of the fixed overhead cost incurred in PE a. Should LMTC Ltd accept or reject the offer from Kids Jump Ltd? b. What other factors do managers consider in accepting or rejecting of investment decisions

of the fixed overhead cost incurred in PE a. Should LMTC Ltd accept or reject the offer from Kids Jump Ltd? b. What other factors do managers consider in accepting or rejecting of investment decisions

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter13: Lean Manufacturing And Activity Analysis

Section: Chapter Questions

Problem 13E: Lean accounting Modern Lighting Inc. manufactures lighting fixtures, using lean manufacturing...

Related questions

Question

Qw.111.

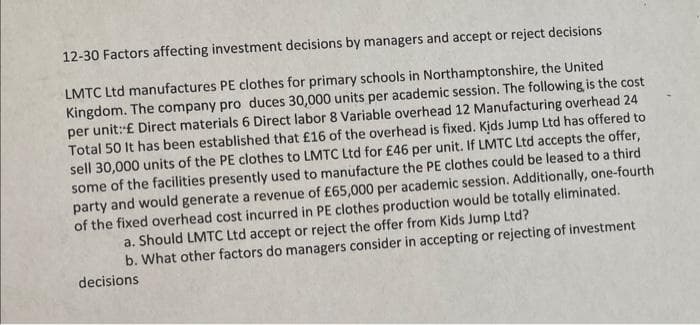

Transcribed Image Text:12-30 Factors affecting investment decisions by managers and accept or reject decisions

LMTC Ltd manufactures PE clothes for primary schools in Northamptonshire, the United

Kingdom. The company pro duces 30,000 units per academic session. The following is the cost

per unit: £ Direct materials 6 Direct labor 8 Variable overhead 12 Manufacturing overhead 24

Total 50 It has been established that £16 of the overhead is fixed. Kids Jump Ltd has offered to

sell 30,000 units of the PE clothes to LMTC Ltd for £46 per unit. If LMTC Ltd accepts the offer,

some of the facilities presently used to manufacture the PE clothes could be leased to a third

party and would generate a revenue of £65,000 per academic session. Additionally, one-fourth

of the fixed overhead cost incurred in PE clothes production would be totally eliminated.

a. Should LMTC Ltd accept or reject the offer from Kids Jump Ltd?

b. What other factors do managers consider in accepting or rejecting of investment

decisions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning