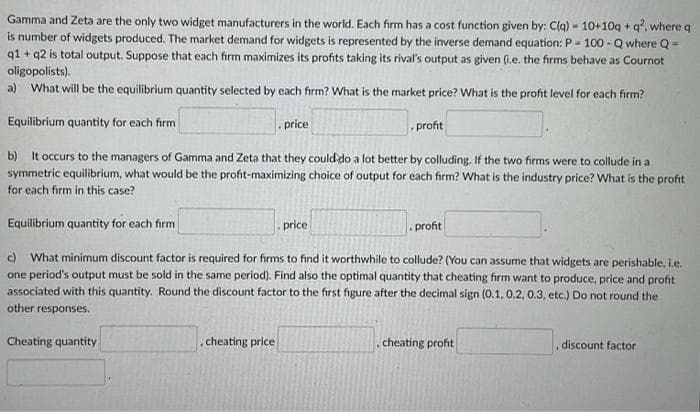

Gamma and Zeta are the only two widget manufacturers in the world. Each firm has a cost function given by: C(q)- 10+10q+q², where a is number of widgets produced. The market demand for widgets is represented by the inverse demand equation: P-100-Q where Q- q1+q2 is total output. Suppose that each firm maximizes its profits taking its rival's output as given (i.e. the firms behave as Cournot oligopolists). a) What will be the equilibrium quantity selected by each firm? What is the market price? What is the profit level for each firm?

Gamma and Zeta are the only two widget manufacturers in the world. Each firm has a cost function given by: C(q)- 10+10q+q², where a is number of widgets produced. The market demand for widgets is represented by the inverse demand equation: P-100-Q where Q- q1+q2 is total output. Suppose that each firm maximizes its profits taking its rival's output as given (i.e. the firms behave as Cournot oligopolists). a) What will be the equilibrium quantity selected by each firm? What is the market price? What is the profit level for each firm?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter12: Price And Output Determination: Oligopoly

Section: Chapter Questions

Problem 2E

Related questions

Question

A9

Transcribed Image Text:Gamma and Zeta are the only two widget manufacturers in the world. Each firm has a cost function given by: C(q)- 10+10q+q², where q

is number of widgets produced. The market demand for widgets is represented by the inverse demand equation: P = 100-Q where Q

q1 + q2 is total output. Suppose that each firm maximizes its profits taking its rival's output as given (i.e. the firms behave as Cournot

oligopolists).

=

a) What will be the equilibrium quantity selected by each firm? What is the market price? What is the profit level for each firm?

Equilibrium quantity for each firm

.price

profit

b) It occurs to the managers of Gamma and Zeta that they could do a lot better by colluding. If the two firms were to collude in a

symmetric equilibrium, what would be the profit-maximizing choice of output for each firm? What is the industry price? What is the profit

for each firm in this case?

Equilibrium quantity for each firm

price:

profit

c) What minimum discount factor is required for firms to find it worthwhile to collude? (You can assume that widgets are perishable, i.e.

one period's output must be sold in the same period). Find also the optimal quantity that cheating firm want to produce, price and profit

associated with this quantity. Round the discount factor to the first figure after the decimal sign (0.1, 0.2, 0.3, etc.) Do not round the

other responses.

Cheating quantity

, cheating price

.cheating profit

discount factor

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning