Hans borrowed money from an online lending company to invest in antiques. He took out a personal, amortized loan for $25,500, at an interest rate of 7.5%, with monthly payments t For each part, do not round any intermediate computations and round your final answers to the nearest ce If necessary, refer to the list of financial formulas. (a) Find Hans monthly payment. $0 (b) If Hans pays the monthly payment each month for the full term, find his total amount to repay the loan. $0 (c) If Hans pays the monthly payment each month for the full term, find the total amount of interest he will pay. $0

Hans borrowed money from an online lending company to invest in antiques. He took out a personal, amortized loan for $25,500, at an interest rate of 7.5%, with monthly payments t For each part, do not round any intermediate computations and round your final answers to the nearest ce If necessary, refer to the list of financial formulas. (a) Find Hans monthly payment. $0 (b) If Hans pays the monthly payment each month for the full term, find his total amount to repay the loan. $0 (c) If Hans pays the monthly payment each month for the full term, find the total amount of interest he will pay. $0

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 25PROB

Related questions

Question

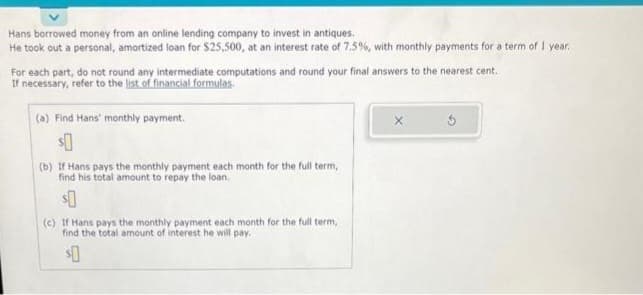

Transcribed Image Text:Hans borrowed money from an online lending company to invest in antiques.

He took out a personal, amortized loan for $25,500, at an interest rate of 7.5%, with monthly payments for a term of 1 year.

For each part, do not round any intermediate computations and round your final answers to the nearest cent.

If necessary, refer to the list of financial formulas.

(a) Find Hans' monthly payment.

$0

(b) If Hans pays the monthly payment each month for the full term,

find his total amount to repay the loan.

$0

(c) If Hans pays the monthly payment each month for the full term,

find the total amount of interest he will pay.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT