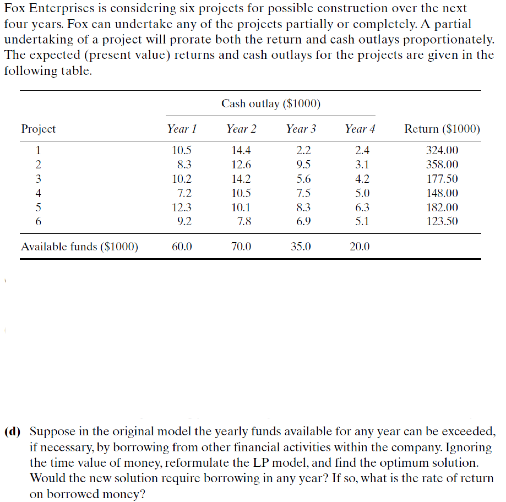

Fox Enterprises is considering six projects for possible construction over the next four ycars. Fox can undertake any of the projects partially or completely. A partial undertaking of a project will prorate both the return and cash outlays proportionately. The expected (present value) returns and cash outlays for the projects are given in the following table. Cash outlay ($1000) Project Year ! Year 2 Year 3 Year 4 Return ($1000) 1 10.5 14.4 2.2 2.4 324.00 8.3 12.6 9.5 3.1 358.00 3 10.2 14.2 5.6 4.2 177.50 4 7.2 10.5 7.5 5.0 148.00 5 12.3 10.1 8.3 6.3 182.00 9.2 7.8 6.9 5.1 123.50 Available funds ($1000) 60.0 70.0 35.0 20,0 (d) Suppose in the original model the yearly funds available for any year can be exceeded, if necessary, by borrowing from other financial activities within the company. Ignoring the time value of money, reformulate the LP model, and flind the optimum solution. Would the new solution require borrowing in any ycar? If so, what is the rate of return on borrowed moncy?

Fox Enterprises is considering six projects for possible construction over the next four ycars. Fox can undertake any of the projects partially or completely. A partial undertaking of a project will prorate both the return and cash outlays proportionately. The expected (present value) returns and cash outlays for the projects are given in the following table. Cash outlay ($1000) Project Year ! Year 2 Year 3 Year 4 Return ($1000) 1 10.5 14.4 2.2 2.4 324.00 8.3 12.6 9.5 3.1 358.00 3 10.2 14.2 5.6 4.2 177.50 4 7.2 10.5 7.5 5.0 148.00 5 12.3 10.1 8.3 6.3 182.00 9.2 7.8 6.9 5.1 123.50 Available funds ($1000) 60.0 70.0 35.0 20,0 (d) Suppose in the original model the yearly funds available for any year can be exceeded, if necessary, by borrowing from other financial activities within the company. Ignoring the time value of money, reformulate the LP model, and flind the optimum solution. Would the new solution require borrowing in any ycar? If so, what is the rate of return on borrowed moncy?

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter7: Nonlinear Optimization Models

Section: Chapter Questions

Problem 49P: If a monopolist produces q units, she can charge 400 4q dollars per unit. The variable cost is 60...

Related questions

Question

100%

Here is the question

Transcribed Image Text:Fox Enterprises is considering six projects for possible construction over the next

four ycars. Fox can undertake any of the projects partially or completely. A partial

undertaking of a project will prorate both the return and cash outlays proportionately.

The expected (present value) returns and cash outlays for the projects are given in the

following table.

Cash outlay ($1000)

Project

Year !

Year 2

Year 3

Year 4

Return ($1000)

1

10.5

14.4

2.2

2.4

324.00

8.3

12.6

9.5

3.1

358.00

3

10.2

14.2

5.6

4.2

177.50

4

7.2

10.5

7.5

5.0

148.00

5

12.3

10.1

8.3

6.3

182.00

9.2

7.8

6.9

5.1

123.50

Available funds ($1000)

60.0

70.0

35.0

20,0

(d) Suppose in the original model the yearly funds available for any year can be exceeded,

if necessary, by borrowing from other financial activities within the company. Ignoring

the time value of money, reformulate the LP model, and flind the optimum solution.

Would the new solution require borrowing in any ycar? If so, what is the rate of return

on borrowed moncy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,