Fox Corporation had the fölloWing Preferred Stock, 5%, $40 par, 30,000 shares authorized, 10,000 shares issued and outstanding, cumulative, nonparticipating $400,000 10,000 Paid in Capital in Excess of Par - Preferred Common Stock, $10 par, 1,000,000 shares authorized, 450,000 shares issued and outstanding Paid in Capital in Excess of Par- Common Total Paid in Capital Accumulated Other Comprehensive Income 4,500,000 9.000.000 13,910,000 Unrealized Gain on Available for Sale Securities (bonds) 120,000 6.400.000 $20,430,000 Retained Earnings Total Stockholders' Equity Fox completed the following chronological transactions during 2022: a. Sold 10,000 shares of common stock at $36 per share in cash. b. Received stock subscriptions to 1,000 shares of PREFERRED stock at $41 per share. c. Collected the full subscription price on 800 shares in part "b." and issued the shares. d. Purchased 6,000 shares of common stock at $34 per share in cash and plan to resell them. Fox uses the cost method. e. Resold 2,000 shares in part "d." at $37 per share in cash f. Resold another 3,000 shares in part "d." at $34 per share in cash g. The Available for Sale Securities which were bonds decreased in value by $6,000 this year. Ignore any tax issues related to this increase. h. Fox declared and paid $50,000 of cash dividends during the year. i. Fox earned $3,000,000 of revenues and reported $2,200,000 of expenses for the year. Prepare the closing entries at the end of the year in summary format. NSTRUCTIONS: 1. Prepare journal entries for the above events 2. Prepare the updated stockholders' equity section of the balance sheet in good form on December 31, 2022, including the effects of the entries above.

Fox Corporation had the fölloWing Preferred Stock, 5%, $40 par, 30,000 shares authorized, 10,000 shares issued and outstanding, cumulative, nonparticipating $400,000 10,000 Paid in Capital in Excess of Par - Preferred Common Stock, $10 par, 1,000,000 shares authorized, 450,000 shares issued and outstanding Paid in Capital in Excess of Par- Common Total Paid in Capital Accumulated Other Comprehensive Income 4,500,000 9.000.000 13,910,000 Unrealized Gain on Available for Sale Securities (bonds) 120,000 6.400.000 $20,430,000 Retained Earnings Total Stockholders' Equity Fox completed the following chronological transactions during 2022: a. Sold 10,000 shares of common stock at $36 per share in cash. b. Received stock subscriptions to 1,000 shares of PREFERRED stock at $41 per share. c. Collected the full subscription price on 800 shares in part "b." and issued the shares. d. Purchased 6,000 shares of common stock at $34 per share in cash and plan to resell them. Fox uses the cost method. e. Resold 2,000 shares in part "d." at $37 per share in cash f. Resold another 3,000 shares in part "d." at $34 per share in cash g. The Available for Sale Securities which were bonds decreased in value by $6,000 this year. Ignore any tax issues related to this increase. h. Fox declared and paid $50,000 of cash dividends during the year. i. Fox earned $3,000,000 of revenues and reported $2,200,000 of expenses for the year. Prepare the closing entries at the end of the year in summary format. NSTRUCTIONS: 1. Prepare journal entries for the above events 2. Prepare the updated stockholders' equity section of the balance sheet in good form on December 31, 2022, including the effects of the entries above.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter20: Corporations: Organization And Capital Stock

Section: Chapter Questions

Problem 1MP: Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--,...

Related questions

Question

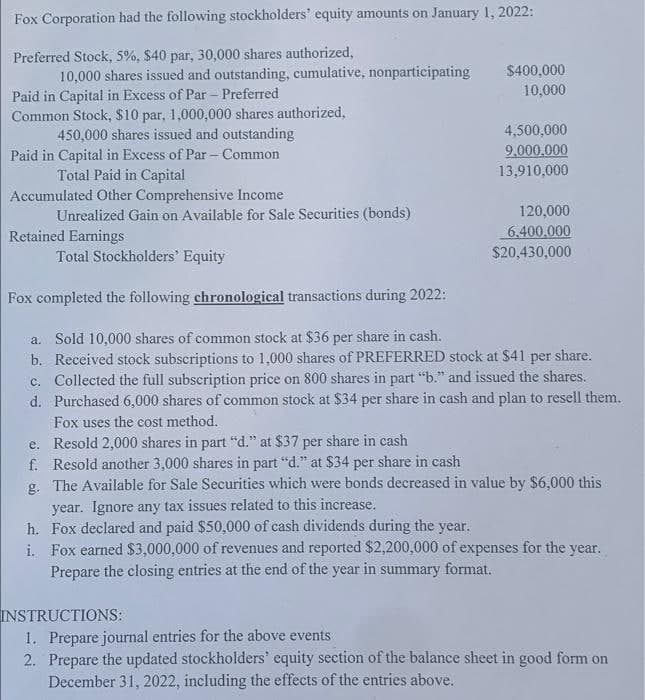

Transcribed Image Text:Fox Corporation had the following stockholders' equity amounts on January 1, 2022:

Preferred Stock, 5%, $40 par, 30,000 shares authorized,

10,000 shares issued and outstanding, cumulative, nonparticipating

$400,000

10,000

Paid in Capital in Excess of Par – Preferred

Common Stock, $10 par, 1,000,000 shares authorized,

450,000 shares issued and outstanding

Paid in Capital in Excess of Par Common

Total Paid in Capital

Accumulated Other Comprehensive Income

4,500,000

9.000.000

13,910,000

120,000

00.000

$20,430,000

Unrealized Gain on Available for Sale Securities (bonds)

Retained Earnings

Total Stockholders' Equity

Fox completed the following chronological transactions during 2022:

a. Sold 10,000 shares of common stock at $36 per share in cash.

b. Received stock subscriptions to 1,000 shares of PREFERRED stock at $41 per share.

c. Collected the full subscription price on 800 shares in part "b." and issued the shares.

d. Purchased 6,000 shares of common stock at $34 per share in cash and plan to resell them.

Fox uses the cost method.

e. Resold 2,000 shares in part "d." at $37 per share in cash

f. Resold another 3,000 shares in part "d." at $34 per share in cash

g. The Available for Sale Securities which were bonds decreased in value by $6,000 this

year. Ignore any tax issues related to this increase.

h. Fox declared and paid $50,000 of cash dividends during the year.

i. Fox earned $3,000,000 of revenues and reported $2,200,000 of expenses for the year.

Prepare the closing entries at the end of the year in summary format.

INSTRUCTIONS:

1. Prepare journal entries for the above events

2. Prepare the updated stockholders' equity section of the balance sheet in good form on

December 31, 2022, including the effects of the entries above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College