g. Heteroscedasticity occurs when the disturbance term in a regression model is correlated with one of the explanatory variables h. In the presence of heteroscedasticity, ordinary lease squares (OLS) is an inefficient estimation technique and this causes t tests and F tests to be invalid. i. Heteroscedasticity can be detected with the Chow test.

g. Heteroscedasticity occurs when the disturbance term in a regression model is correlated with one of the explanatory variables h. In the presence of heteroscedasticity, ordinary lease squares (OLS) is an inefficient estimation technique and this causes t tests and F tests to be invalid. i. Heteroscedasticity can be detected with the Chow test.

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter3: Matrices

Section3.5: Subspaces, Basis, Dimension, And Rank

Problem 14EQ

Related questions

Question

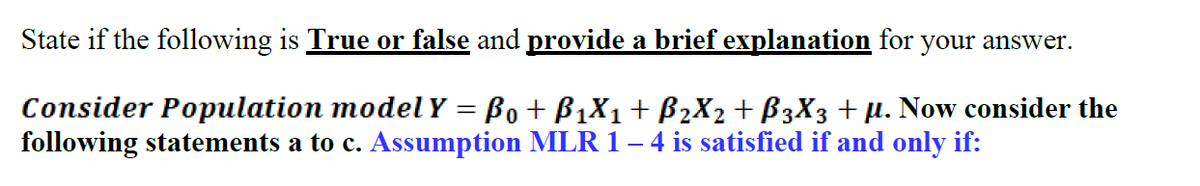

Transcribed Image Text:State if the following is True or false and provide a brief explanation for your answer.

Consider Population modelY = Bo+ B1X1+ B2X2 + B3X3 +µ. Now consider the

following statements a to c. Assumption MLR 1– 4 is satisfied if and only if:

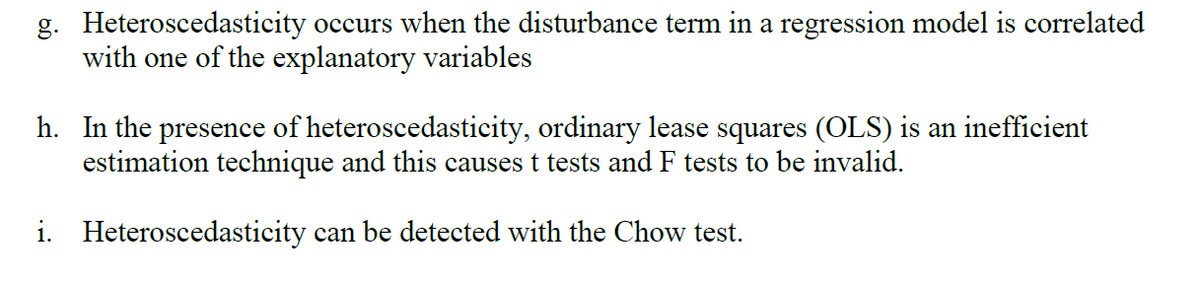

Transcribed Image Text:g. Heteroscedasticity occurs when the disturbance term in a regression model is correlated

with one of the explanatory variables

h. In the presence of heteroscedasticity, ordinary lease squares (OLS) is an inefficient

estimation technique and this causes t tests and F tests to be invalid.

i. Heteroscedasticity can be detected with the Chow test.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning