for transportation, $800 for lodging, What amount of the total costs can Melissa deduct as business expenses?

Q: 7-12 MATURITY RISK PREMIUM An investor in Treasury securities expects inflation to be 2.5% in Year…

A: Bond Risk Premium Bonds are a kind of assets that offer a steady stream of predictable cash flows,…

Q: Consolidated Balance Sheet $ millions, except par value Feb. 1, 2019 Current assets Cash and cash…

A: Net operating assets is difference between operating assets and operating liabilities. These assets…

Q: On January 2, 20X1, Gold Sor Lesting Company leases equipment to Brick Co. with 5 equal annual…

A: Solution: Lease receivables at the beginning of lease = Present value of minimum lease payment and…

Q: STARPLUS LIMITED: PLANNING FOR 2023 Starplus, Limited is well known for its focus on customer…

A: The statement of financial position also known as balance sheet shows the assets, liabilities and…

Q: Answer the following questions including all the formulas and calculations to arrive at financial…

A: Cash Budget for 10 months from March to December Particulars March April May June July August…

Q: On May 3, 2020, Leven Corporation negotiated a short-term loan of $885,000. The loan is due October…

A: Interest = Principal x Rate of Interest x Time(Yrs) I = P×R×T

Q: Nichols Inc. issued 3,000 $1,000 bonds at 102. Each bond was issued with one detachable stock…

A: Proportional Method of Allocation between bond and Warrant The division of the proceeds from a bond…

Q: 9- Classifying Long-Lived Assets and Related Cost Allocation For each of the following long-lived…

A: Long-lived assets are those assets that have a life of more than one year. These assets are…

Q: Use the above information to prepare a statement of cash flows for the current year using the…

A: The cash flow statement is one of the financial statements which tells about the cash flow from…

Q: Required information [The following information applies to the questions displayed below.] Diego…

A: MARGINAL COSTING INCOME STATEMENT Marginal Costing is Also Known as Variable Costing. Marginal…

Q: How did you determine the federal income tax amount?

A: The federal income tax is the tax which is payable over the taxable income of the person and this is…

Q: Cost data for Firetree Manufacturing Inventories March 1 Materials Work in process Finished goods…

A: The statement of cost of goods manufactured is prepared to estimate the cost of goods that are…

Q: Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur…

A: SHEDULE OF COLLECTION FROM CUSTOMER Schedule of Collection From Sales States the amount of Cash…

Q: 18 Oxford Company uses a job order costing system. In the last month, the system accumulated labor…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Accounting Information System Provide an analysis/explanation of the flow of the expenses flowchart…

A: A business expenses flowchart is a visual representation of the flow of expenditures in a business.…

Q: K Use the simple interest formula to determine the missing value. p=$959.96, r=4.5%, t=?, i=$172.79

A: In multiple questions we can solve only first question for you if you want to get another answer…

Q: [The following information applies to the questions displayed below.] The county collector of…

A: a. The journal entries are as follows: S. No. Account Titles Debit Credit 1. Taxes receivable…

Q: From the following data, calculate labor variances : The budgeted labor force for producing product…

A: A labor variance occurs when the actual cost of a labor activity differs from the amount predicted.…

Q: Chapters Beginning WIP Direct materials Direct labor Applied overhead The Work in Process Inventory…

A: In manufacturing process, goods from various stages transfers to another stages. In this process…

Q: Analytical procedures are a critical part of audit work. Describe at least three different…

A: The audit process includes analytical techniques, which involve evaluating financial data by looking…

Q: 2. The listed App AG has issued shares with a nominal value of €1. In t5, a capital increase is…

A: A capital increase by a firm often entails the issuance of new shares to raise additional funds. In…

Q: Real Estate Tax Property Tax Purchase Price Market Value A. $2,240 C. $26,600 1.4% $160,000 $190,000…

A: Taxes are mandatory payments made to individuals or organizations by the government, whether…

Q: You work as a freelance accounting professional and have been recently engaged by the auditors of…

A: The overall cash flow to creditors and cash flow to stockholders, also known as cash flow from…

Q: Assume a company had no jobs in progress at the beginning of July and no beginning inventories. It…

A: PREDETERMINED OVERHEAD RATE Predetermined rate means an indirect cost rate. predetermined overhead…

Q: . Prepare a balance sheet for 2021 and 2022 for the company, clearly showing information about each…

A: Balance sheet is a financial statement which provides details about a company actual position and it…

Q: P-1 A branch of Venell Corporation is on its first year of operations. The following series of…

A: Branch accounting: It is a type of system for recording accounting transactions in which the…

Q: Find the following financial ratios for Earl Grey Golf Corp. (use year-end figures rather than…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: the context of auditing, what does "tracking" actually

A: In the auditing the audit trails is said to be the process that involved tracking data and verifying…

Q: Lily Wyatt is unable to reconcile the bank balance at January 31. Lily's reconciliation is as…

A: The balance of the cash book occasionally does not match the balance of the bank account due to…

Q: Pharoah Company adopts acceptable accounting for its defined benefit pension plan on January 1,…

A: A defined benefit pension plan is provided by employers as a retirement pension plan for employees…

Q: Consider the following situations for Shocker: On November 28, 2024, Shocker receives a $4,200…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: 不 Becky would like to be a millionaire in 20 years. How much would she need to invest quarterly in a…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: Cycle USA is in the business

A: In standard costing we calculate variances to find out deviation from budegeted…

Q: Jan. 1 Apr. 1 Oct. 1 Beginning inventory Purchased Purchased 400 units $18 $23 2,500 units 1,000…

A: operating activities refer a day to day transactions and events that are directly involved in…

Q: Morris Company applies overhead based on direct labor costs. For the current year, Morris Company…

A: Answer:- Overhead meaning:- The term "overhead" describes continuing business costs that are not…

Q: For a purchase of goods on destination, input tax of €665 is booked. How high are the trade…

A: Input taxes are added to the cost of purchase. Thus increasing the amount by such tax amount. Goods…

Q: resented here are the comparative balance sheets of Hames Incorporated at December 31, 2023 and…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: These items are taken from the financial statements of Oriole Co. at December 31, 2022. Buildings…

A: The balance sheet is a summary of permanent accounts prepared at the end of the accounting period.…

Q: An engineer wished to purchase an $80,000 home by making a down payment of $20,000 and borrowing the…

A: Bank fees are any charges made by financial institutions to their individual and commercial…

Q: 91 Reporting and Recording the Disposal of a Long-Lived Asset (Straight-Line Depreciation) As part…

A: The gain or loss on sale of a fixed asset is calculated as difference between the book value and…

Q: Splish Windows manufactures and sells custom storm windows for enclosed porches. Splish also…

A: INTRODUCTION: Sales revenue and revenue are phrases that are sometimes used interchangeably.…

Q: Tarnish Industries produces miniature models of farm equipment. These collectibles are in great…

A: The budgeted overhead cost is the standard cost that is estimated by the business for the budgeted…

Q: Rate on Taxable Income 10% 12 22 24 32 35 37 Single Taxpayers Up to $9,950 $9,951-$40,525…

A: Tax liability refers to an amount on which tax is paid to the local or state government by an…

Q: Accounting Information System Prepare a step-by-step payment flowchart for a bookstore business,…

A: A payment flowchart is a visual representation of the steps involved in a payment process. It…

Q: 2. Johnstown Company granted 10 officers rights to buy 10,000 shares each of common stock $2 par, at…

A: Compensation is the total pay an employee receives when working. This includes a traditional salary,…

Q: Firm C has the following: $50,000,000 $15,000,000 2,500,000 $20 $3,000,000 Firm C will take on a new…

A: Earnings per share is defined as the amount available per share to the equity share holders. This is…

Q: AB Ltd. presents the following selected accounts, all balances are after adjusting journal entries.…

A: The income statement is prepared at the and of the accounting period t determine profit or loss. The…

Q: Sheffield Corp. issues $6000000 face value of bonds at 96 on January 1, 2019. The bonds are dated…

A: The bonds may be issued at a discount when the interest offered by bonds is lower that the interest…

Q: Sandhill Manufacturing Inc. has the following cost and production data for the month of April. Units…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Q: Post the transactions to T accounts .(post entries in the order (cash,account receivable,equipment,…

A: Cash Date Particulars Amount Date Particulars Amount 1-Sep-18 Capital $…

Step by step

Solved in 2 steps

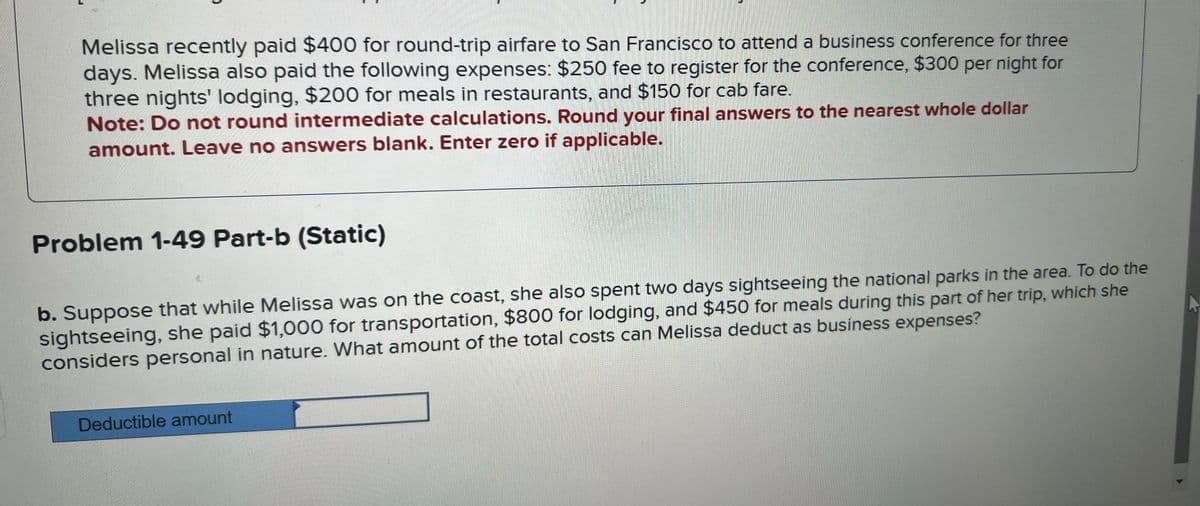

- Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three nights' lodging, $200 for meals in restaurants, and $150 for cab fare. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. d. Suppose that Melissa's permanent residence and business were located in San Francisco. She attended the conference in San Francisco and paid $250 for the registration fee. She drove 100 miles over the course of three days and paid $90 for parking at the conference hotel. In addition, she spent $150 for breakfast and dinner over the three days of the conference. She bought breakfast on the way to the conference hotel, and she bought dinner on her way home each night from the conference. What amount of these costs can Melissa deduct as…Melissa recently paid $595 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $380 fee to register for the conference, $295 per night for three nights' lodging, $180 for meals in restaurants, and $420 for cab fare. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. a. What amount of these costs can Melissa deduct as business expenses?Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three nights' lodging, $200 for meals in restaurants, and $150 for cab fare. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. a. What amount of these costs can Melissa deduct as business expenses? Note: when I attempted it, I got 1,800 but when I enter it and check, it had indicated it was incorrect.

- [The following information applies to the questions displayed below.] Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three nights' lodging, $200 for meals in restaurants, and $150 for cab fare. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. a. What amount of these costs can Melissa deduct as business expenses? b. Suppose that while Melissa was on the coast, she also spent two days sightseeing the national parks in the area. To do the sightseeing, she paid $1,000 for transportation, $800 for lodging, and $450 for meals during this part of her trip, which she considers personal in nature. What amount of the total costs can Melissa deduct as business expenses? c. Suppose that Melissa made the trip to San…The following information applies to the questions displayed below.]Melissa recently paid $530 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $585 fee to register for the conference, $275 per night for three nights' lodging, $210 for meals in restaurants, and $620 for cab fare. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable.) d. Suppose that Melissa’s permanent residence and business were located in San Francisco. She attended the conference in San Francisco and paid $585 for the registration fee. She drove 155 miles over the course of three days and paid $98 for parking at the conference hotel. In addition, she spent $330 for breakfast and dinner over the three days of the conference. She bought breakfast on the way to the conference hotel and she bought dinner on her way home each night from the…Melissa recently paid $760 for round trip airfare to San Francisco to attend a business conference for three days. Melissa also put the following expenses: $370 fee to register for the conference, $365 per night for three nights' lodging, $250 for meals and $300 for can fare. what amount of these costs can Melissa deduct as business expenses. Explain the answer

- Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three nights' lodging, $200 for meals in restaurants, and $150 for cab fare. a) What amount of these costs can Melissa deduct as business expenses? b) Suppose that while Melissa was on the coast, she also spent two days sightseeing the national parks in the area. To do the sightseeing, she paid $1,000 for transportation, $800 for lodging, and $450 for meals during this part of her trip, which she considers personal in nature. What amount of these costs can Melissa deduct as business expenses? c) Suppose that Melissa made the trip to San Francisco primarily to visit the national parks and only attended the business conference as an incidental benefit of being present on the coast at that time. What amount of the airfare can Melissa deduct as a business expense? d) Suppose…Melissa recently paid $640 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $590 fee to register for the conference, $255 per night for three nights' lodging, $170 for meals in restaurants, and $605 for cab fare. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable.) Problem 9-49 Part-d (Algo) d. Suppose that Melissa’s permanent residence and business were located in San Francisco. She attended the conference in San Francisco and paid $590 for the registration fee. She drove 107 miles over the course of three days and paid $156 for parking at the conference hotel. In addition, she spent $560 for breakfast and dinner over the three days of the conference. She bought breakfast on the way to the conference hotel and she bought dinner on her way home each night from the conference. What amount of these…Melissa recently paid $760 for round trip airfare to San Francisco to attend a business conference for three days. Melissa also put the following expenses: $370 fee to register for the conference, $365 per night for three nights' lodging, $250 for meals and $300 for can fare. Suppose that San Francisco was Melissa permanent residence and business location. She attended the conference in San Francisco and paid $370 for the registration fee. She drove 153 miles over the course of theee days and paid $190 for parking at the conference hotel. In addition, she spent $430 for breakfast and dinner over the three days of the conference. She bought breakfast on the way to the conference hotel, and she bought dinner on her way home each night from the conference. What amount of these costs can Melissa deduct as business expenses?

- Jordan took a business trip from New York to Denver. She spent two days in travel, conducted business for nine days, and visited friends for five days. She incurred the following expenses Airfare $ 570 Lodging 3,708 Meals 925 Entertainment of clients 740 How much of these expenses can Jordan deduct? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar value.Juanita travels to San Francisco for 7 days. The following facts are related to the trip: Round trip airfare $465 Hotel daily rate for single or double occupancy 155 Meals—$50 per day 50 Incidentals—$27 per day 27 If an amount is zero, enter "0". a. If she spends 4 days on business and 3 days sightseeing, what amount may she deduct as travel expense? b. If she spends 2 days on business and 5 days sightseeing, what amount may she deduct as travel expense? c. Assume the same facts as in Part a, except that Juanita's husband Jorge accompanied her on the trip and that the hotel's single occupancy rate is $130. Jorge went sightseeing every day and attended business receptions with Juanita at night. Assume that Jorge's expenses are identical to Juanita's. What amount may Juanita and Jorge deduct as travel expense?Melissa recently pod $760 for round trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $370 fee to register for the conference, $365 per night for three nights' lodging, $250 for meals and $300 for cab fare. Suppose that while Melissa was on the coast, she also spent two day's sightseeing the national parks in the area. To do the sightseeing, she paid $1,710 for transportation, $1,285 for lodging, and $475 for meals during this part of her trip, which she considers personal in nature. What amount of these costs can Melissa deduct as business expense?