Shep Company's records show the following information for the current year: Beginning of End of year $ 89,500 $ 38,800 year Total assets Total liabilities $ 57,600 $ 25,800 Determine net income (loss) for each of the following separate situations. (For all requirements, losses should be entered wit minus sign.) a. Additional common stock of $6,800 was issued, and dividends of $10,800 were paid during the current year. b. Additional common stock of $15,950 was issued, and no dividends were paid during the current year. c. No additional common stock was issued, and dividends of $15,800 were paid during the current year. a. Net income (loss)

Shep Company's records show the following information for the current year: Beginning of End of year $ 89,500 $ 38,800 year Total assets Total liabilities $ 57,600 $ 25,800 Determine net income (loss) for each of the following separate situations. (For all requirements, losses should be entered wit minus sign.) a. Additional common stock of $6,800 was issued, and dividends of $10,800 were paid during the current year. b. Additional common stock of $15,950 was issued, and no dividends were paid during the current year. c. No additional common stock was issued, and dividends of $15,800 were paid during the current year. a. Net income (loss)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 65BPSB: Problem 1-65B Relationships Among Financial Statements Leno Corporation reported the following...

Related questions

Question

100%

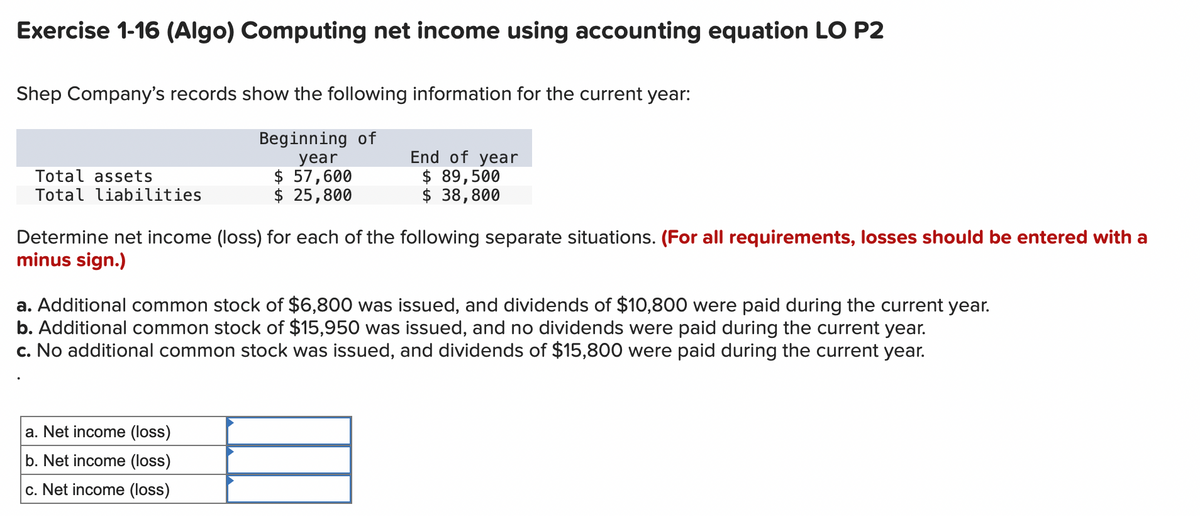

Transcribed Image Text:Exercise 1-16 (Algo) Computing net income using accounting equation LO P2

Shep Company's records show the following information for the current year:

Beginning of

year

$ 57,600

$ 25,800

End of year

$ 89,500

$ 38,800

Total assets

Total liabilities

Determine net income (loss) for each of the following separate situations. (For all requirements, losses should be entered with a

minus sign.)

a. Additional common stock of $6,800 was issued, and dividends of $10,800 were paid during the current year.

b. Additional common stock of $15,950 was issued, and no dividends were paid during the current year.

c. No additional common stock was issued, and dividends of $15,800 were paid during the current year.

a. Net income (loss)

b. Net income (loss)

c. Net income (loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning