purchased additional equipment for $11.7 million at the end of 2016, and this equipment was depreciated by $3.9 million per year in 2017, 2018, and 2019. Given Mydeco‘s tax rate of 35%, what impact would this additional purchase have had on Mydecco’s net income in years 2016-2019? Assume that the equipment is paid for out of cash and that Mydeco earns no interest on its cash balances. In the table, calculate the new net income below. **round to one decimal place**

purchased additional equipment for $11.7 million at the end of 2016, and this equipment was depreciated by $3.9 million per year in 2017, 2018, and 2019. Given Mydeco‘s tax rate of 35%, what impact would this additional purchase have had on Mydecco’s net income in years 2016-2019? Assume that the equipment is paid for out of cash and that Mydeco earns no interest on its cash balances. In the table, calculate the new net income below. **round to one decimal place**

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 7PEA: Financial statement data for years ending December 31 for Latchkey Company follows: a. Determine the...

Related questions

Question

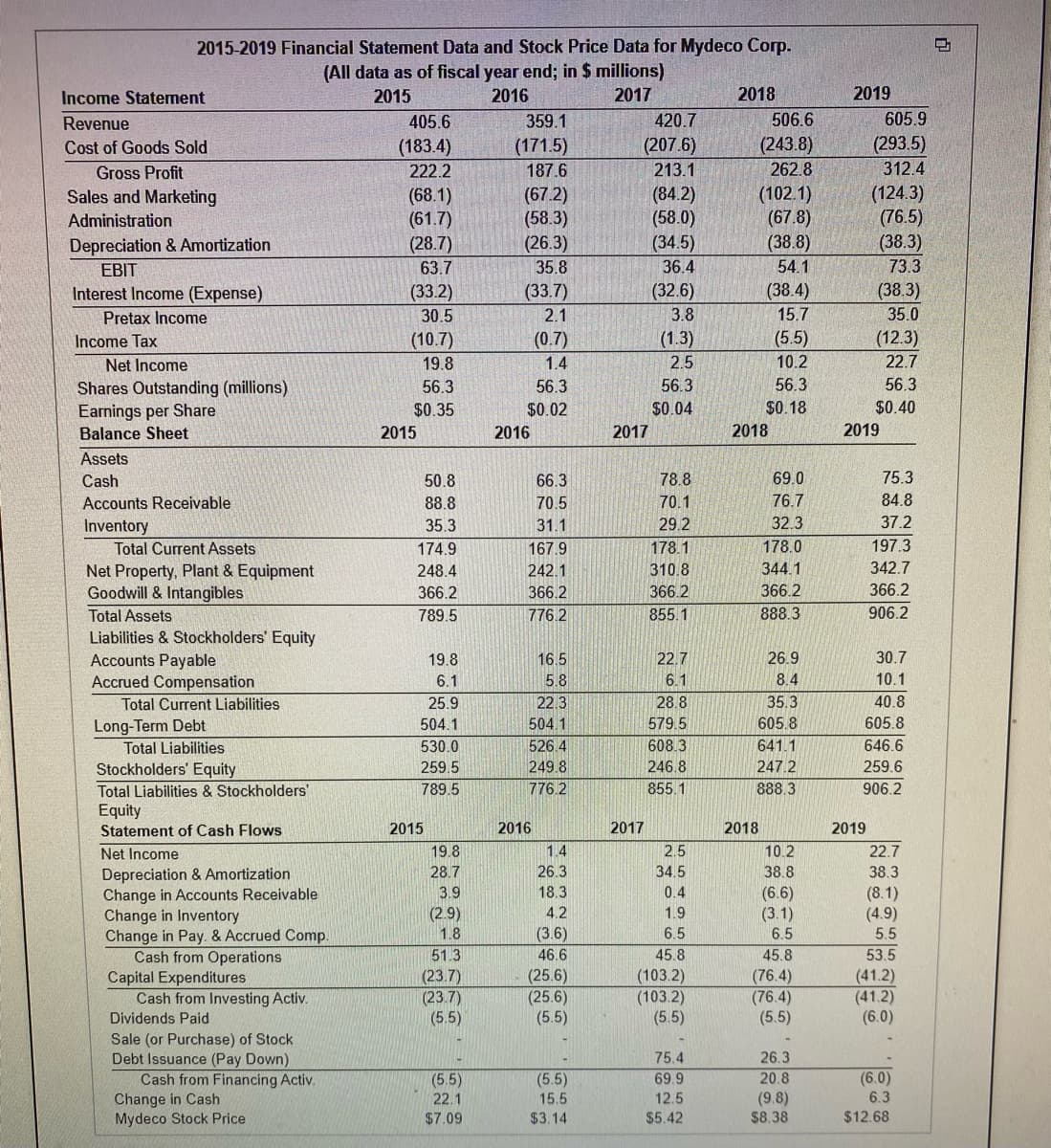

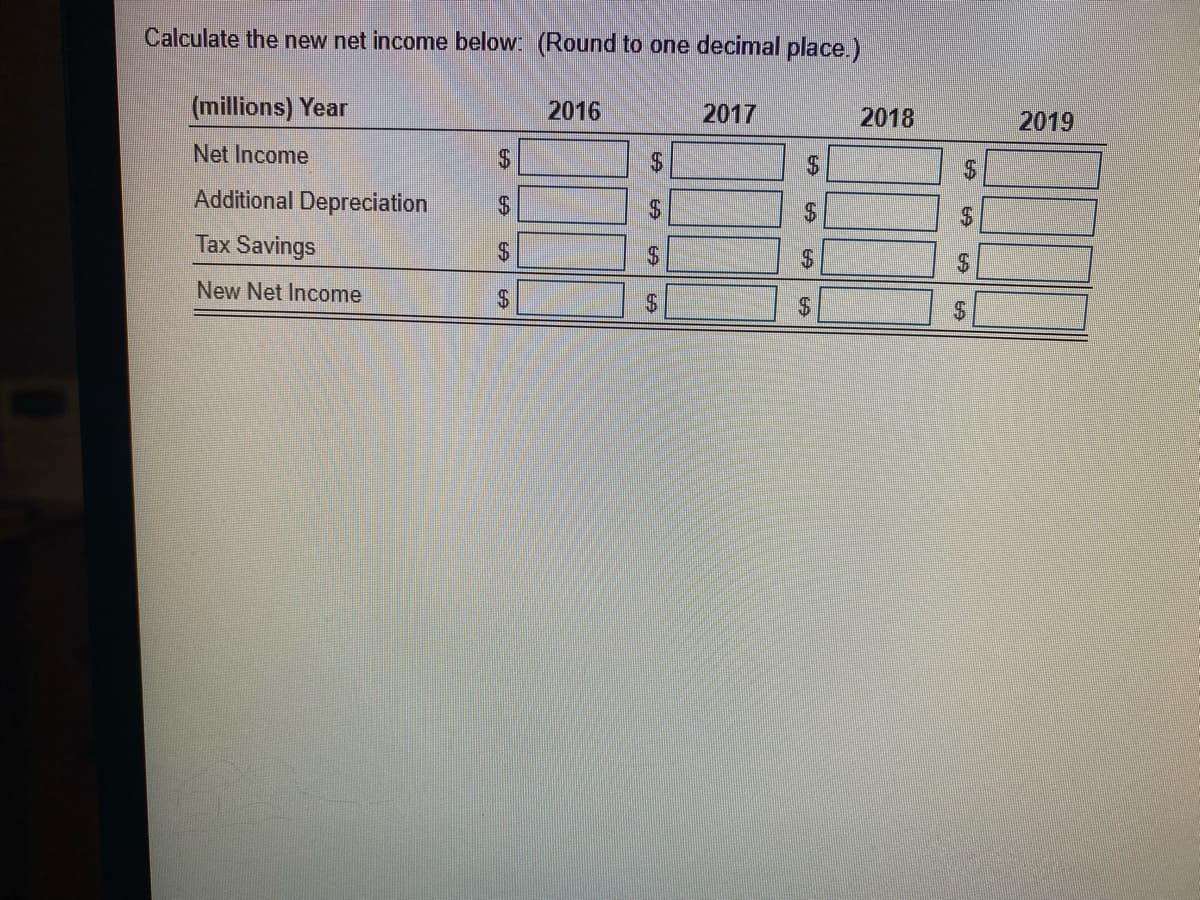

The data table shows financial statement data and stock price data for Mydeco Corp. Suppose Mydeco had purchased additional equipment for $11.7 million at the end of 2016, and this equipment was depreciated by $3.9 million per year in 2017, 2018, and 2019. Given Mydeco‘s tax rate of 35%, what impact would this additional purchase have had on Mydecco’s net income in years 2016-2019? Assume that the equipment is paid for out of cash and that Mydeco earns no interest on its cash balances.

In the table, calculate the new net income below.

**round to one decimal place**

Transcribed Image Text:2015-2019 Financial Statement Data and Stock Price Data for Mydeco Corp.

(All data as of fiscal year end; in $ millions)

2015

Income Statement

2016

2017

2018

2019

Revenue

405.6

359.1

420.7

506.6

605.9

(207.6)

(293.5)

(243.8)

262.8

Cost of Goods Sold

(183.4)

(171.5)

Gross Profit

222.2

187.6

213.1

312.4

(67.2)

(58.3)

(26.3)

(84.2)

(58.0)

(34.5)

(102.1)

(67.8)

(38.8)

(124.3)

(76.5)

(38.3)

Sales and Marketing

(68.1)

(61.7)

(28.7)

63.7

Administration

Depreciation & Amortization

EBIT

35.8

36.4

54.1

73.3

Interest Income (Expense)

(33.2)

(33.7)

(32.6)

(38.4)

(38.3)

Pretax Income

30.5

2.1

3.8

15.7

35.0

Income Tax

(10.7)

(0.7)

(1.3)

(5.5)

(12.3)

Net Income

19.8

1.4

2.5

10.2

22.7

56.3

56.3

56.3

Shares Outstanding (millions)

Earnings per Share

Balance Sheet

56.3

56.3

$0.35

$0.02

$0.04

$0. 18

$0.40

2015

2016

2017

2018

2019

Assets

Cash

50.8

66.3

78.8

69.0

75.3

Accounts Receivable

88.8

70.5

70.1

76.7

84.8

Inventory

35.3

31.1

29.2

32.3

37.2

Total Current Assets

174.9

167.9

178.1

178.0

197.3

242.1

310.8

344.1

342.7

Net Property, Plant & Equipment

Goodwill & Intangibles

248.4

366.2

366.2

366.2

366.2

366.2

Total Assets

789.5

776.2

855.1

888.3

906.2

Liabilities & Stockholders' Equity

Accounts Payable

Accrued Compensation

19.8

16.5

22.7

26.9

30.7

6.1

5.8

6.1

8.4

10.1

Total Current Liabilities

25.9

22.3

28.8

35.3

40.8

Long-Term Debt

504.1

504.1

579.5

605.8

605.8

Total Liabilities

530.0

526.4

608.3

641.1

646.6

249.8

246.8

247.2

259.6

Stockholders' Equity

Total Liabilities & Stockholders'

Equity

Statement of Cash Flows

259.5

789.5

776.2

855.1

888.3

906.2

2015

2016

2017

2018

2019

Net Income

19.8

1.4

2.5

10.2

22.7

28.7

Depreciation & Amortization

Change in Accounts Receivable

Change in Inventory

Change in Pay. & Accrued Comp.

Cash from Operations

Capital Expenditures

Cash from Investing Activ.

26.3

34.5

38.8

38.3

3.9

18.3

0.4

(6.6)

(3.1)

6.5

(8.1)

(4.9)

5.5

4.2

(2.9)

1.8

1.9

(3.6)

6.5

51.3

46.6

45.8

45.8

53.5

(23.7)

(23.7)

(5.5)

(25.6)

(25.6)

(5.5)

(103.2)

(103.2)

(5.5)

(76.4)

(76.4)

(5.5)

(41.2)

(41.2)

(6.0)

Dividends Paid

Sale (or Purchase) of Stock

Debt Issuance (Pay Down)

Cash from Financing Activ.

Change in Cash

Mydeco Stock Price

75.4

26.3

(5.5)

(5.5)

69.9

20.8

(6.0)

(9.8)

$8.38

22.1

15.5

12.5

6.3

$7.09

$3.14

$5.42

$12.68

Transcribed Image Text:Calculate the new net income below: (Round to one decimal place.)

(millions) Year

2016

2017

2018

2019

Net Income

$4

Additional Depreciation

24

24

Tax Savings

24

New Net Income

%24

%24

%%24

%24

%24

%24

%24

%24

%24

Expert Solution

Step 1

Depreciation is the reduction in the value of fixed assets due to normal wear and tear, passage of time, etc.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning