Hanabishi Company had 20,500 units on January 30, 2019, based on physical count of goods c that date. The following items have not yet been recorded as purchases and sales as of Novembe 30. Number of units 550 No. Transaction Purchase Terms FOB Shipping point FOB Destination FOB Buyer FOB Shipping point FOB Destination 2 Purchase 450 Purchase Sale 3 650 600 850 4 5 Sale All items were shipped by the seller January 30, 2019 and received by buyer February 15, 2019.

Hanabishi Company had 20,500 units on January 30, 2019, based on physical count of goods c that date. The following items have not yet been recorded as purchases and sales as of Novembe 30. Number of units 550 No. Transaction Purchase Terms FOB Shipping point FOB Destination FOB Buyer FOB Shipping point FOB Destination 2 Purchase 450 Purchase Sale 3 650 600 850 4 5 Sale All items were shipped by the seller January 30, 2019 and received by buyer February 15, 2019.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11RE: At the end of 2019, Manny Company recorded its ending inventory at 350,000 based on a physical...

Related questions

Question

Question 46

Choose the correct answer from the choices.

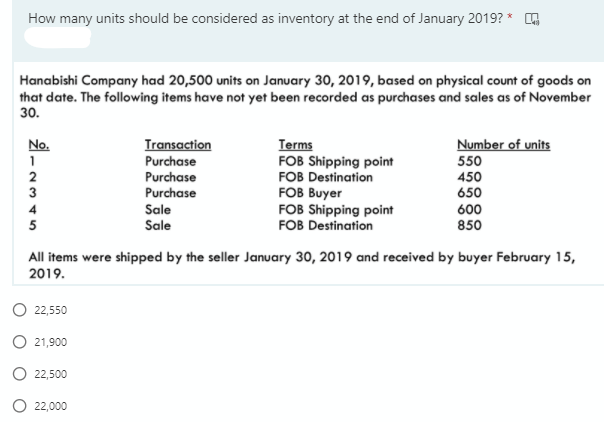

Transcribed Image Text:How many units should be considered as inventory at the end of January 2019? *

Hanabishi Company had 20,500 units on January 30, 2019, based on physical count of goods on

that date. The following items have not yet been recorded as purchases and sales as of November

30.

No.

Transaction

Number of units

Terms

FOB Shipping point

FOB Destination

FOB Buyer

FOB Shipping point

FOB Destination

Purchase

550

Purchase

Purchase

Sale

Sale

2

450

650

600

850

3

5

All items were shipped by the seller January 30, 2019 and received by buyer February 15,

2019.

O 22,550

O 21,900

O 22,500

O 22,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,