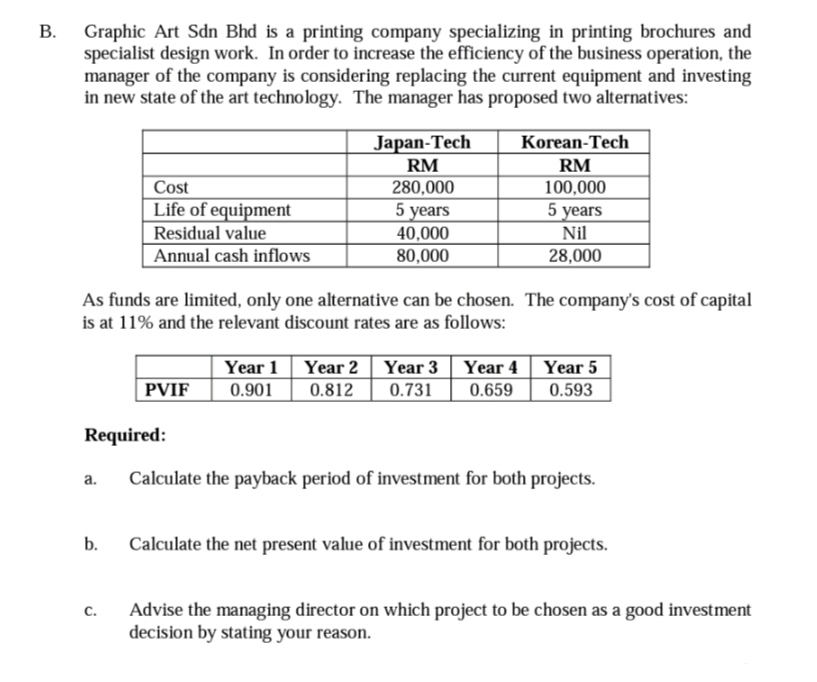

Graphic Art Sdn Bhd is a printing company specializing in printing brochures and specialist design work. In order to increase the efficiency of the business operation, the manager of the company is considering replacing the current equipment and investing in new state of the art technology. The manager has proposed two alternatives: В. Japan-Tech Korean-Tech RM RM Cost 280,000 100,000 Life of equipment 5 years 5 years Residual value 40,000 Nil Annual cash inflows 80,000 28,000 As funds are limited, only one alternative can be chosen. The company's cost of capital is at 11% and the relevant discount rates are as follows: Year 1| Year 2 | Year 3 Year 4 Year 5 PVIF 0.901 0.812 0.731 0.659 0.593 Required: а. Calculate the payback period of investment for both projects. b. Calculate the net present value of investment for both projects. Advise the managing director on which project to be chosen as a good investment decision by stating your reason. с. B.

Graphic Art Sdn Bhd is a printing company specializing in printing brochures and specialist design work. In order to increase the efficiency of the business operation, the manager of the company is considering replacing the current equipment and investing in new state of the art technology. The manager has proposed two alternatives: В. Japan-Tech Korean-Tech RM RM Cost 280,000 100,000 Life of equipment 5 years 5 years Residual value 40,000 Nil Annual cash inflows 80,000 28,000 As funds are limited, only one alternative can be chosen. The company's cost of capital is at 11% and the relevant discount rates are as follows: Year 1| Year 2 | Year 3 Year 4 Year 5 PVIF 0.901 0.812 0.731 0.659 0.593 Required: а. Calculate the payback period of investment for both projects. b. Calculate the net present value of investment for both projects. Advise the managing director on which project to be chosen as a good investment decision by stating your reason. с. B.

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter5: Probability: An Introduction To Modeling Uncertainty

Section: Chapter Questions

Problem 18P: The J.R. Ryland Computer Company is considering a plant expansion to enable the company to begin...

Related questions

Question

Solve this.

Transcribed Image Text:В.

Graphic Art Sdn Bhd is a printing company specializing in printing brochures and

specialist design work. In order to increase the efficiency of the business operation, the

manager of the company is considering replacing the current equipment and investing

in new state of the art technology. The manager has proposed two alternatives:

Japan-Tech

Korean-Tech

RM

RM

Cost

280,000

100,000

Life of equipment

Residual value

Annual cash inflows

5 years

40,000

80,000

5 years

Nil

28,000

As funds are limited, only one alternative can be chosen. The company's cost of capital

is at 11% and the relevant discount rates are as follows:

Year 1

Year 2 | Year 3 Year 4

0.731

Year 5

0.593

PVIF

0.901

0.812

0.659

Required:

a.

Calculate the payback period of investment for both projects.

b.

Calculate the net present value of investment for both projects.

Advise the managing director on which project to be chosen as a good investment

decision by stating your reason.

с.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning