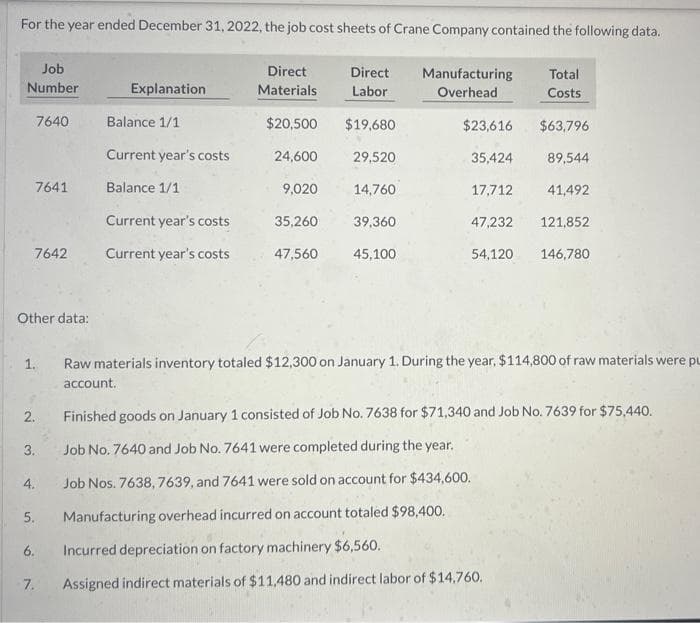

For the year ended December 31, 2022, the job cost sheets of Crane Company contained the following data. Direct Materials Total Costs $20,500 $23,616 $63,796 24,600 35,424 89,544 9,020 Job Number 7642 Other data: 1. 7641 2. 3. 5. 4. 7640 6. 7. Explanation Balance 1/1. Current year's costs Balance 1/1 Current year's costs Current year's costs 35,260 47,560 Direct Labor $19,680 29,520 14,760 39,360 45,100 Manufacturing Overhead 17,712 41,492 47,232 121,852 54,120 146,780 Raw materials inventory totaled $12,300 on January 1. During the year, $114,800 of raw materials were pu account. Finished goods on January 1 consisted of Job No. 7638 for $71,340 and Job No. 7639 for $75,440. Job No. 7640 and Job No. 7641 were completed during the year. Job Nos. 7638,7639, and 7641 were sold on account for $434,600. Manufacturing overhead incurred on account totaled $98,400. Incurred depreciation on factory machinery $6,560. Assigned indirect materials of $11,480 and indirect labor of $14,760.

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Sh15

Please help me

Solution

Thankyou

Trending now

This is a popular solution!

Step by step

Solved in 3 steps