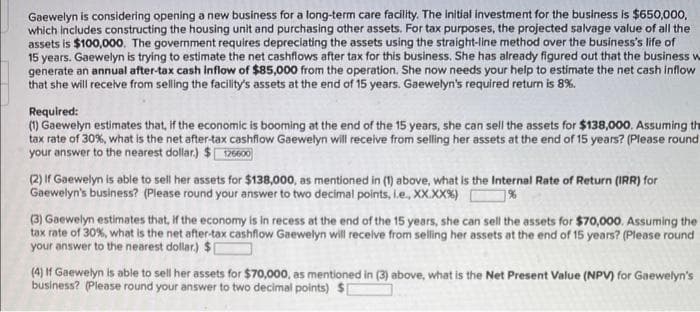

Gaewelyn is considering opening a new business for a long-term care facility. The initial investment for the business is $650,000, which includes constructing the housing unit and purchasing other assets. For tax purposes, the projected salvage value of all the assets is $100,000. The government requires depreciating the assets using the straight-line method over the business's life of 15 years. Gaewelyn is trying to estimate the net cashflows after tax for this business. She has already figured out that the business generate an annual after-tax cash inflow of $85,000 from the operation. She now needs your help to estimate the net cash inflow that she will receive from selling the facility's assets at the end of 15 years. Gaewelyn's required return is 8%. Required: (1) Gaewelyn estimates that, if the economic is booming at the end of the 15 years, she can sell the assets for $138,000. Assuming t tax rate of 30%, what is the net after-tax cashflow Gaewelyn will receive from selling her assets at the end of 15 years? (Please roun your answer to the nearest dollar) $126600 (2) If Gaewelyn is able to sell her assets for $138,000, as mentioned in (1) above, what is the Internal Rate of Return (IRR) for Gaewelyn's business? (Please round your answer to two decimal points, i.e., XXXX%) (3) Gaewelyn estimates that, if the economy is in recess at the end of the 15 years, she can sell the assets for $70,000. Assuming the tax rate of 30%, what is the net after-tax cashflow Gaewelyn will receive from selling her assets at the end of 15 years? (Please rounds your answer to the nearest dollar) $[ (4) If Gaewelyn is able to sell her assets for $70,000, as mentioned in (3) above, what is the Net Present Value (NPV) for Gaewelyn's business? (Please round your answer to two decimal points) $[

Gaewelyn is considering opening a new business for a long-term care facility. The initial investment for the business is $650,000, which includes constructing the housing unit and purchasing other assets. For tax purposes, the projected salvage value of all the assets is $100,000. The government requires depreciating the assets using the straight-line method over the business's life of 15 years. Gaewelyn is trying to estimate the net cashflows after tax for this business. She has already figured out that the business generate an annual after-tax cash inflow of $85,000 from the operation. She now needs your help to estimate the net cash inflow that she will receive from selling the facility's assets at the end of 15 years. Gaewelyn's required return is 8%. Required: (1) Gaewelyn estimates that, if the economic is booming at the end of the 15 years, she can sell the assets for $138,000. Assuming t tax rate of 30%, what is the net after-tax cashflow Gaewelyn will receive from selling her assets at the end of 15 years? (Please roun your answer to the nearest dollar) $126600 (2) If Gaewelyn is able to sell her assets for $138,000, as mentioned in (1) above, what is the Internal Rate of Return (IRR) for Gaewelyn's business? (Please round your answer to two decimal points, i.e., XXXX%) (3) Gaewelyn estimates that, if the economy is in recess at the end of the 15 years, she can sell the assets for $70,000. Assuming the tax rate of 30%, what is the net after-tax cashflow Gaewelyn will receive from selling her assets at the end of 15 years? (Please rounds your answer to the nearest dollar) $[ (4) If Gaewelyn is able to sell her assets for $70,000, as mentioned in (3) above, what is the Net Present Value (NPV) for Gaewelyn's business? (Please round your answer to two decimal points) $[

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 10P

Related questions

Question

Please Explain Proper Step by Step and Do Not Give Solution In Image Format And Fast Answering Please ? And Thanks In Advance

Transcribed Image Text:Gaewelyn is considering opening a new business for a long-term care facility. The initial investment for the business is $650,000,

which includes constructing the housing unit and purchasing other assets. For tax purposes, the projected salvage value of all the

assets is $100,000. The government requires depreciating the assets using the straight-line method over the business's life of

15 years. Gaewelyn is trying to estimate the net cashflows after tax for this business. She has already figured out that the business w

generate an annual after-tax cash inflow of $85,000 from the operation. She now needs your help to estimate the net cash inflow

that she will receive from selling the facility's assets at the end of 15 years. Gaewelyn's required return is 8%.

Required:

(1) Gaewelyn estimates that, if the economic is booming at the end of the 15 years, she can sell the assets for $138,000. Assuming the

tax rate of 30%, what is the net after-tax cashflow Gaewelyn will receive from selling her assets at the end of 15 years? (Please round

your answer to the nearest dollar.) $126600

(2) If Gaewelyn is able to sell her assets for $138,000, as mentioned in (1) above, what is the Internal Rate of Return (IRR) for

Gaewelyn's business? (Please round your answer to two decimal points, i.e., XX.XX%) 7%

(3) Gaewelyn estimates that, if the economy is in recess at the end of the 15 years, she can sell the assets for $70,000. Assuming the

tax rate of 30%, what is the net after-tax cashflow Gaewelyn will receive from selling her assets at the end of 15 years? (Please round

your answer to the nearest dollar) $[

(4) If Gaewelyn is able to sell her assets for $70,000, as mentioned in (3) above, what is the Net Present Value (NPV) for Gaewelyn's

business? (Please round your answer to two decimal points) $[

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College