four employer count earns 4% interest. Suppose you just got the job, your starting salary is $55000, and you expect to 27 receive a 5% raise each year, Additionally, you decide to deposit a fixed amount of $4000 each year to play ly puts 10 percent of your salary into a 401(k) retirement account each year. The it conservatively. S4) = 0.055 S(0) = S0000 こ For simplicity, assume that interest earned, your raises, and your annual deposit all occur continuously. A) Let R(t) denote the dollar value of your retirement account in years. Write the differential equation modeling your account: dR 0.04R + %3D dt B) Solve the differential equation to find R(t). Hint: make use of the Extended Linearity Principle. R(t) = C) Find the value of your retirement account after 35 years. Round answer to 2 decimal places. Value = $

four employer count earns 4% interest. Suppose you just got the job, your starting salary is $55000, and you expect to 27 receive a 5% raise each year, Additionally, you decide to deposit a fixed amount of $4000 each year to play ly puts 10 percent of your salary into a 401(k) retirement account each year. The it conservatively. S4) = 0.055 S(0) = S0000 こ For simplicity, assume that interest earned, your raises, and your annual deposit all occur continuously. A) Let R(t) denote the dollar value of your retirement account in years. Write the differential equation modeling your account: dR 0.04R + %3D dt B) Solve the differential equation to find R(t). Hint: make use of the Extended Linearity Principle. R(t) = C) Find the value of your retirement account after 35 years. Round answer to 2 decimal places. Value = $

Advanced Engineering Mathematics

10th Edition

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Erwin Kreyszig

Chapter2: Second-order Linear Odes

Section: Chapter Questions

Problem 1RQ

Related questions

Question

Differential equations

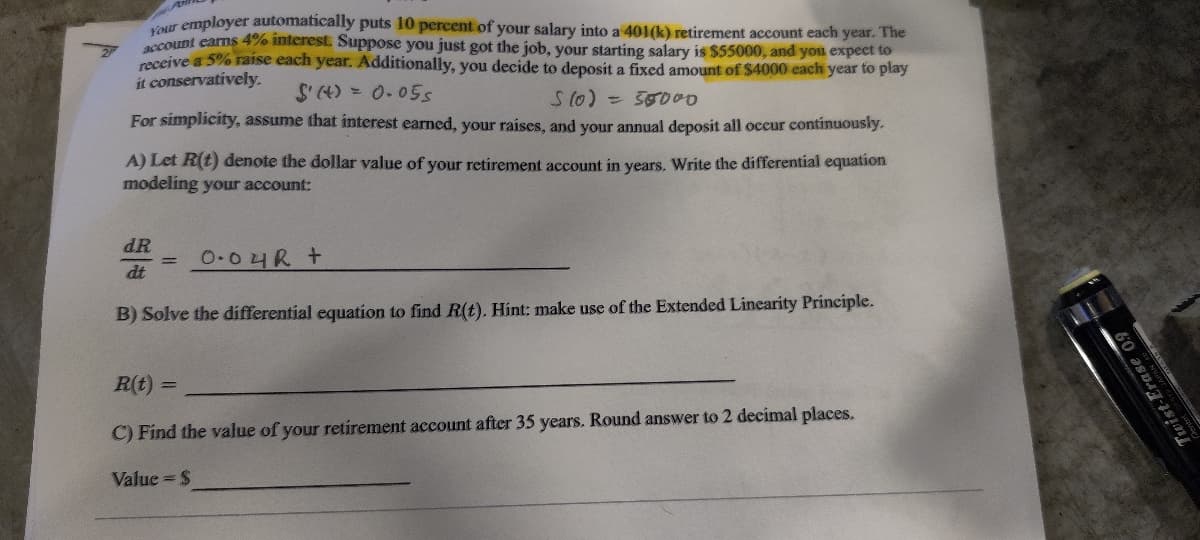

Transcribed Image Text:ur employer automatically puts 10 percent of your salary into a 401(k) retirement account each year. The

count earns 4% interest. Suppose you just got the job, your starting salary is $55000, and you expect to

receive a 5% raise each year. Additionally, you decide to deposit a fixed amount of $4000 each year to play

it conservatively.

S'4) = 0.055

S10)3D50000

For simplicity, assume that interest earned, your raises, and your annual deposit all occur continuously.

A) Let R(t) denote the dollar value of your retirement account in years. Write the differential equation

modeling your account:

dR

O 04R+

dt

B) Solve the differential equation to find R(t). Hint: make use of the Extended Linearity Principle.

R(t) =

C) Find the value of your retirement account after 35 years. Round answer to 2 decimal places.

Value = $

Twist-Erase 09

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Recommended textbooks for you

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,