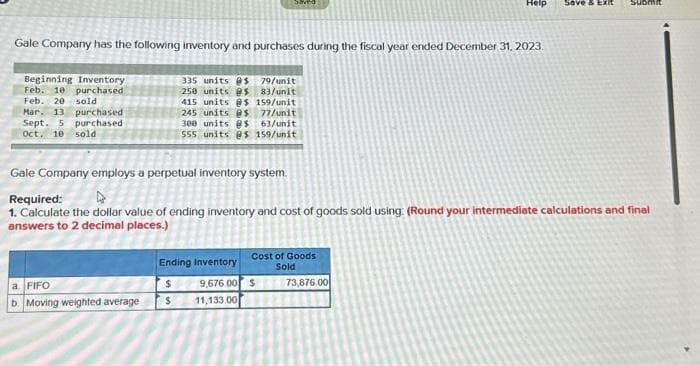

Gale Company has the following inventory and purchases during the fiscal year ended December 31, 2023 Beginning Inventory Feb. 10 purchased Feb. 20 sold Mar. 13 purchased Sept. 5 purchased Oct. 10 sold 335 units @$ 79/unit 250 units @s 83/unit 415 units @s 159/unit 245 units es 77/unit 300 units @s 63/unit 555 units @s 159/unit Gale Company employs a perpetual inventory system.

Gale Company has the following inventory and purchases during the fiscal year ended December 31, 2023 Beginning Inventory Feb. 10 purchased Feb. 20 sold Mar. 13 purchased Sept. 5 purchased Oct. 10 sold 335 units @$ 79/unit 250 units @s 83/unit 415 units @s 159/unit 245 units es 77/unit 300 units @s 63/unit 555 units @s 159/unit Gale Company employs a perpetual inventory system.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8P: Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning...

Related questions

Question

vj

subject-Accounting

Transcribed Image Text:Gale Company has the following inventory and purchases during the fiscal year ended December 31, 2023.

Beginning Inventory

Feb. 10 purchased

Feb. 20 sold

Mar. 13 purchased

Sept. 5 purchased

Oct. 10 sold

335 units @$ 79/unit

250 units @s 83/unit

415 units @s 159/unit

245 units es 77/unit

a FIFO

b. Moving weighted average.

Saved

300 units @s 63/unit

555 units @s 159/unit

Ending Inventory

$

S

Gale Company employs a perpetual inventory system.

Required:

1. Calculate the dollar value of ending inventory and cost of goods sold using: (Round your intermediate calculations and final

answers to 2 decimal places.)

Cost of Goods

Sold

9,676.00 $

11,133.001

Help

73,876.00

Save & Exit

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College