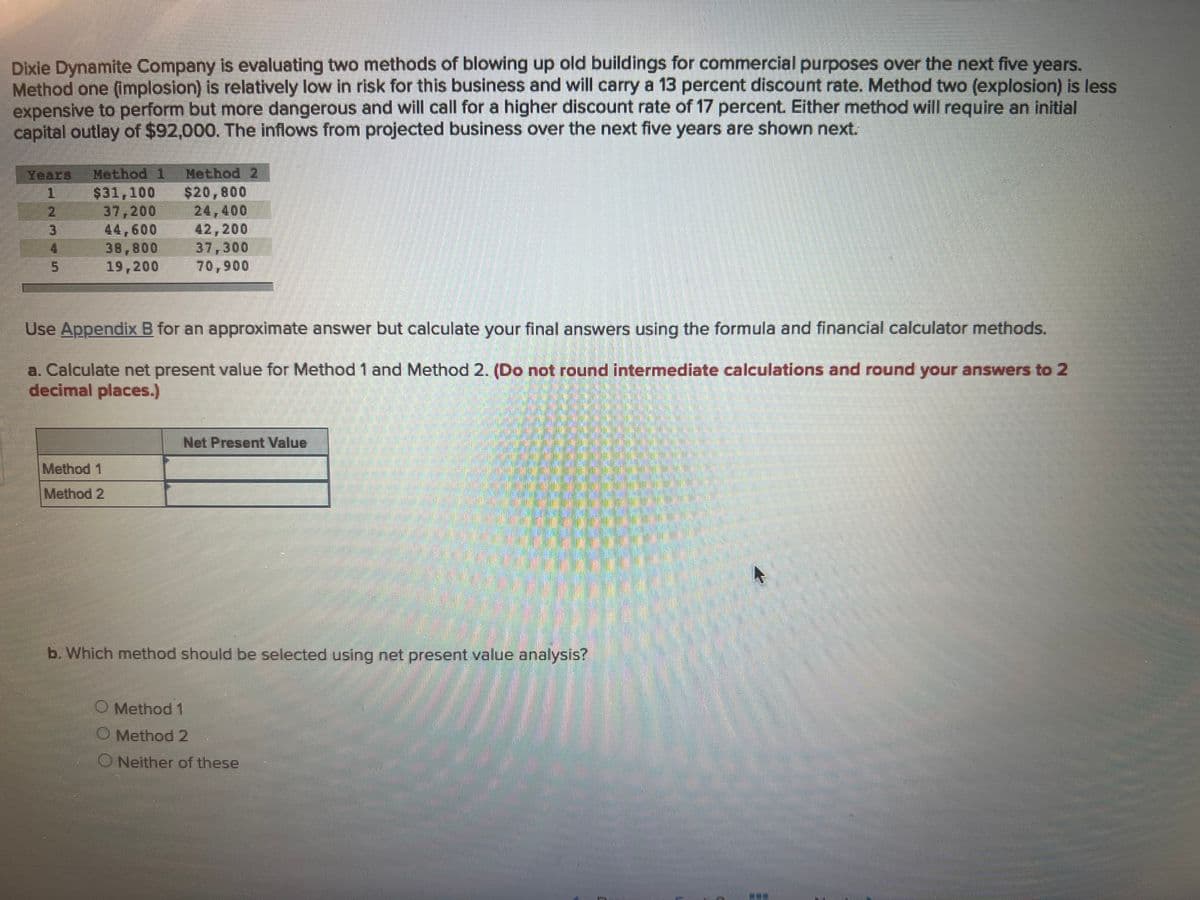

Dixie Dynamite Company is evaluating two methods of blowing up old buildings for commercial purposes over the next five years. Method one (implosion) is relatively low in risk for this business and will carry a 13 percent discount rate. Method two (explosion) is less expensive to perform but more dangerous and will call for a higher discount rate of 17 percent. Either method will require an initial capital outlay of $92,000. The inflows from projected business over the next five years are shown next. Years Method 1 Method 2 1 2 3 4 5 $31,100 $20,800 37,200 24,400 44,600 42,200 38,800 37,300 19,200 70,900 Use Appendix B for an approximate answer but calculate your final answers using the formula and financial calculator methods. a. Calculate net present value for Method 1 and Method 2. (Do not round intermediate calculations and round your answers to 2 decimal places.) Method 1 Method 2 Net Present Value b. Which method should be selected using net present value analysis? O Method 1 O Method 2 ONeither of these

Dixie Dynamite Company is evaluating two methods of blowing up old buildings for commercial purposes over the next five years. Method one (implosion) is relatively low in risk for this business and will carry a 13 percent discount rate. Method two (explosion) is less expensive to perform but more dangerous and will call for a higher discount rate of 17 percent. Either method will require an initial capital outlay of $92,000. The inflows from projected business over the next five years are shown next. Years Method 1 Method 2 1 2 3 4 5 $31,100 $20,800 37,200 24,400 44,600 42,200 38,800 37,300 19,200 70,900 Use Appendix B for an approximate answer but calculate your final answers using the formula and financial calculator methods. a. Calculate net present value for Method 1 and Method 2. (Do not round intermediate calculations and round your answers to 2 decimal places.) Method 1 Method 2 Net Present Value b. Which method should be selected using net present value analysis? O Method 1 O Method 2 ONeither of these

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 4P

Related questions

Question

Transcribed Image Text:Dixie Dynamite Company is evaluating two methods of blowing up old buildings for commercial purposes over the next five years.

Method one (implosion) is relatively low in risk for this business and will carry a 13 percent discount rate. Method two (explosion) is less

expensive to perform but more dangerous and will call for a higher discount rate of 17 percent. Either method will require an initial

capital outlay of $92,000. The inflows from projected business over the next five years are shown next.

Years Method 1 Method 2

1

2

3

4

5

$31,100 $20,800

37,200

24,400

44,600

42,200

38,800

37,300

19,200

70,900

Use Appendix B for an approximate answer but calculate your final answers using the formula and financial calculator methods.

a. Calculate net present value for Method 1 and Method 2. (Do not round intermediate calculations and round your answers to 2

decimal places.)

Method 1

Method 2

Net Present Value

b. Which method should be selected using net present value analysis?

Method 1

Method 2

ONeither of these

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning