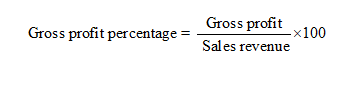

Gross Profit Percentage Calculate the company's 2020 gross profit percentage and compare the result to the industry average

Gross Profit Percentage Calculate the company's 2020 gross profit percentage and compare the result to the industry average

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.4P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Gross Profit Percentage

Calculate the company's 2020 gross profit percentage and compare the result to the industry average.

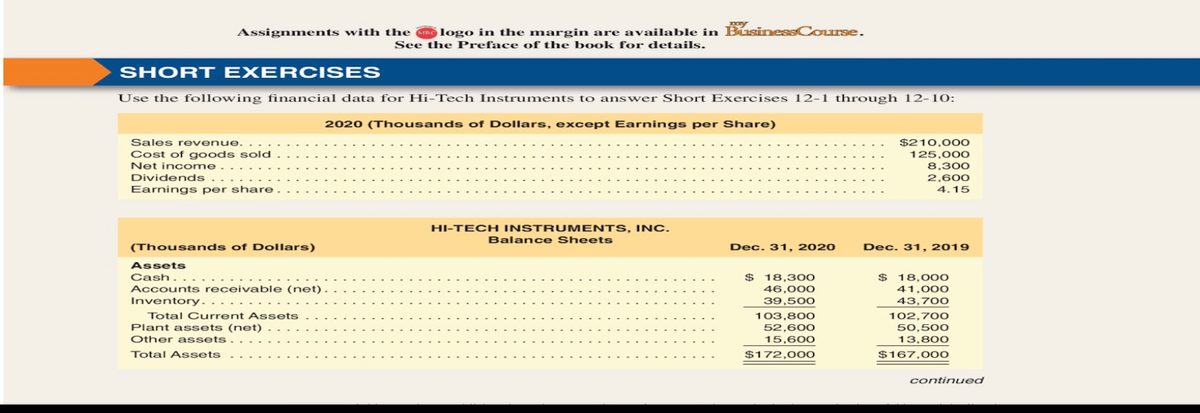

Transcribed Image Text:Assignments with the ne logo in the margin are available in BusinessCourse.

See the Preface of the book for details.

SHORT EXERCISES

Use the following financial data for Hi-Tech Instruments to answer Short Exercises 12-1 through 12-10:

2020 (Thousands of Dollars, except Earnings per Share)

Sales revenue.

$210,00o

125,000

Cost of goods sold

Net income .

8,300

2,600

Dividends

Earnings per share.

4.15

HI-TECH INSTRUMENTS, INc.

Balance Sheets

(Thousands of Dollars)

Dec. 31, 2020

Dec. 31, 2019

Assets

Cash

$

,300

$ 18,000

Accounts receivable (net)

Inventory.

46,000

41,000

39,500

43,700

Total Current Assets

103,800

52,600

102,700

Plant assets (net)

50,500

Other assets

15,600

13,800

Total Assets

$172,00O

$167,000

continued

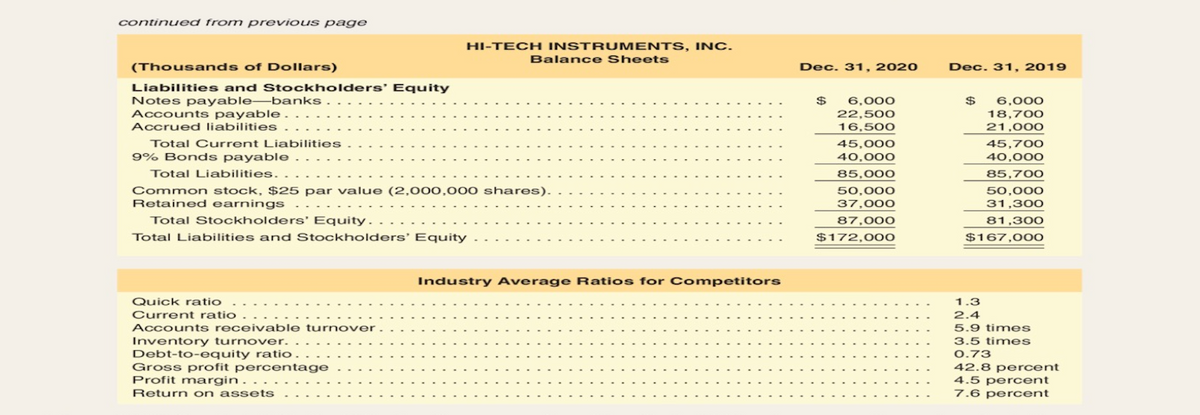

Transcribed Image Text:continued from previous page

HI-TECH INSTRUMENTS, INC.

Balance Sheets

(Thousands of Dollars)

Dec. 31, 2020

Dec. 31, 2019

Liabilities and Stockholders' Equity

Notes payable-banks

Accounts payable.

$

22,500

6,000

6,000

18,700

Accrued liabilities

16,500

21,000

45,000

40,000

Total Current Liabilities

45,700

9% Bonds payable

40,000

Total Liabilities.

85,000

85,700

Common stock, $25 par value (2,000,000 shares).

Retained earnings

50,000

37,000

50,000

31,300

Total Stockholders' Equity.

87,000

81,300

Total Liabilities and Stockholders’ Equity

$172,00o

$167,00O

Industry Average Ratios for Competitors

Quick ratio

1.3

Current ratio

2.4

Accounts receivable turnover

5.9 times

Inventory turnover.

Debt-to-equity ratio.

Gross profit percentage

Profit margin.

Return on assets

3.5 times

0.73

42.8 percent

4.5 percent

7.6 percent

Expert Solution

Step 1

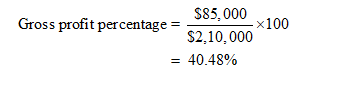

Gross profits are profits before operating expenses.

Step 2

Gross profit = Total sales – Cost of goods sold

= $2,10,000 - $1,25,000

= $85,000

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning