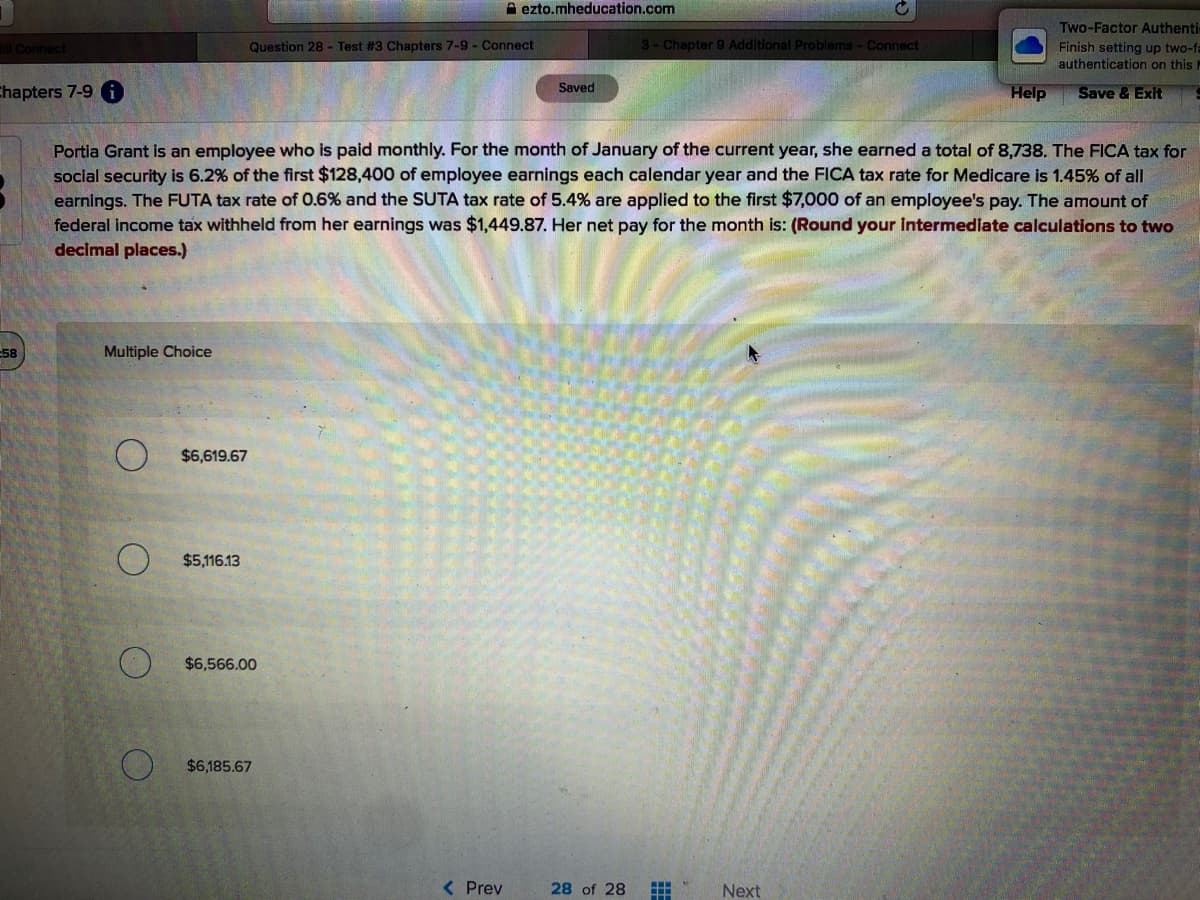

Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of 8,738. The FICA tax for soclal security is 6.2% of the first $128,400 of employee earnings each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The FUTA tax rate of 0.6% and the SUTA tax rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1,449.87. Her net pay for the month is: (Round your Intermediate calculations to two decimal places.)

Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of 8,738. The FICA tax for soclal security is 6.2% of the first $128,400 of employee earnings each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The FUTA tax rate of 0.6% and the SUTA tax rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1,449.87. Her net pay for the month is: (Round your Intermediate calculations to two decimal places.)

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.1AP

Related questions

Question

28

Transcribed Image Text:A ezto.mheducation.com

Two-Factor Authenti

Finish setting up two-fa

authentication on this I

Connect

Question 28 - Test #3 Chapters 7-9 - Connect

3- Chapter 9 Additional Problems - Connect

Saved

Chapters 7-9 i)

Help

Save & Exit

Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of 8,738. The FICA tax for

soclal security is 6.2% of the first $128,400 of employee earnings each calendar year and the FICA tax rate for Medicare is 1.45% of all

earnings. The FUTA tax rate of 0.6% and the SUTA tax rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of

federal income tax withheld from her earnings was $1,449.87. Her net pay for the month is: (Round your intermediate calculations to two

decimal places.)

58

Multiple Choice

$6,619.67

$5,116.13

$6,566.00

$6,185.67

<Prev

28 of 28

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning