You manage a real estate investment company. One year ago, the company purchased 10 parcels of land distributed throughout the community for $ 10.4 million each. A recent appraisal of the properties indicates that five of the parcels are now worth $8.2 million each, while the other five are worth $17.0 million each. Ignoring any income received from the properties and any taxes paid over the year, calculate the investment company's accounting earnings and its economic earnings in each of the following cases: a. The company sells all of the properties at their appraised values today. c. The company sells the properties that have fallen in value and keeps the others. d. The company sells the properties that have risen in value and keeps the others. (Negatlve amounts should be Indicated by a mlnus sign. Enter your answers In milons.) Accounting Income (million) Economic Income (million)

You manage a real estate investment company. One year ago, the company purchased 10 parcels of land distributed throughout the community for $ 10.4 million each. A recent appraisal of the properties indicates that five of the parcels are now worth $8.2 million each, while the other five are worth $17.0 million each. Ignoring any income received from the properties and any taxes paid over the year, calculate the investment company's accounting earnings and its economic earnings in each of the following cases: a. The company sells all of the properties at their appraised values today. c. The company sells the properties that have fallen in value and keeps the others. d. The company sells the properties that have risen in value and keeps the others. (Negatlve amounts should be Indicated by a mlnus sign. Enter your answers In milons.) Accounting Income (million) Economic Income (million)

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 42P

Related questions

Question

Please answer as thoroughly as possible. I will use your answers to help me if I get confused while solving. It's the easiest way for me to check my work and not confuse myself. Thank you!

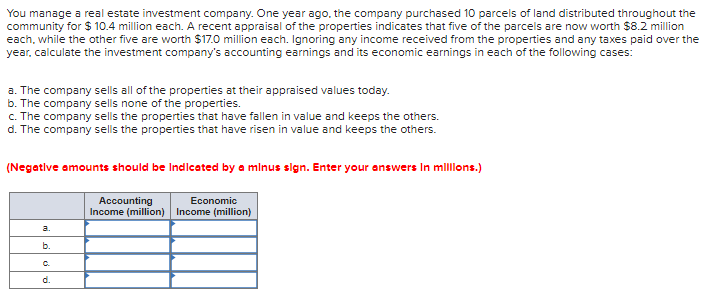

Transcribed Image Text:You manage a real estate investment company. One year ago, the company purchased 10 parcels of land distributed throughout the

community for $ 10.4 million each. A recent appraisal of the properties indicates that five of the parcels are now worth $8.2 million

each, while the other five are worth $17.0 million each. Ignoring any income received from the properties and any taxes paid over the

year, calculate the investment company's accounting earnings and its economic earnings in each of the following cases:

a. The company sells all of the properties at their appraised values today.

b. The company sells none of the properties.

C. The company sells the properties that have fallen in value and keeps the others.

d. The company sells the properties that have risen in value and keeps the others.

(Negative amounts should be Indicated by a mlnus sign. Enter your answers In mlllons.)

Accounting

Income (million) Income (million)

Economic

a.

b.

C.

d.

mi

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College