g). Problem 20 Cnartan started a mobile ice cream service on January 2, 20X5, depositing $10,000 of her unds in a bank account in the name of Spartan Mobile Ice Cream. She purchased a fully auipped truck and operated the business on a cash accounting basis for the first year. She provided you with the following information: 1. She purchased a $30,000 fully equipped truck in early January that is depreciable at 25 percent per year. She paid $5,000 cash and financed $25,000 on a note at 6 percent interest. 44 Chapter 1 ot irithoviril 2. She has $8,000 cash in the bank at the end of the year. * Fier receipts for cash purchases of ice cream total $20,000. * The value of her ice cream inventory at the end of the year is $500. 5. She paid $1,500 cash for all truck operating costs. In addition, she has an unpaid invoice for a recent equipment repair in the amount of $400. She paid $1,500 of interest on the loan and $2,000 to reduce the loan balance. 6. 7. She took $1,500 a month from the business for twelve months to live on. For simpliih purposes treat this as wages expense. 8. She purchased $500 of supplies with cash during the year and has $100 on hand at the end of the year. 9. On October 30, she invested $5,000 in a ninety-day certificate of deposit (an investment). Jill admitted she kept no record of the cash sales made during the year. Required: 1. Determine the cash sales for 20X5. 2. Prepare a simple income statement for 20X5 based on accrual accounting.

g). Problem 20 Cnartan started a mobile ice cream service on January 2, 20X5, depositing $10,000 of her unds in a bank account in the name of Spartan Mobile Ice Cream. She purchased a fully auipped truck and operated the business on a cash accounting basis for the first year. She provided you with the following information: 1. She purchased a $30,000 fully equipped truck in early January that is depreciable at 25 percent per year. She paid $5,000 cash and financed $25,000 on a note at 6 percent interest. 44 Chapter 1 ot irithoviril 2. She has $8,000 cash in the bank at the end of the year. * Fier receipts for cash purchases of ice cream total $20,000. * The value of her ice cream inventory at the end of the year is $500. 5. She paid $1,500 cash for all truck operating costs. In addition, she has an unpaid invoice for a recent equipment repair in the amount of $400. She paid $1,500 of interest on the loan and $2,000 to reduce the loan balance. 6. 7. She took $1,500 a month from the business for twelve months to live on. For simpliih purposes treat this as wages expense. 8. She purchased $500 of supplies with cash during the year and has $100 on hand at the end of the year. 9. On October 30, she invested $5,000 in a ninety-day certificate of deposit (an investment). Jill admitted she kept no record of the cash sales made during the year. Required: 1. Determine the cash sales for 20X5. 2. Prepare a simple income statement for 20X5 based on accrual accounting.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 3PA: Domingo Company started its business on January 1, 2019. The following transactions occurred during...

Related questions

Question

Transcribed Image Text:g).

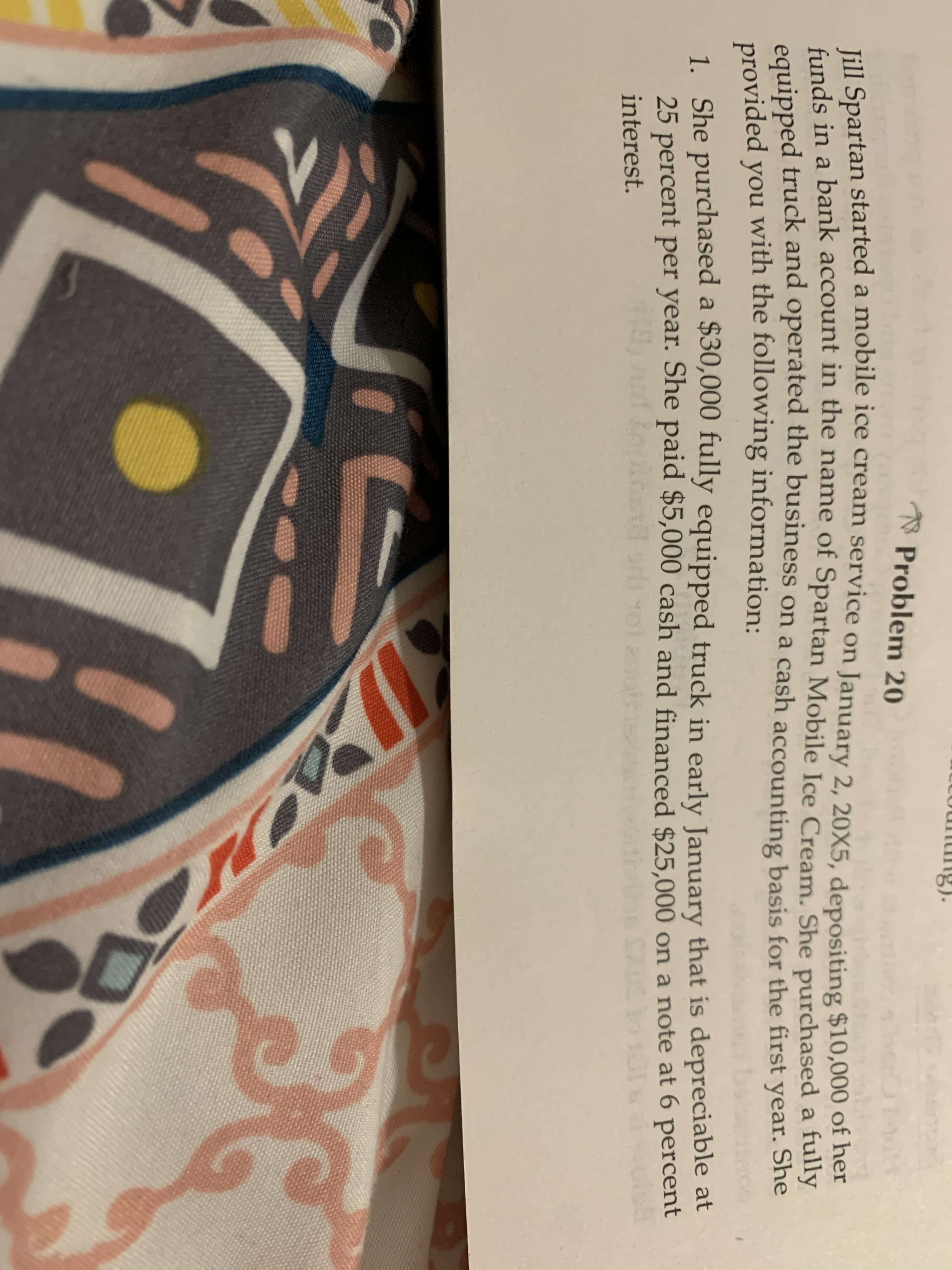

Problem 20

Cnartan started a mobile ice cream service on January 2, 20X5, depositing $10,000 of her

unds in a bank account in the name of Spartan Mobile Ice Cream. She purchased a fully

auipped truck and operated the business on a cash accounting basis for the first year.

She

provided you with the following information:

1. She purchased a $30,000 fully equipped truck in early January that is depreciable at

25 percent per year. She paid $5,000 cash and financed $25,000 on a note at 6 percent

interest.

Transcribed Image Text:44 Chapter 1 ot irithoviril

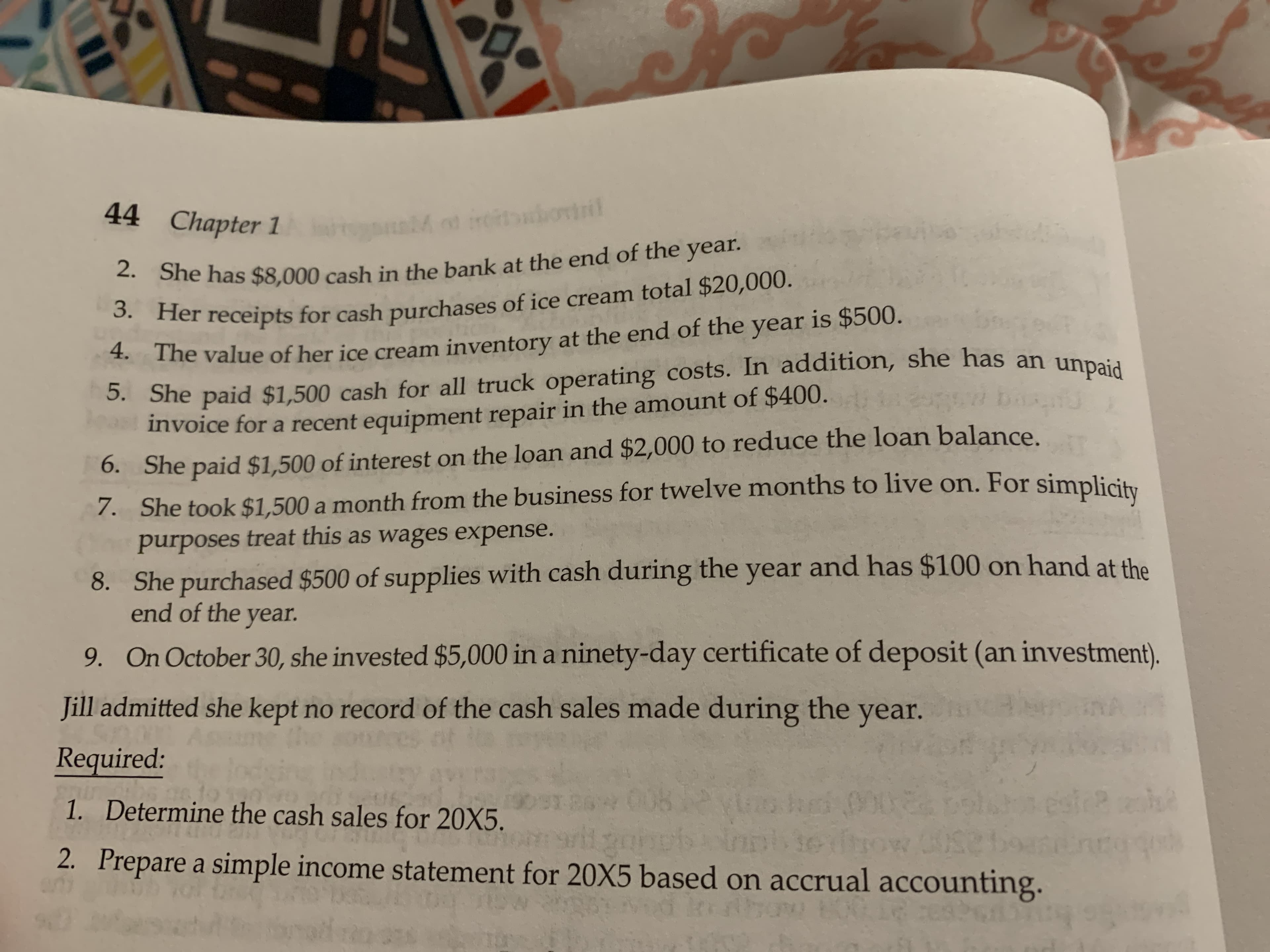

2. She has $8,000 cash in the bank at the end of the year.

* Fier receipts for cash purchases of ice cream total $20,000.

* The value of her ice cream inventory at the end of the year is $500.

5. She paid $1,500 cash for all truck operating costs. In addition, she has an unpaid

invoice for a recent equipment repair in the amount of $400.

She paid $1,500 of interest on the loan and $2,000 to reduce the loan balance.

6.

7. She took $1,500 a month from the business for twelve months to live on. For simpliih

purposes treat this as wages expense.

8. She purchased $500 of supplies with cash during the year and has $100 on hand at the

end of the year.

9. On October 30, she invested $5,000 in a ninety-day certificate of deposit (an investment).

Jill admitted she kept no record of the cash sales made during the year.

Required:

1. Determine the cash sales for 20X5.

2. Prepare a simple income statement for 20X5 based on accrual accounting.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning