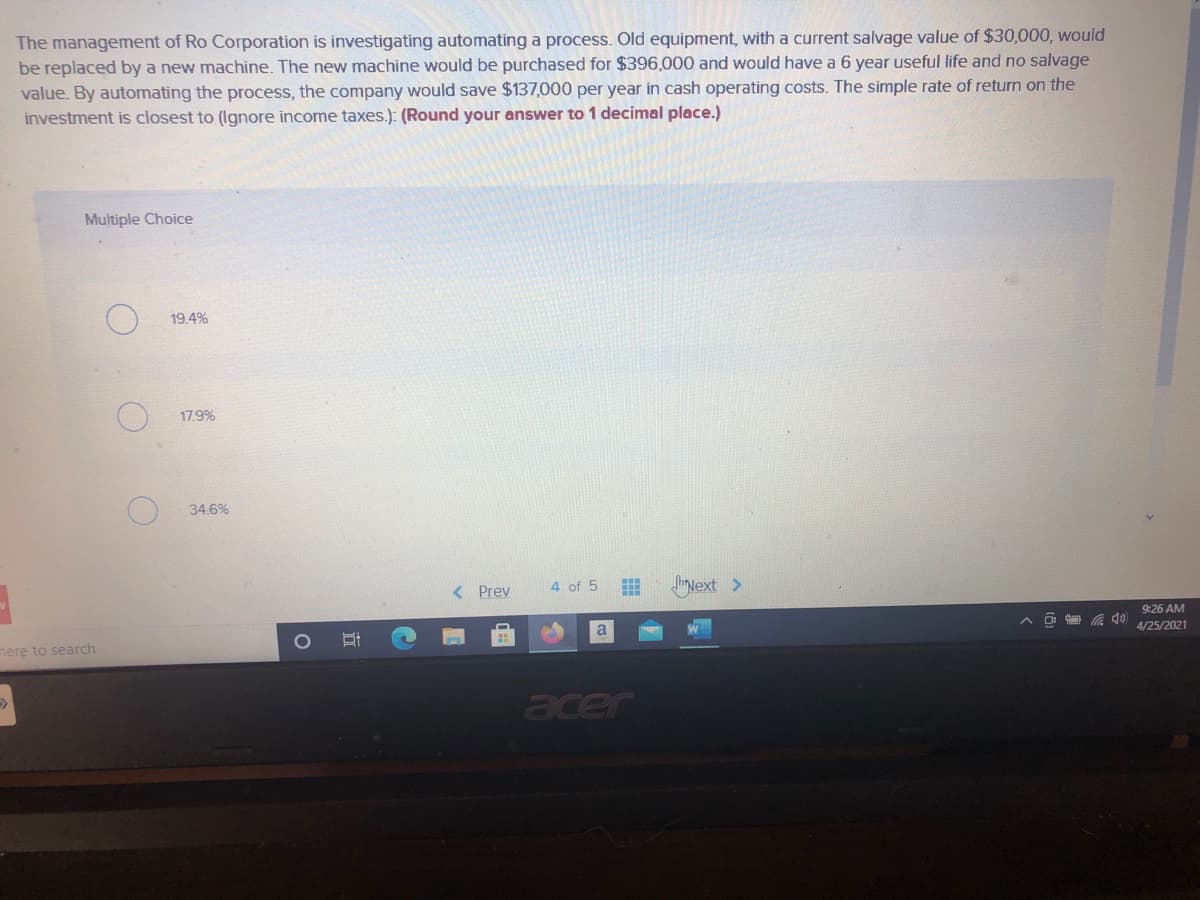

The management of Ro Corporation is investigating automating a process. Old equipment, with a current salvage value of $30,000, would be replaced by a new machine. The new machine would be purchased for $396,000 and would have a 6 year useful life and no salvage value. By automating the process, the company would save $137,000 per year in cash operating costs. The simple rate of return on the investment is closest to (Ignore income taxes.): (Round your answer to 1 decimal place.) Multiple Choice 19.4% 17.9% 34.6% < Prev 4 of 5 Next >

The management of Ro Corporation is investigating automating a process. Old equipment, with a current salvage value of $30,000, would be replaced by a new machine. The new machine would be purchased for $396,000 and would have a 6 year useful life and no salvage value. By automating the process, the company would save $137,000 per year in cash operating costs. The simple rate of return on the investment is closest to (Ignore income taxes.): (Round your answer to 1 decimal place.) Multiple Choice 19.4% 17.9% 34.6% < Prev 4 of 5 Next >

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 10P

Related questions

Question

Transcribed Image Text:The management of Ro Corporation is investigating automating a process. Old equipment, with a current salvage value of $30,000, would

be replaced by a new machine. The new machine would be purchased for $396,000 and would have a 6 year useful life and no salvage

value. By automating the process, the company would save $137,000 per year in cash operating costs. The simple rate of return on the

investment is closest to (Ignore income taxes.): (Round your answer to 1 decimal place.)

Multiple Choice

19.4%

17.9%

34.6%

< Prev

4 of 5

Next >

9:26 AM

a

4/25/2021

nere to search

acer

近

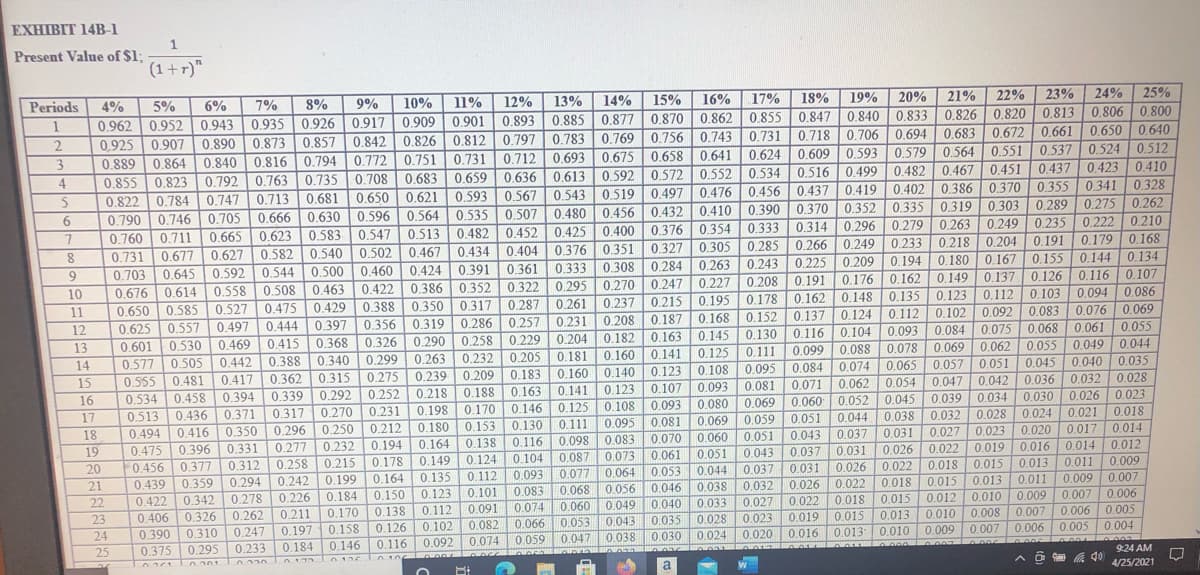

Transcribed Image Text:EXHIBIT 14B-1

1.

Present Value of $1;

(1+r)"

Periods

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

14%

16%

0.962 0.952 0.943 0.9350.926 0.917 0.909 0.901| 0.893 0.885 0.877 0.870 0.862

15%

17%

18%

19%

20%

21%

22%

23%

24%

25%

1

0.855 0.847 0.840 0.833 0.826 0.820 0.813

0.806 0.800

2

0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.7830.769 0.756 0.743 0.731 0.718 0.706 0.694 0.683 0.672

0.661

0.650 0.640

3

0.889

0.864 |

0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658

0.624 0.609 0.593 0.579 0.564 0.551

0.641 |

0.552 0.534 0.516 0.499 0.482 0.467 0.451

0.537 0.524 0,512

4

0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572

0.713 0.681 0.650 0.621 0.593 0.567 0.543 0,519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0328

0.666

0.855 0.823

0.792

0.822 0.784 0.747

0.437 0.4230.410

0.790 0.746 0.705

0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432

0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376

0,540 0.502 0.467 0.434

0.410 0.390

0.354 0.333 0.314 0.296 0.279 0.263

0.305 0.285

0.370 0.352 0.335 0.319

0.289 0.275 0.262

0.303 0

0.249 0.235 0.222 0.210

0.204 0.191

0.167 0.155 0.144

0.711 | 0.665

0.731

0.703

0.676 0.614

0.650 0.585 0.527

0.627 0.582

0.645 0.592 0.544 0.500

0.558 0.508 0.463

0.677

0.467 0.434 0.404 0.376 0.351

0.327

0.308 0.284

0.266

0.249 |

0.233 | 0.218

0.179 | 0.168

9

0.460 0.424 0.391

0.361

0.422 0.386 0.352 0.322 0.295 0.270

0.317 0.287 0.261 0.237

0.263 0.243 0.225 0.209 0.194

0.227 0.208 0.191 0.176 0.162

0.195 0.178 0.162 0.148

0.180

0.134

10

0.247

0.215

0.187

0.229 0.204 0.182 0.163 0.145 0.130 0.116

0.141

0.162 0.137

0.149

0.135 0.123 0.112

0.107

0.094 0.086

0.076 | 0.069

0.068 0.061 0.055

0.055 0.049 0.044

0.126

0.116

11

0.475 0.388 0.350

0.429

0.135

0,103

0.557 0.497 0.444 0.397 0.356

0.368 0.326

12

0.625

0.319

0.286 | 0.257 0.231 | 0.208

0.168

0.152 0.137 0.124

0.102 | 0.092

0.084 0.075

0.062

0.083

0.601 0.5300.469 0.415

0.577 0.505

0.555

0.534 0.458

13

0.104 0.093

0.078

0.065

0.054

0.442 0.388 0.340

0.362

14

0.232 0.205 0.181 0.160

0.183 0.160 0.140

0.299

0.263

0.275 0.239

0.125

0.108

0.111

0.099

0.088

0.069

15

0.481

0.315

0.339 0.292 0.252 0.218

0.371| 0.317 0.270 | 0.231 0.198

0.417

0.074

0.095

0.081

0.209

0.084

0.123

0.141 0.123 0.107

0.057

0.051

0.045

0.040 0.035

16

0.394

0.163

0.170 0.146

0.153 0.130

0.138

0.188

0.093

0.071

0.062

0.047

0.042

0.036

0.032

0.028

17

0.513

0.436

0.125 0.108

0.080

0.069

0.060 0.052

| 0.045

0.039

0.034 0.030

0.026 0.023

0.024 0.021 0.018

0.017

0.093

0.494 0.416 0.350 0.296 0.250 | 0.212 0.180

0.475 0.396

F0.456

0.095

0.083

0.073 0.061

0.093 0.077 0.064 0.053

0.068 0056 0.046

0.038

0.037 | 0.031

0.031 0.026 0.022

0.022 | 0.018

0.018 0.015

18

0.111

0.059 0.051

0.044

0.032 | 0.028

0.027 0.023

0.081

0.069

19

0.331 0.277 0.232 0.194 0.164

0.116

0.098

0.060

0.051

0.044 0.037 0.031

0.038

0.033

0.051 0.043

0.043 0.037

0.070

0.020

0.014

20

0.377

0.215 0.178 0.149

0.087

0.312

0.294

0.258

0.124

0.104

0.016 | 0.014 0.012

0.013 0.0110.009

0.019

0.439

0.422

0.359

0.342

0.135 0.112

0.123 0.101

21

0.242

0.199

0.164

0.026

0.015

0.226 0.184

0.083

0.032 0.026 0.022

0.027 0.022

22

0.278

0.150

0.013

0.011

0.009

0.007

0.406 0.326 0.262 0.211 0.170 0.138

0.390

0.375

23

0.060 0.049 0.040

0.018 0.0115

0.112 0.091

0.102 0.082 0.066

0.074

0.009

0.007

0.006

0.006

0.006 0 005

0.005 | 0.004

0.012

0.007

0.010

0.008

0.007

24

0.310 0.247 0.197 0.158 0.126

0.053 0.043 0.035 0.028

0.023 0.019 0.015

0.013

0.010

0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.038 0.030 0.024 0.020 0.016 0.013: 0.010 0.009

O201 0.230 0173

25

0201

001

9:24 AM

a

A O 40

4/25/2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College