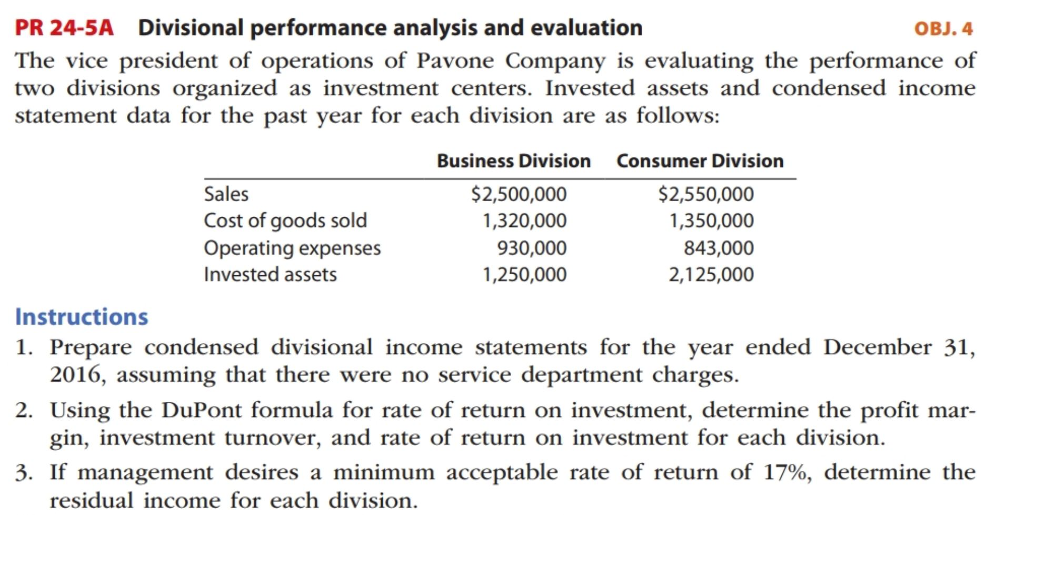

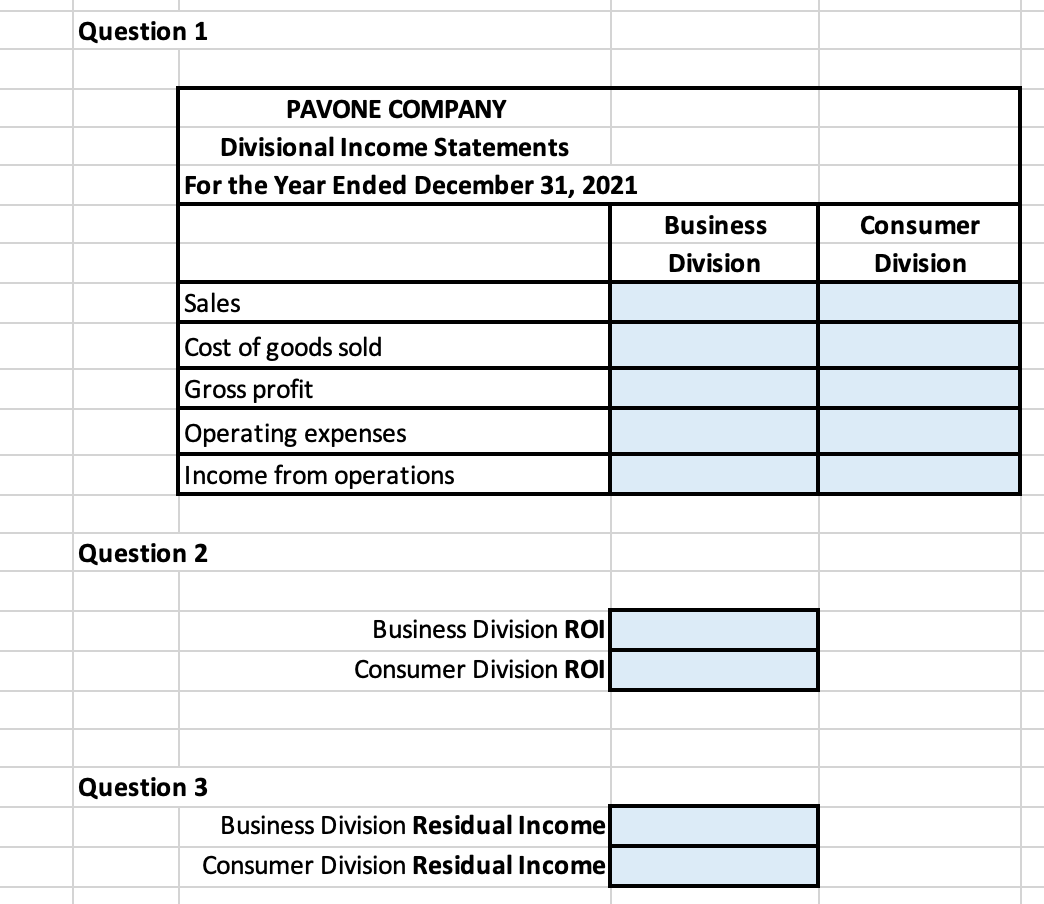

he vice president of operations of Pavone Company is evaluating the performance of wo divisions organized as investment centers. Invested assets and condensed income tatement data for the past year for each division are as follows: Business Division Consumer Division Sales $2,500,000 $2,550,000 Cost of goods sold Operating expenses Invested assets 1,320,000 1,350,000 930,000 843,000 1,250,000 2,125,000 nstructions . Prepare condensed divisional income statements for the year ended December 31, 2016, assuming that there were no service department charges. . Using the DuPont formula for rate of return on investment, determine the profit mar- gin, investment turnover, and rate of return on investment for each division. If management desires a minimum acceptable rate of return of 17%, determine the residual income for each division.

Q: Far Sight is a division of a major corporation. The following data are for the latest year of…

A: a. Return On Investment = Net Operating IncomeAverage Operating Assets =$1,738,080$6,000,000=28.97%

Q: Nantor Corporation has two divisions, Southern and Northern. The following information was taken…

A: Fixed cost is the cost that has been fixed at all levels of output. Whereas, variable cost is the…

Q: Divisional Performance Analysis and Evaluation The vice president of operations of Free Ride Bike…

A: 1. Prepare divisional income statements for Road Bike and Mountain Bike Divisions of Free Ride Bike…

Q: Return on investment The income from operations and the amount of invested assets in each division…

A: Return on investment is calculated by dividing the income from operations by the invested assets.

Q: The following data relate to the Western Division of Palmerston Ltd for the current year. Sales…

A: Note:- Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Thomas Railroad Company organizes its three divisions, the North (N), South (S), and West (W)…

A:

Q: The vice president of operations of Pavone Company is evaluating the performance of two divisions…

A: Solution:- Preparation of the condensed divisional income statements for the year ended December…

Q: Return on investment The operating income and the amount of invested assets in each division of…

A: Return on investment means percentage of profit on the basis of amount invested in business. It can…

Q: The vice president of operations of Moab Bike Company is evaluating the performance of two divisions…

A: SOLUTION- 1 INCOME STATEMENT- IT IS A PART OF A COMPANY AND IS MOST IMPORTANT ELEMENT AS IT SHOWS…

Q: The vice president of operations of Moab Bike Company is evaluating the performance of two divisions…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. If you want…

Q: Nantor Corporation has two divisions, Southern and Northern. The following information was taken…

A: Net operating income = Total company Divisional segment margin - Total common fixed expenses Total…

Q: Selected sales and operating data for three divisions of different structural engineering firms are…

A: Return on investment (ROI) is a performance statistic used to evaluate the efficiency or…

Q: Far Sight is a division of a major corporation. The following data are for the latest year of…

A: Return on investment represents the profit earned on an investment made. It is calculated by…

Q: The income from operations and the amount of invested assets in each division of Beck Industries are…

A: Return on investment (ROI): This financial ratio evaluates how efficiently the assets are used in…

Q: Nicholas Technologies operates two divisions: Hardware Services and Software Services. During the…

A: Income statement is one of the financial statement being prepared by business for showing all…

Q: Return on investment The income from operations and the amount of invested assets in each division…

A: The Return on investment is calculated as operating income divided by investing assets.

Q: Return on investment The operating income and the amount of invested assets in each division of…

A: Given information: Operating Income Invested Assets Retail Division $85,500 $450,000…

Q: Selected sales and operating data for three divisions of different structural engineering firms are…

A: ROI is the return on investment. It basically means the amount earned by investing in some asset or…

Q: 2. The vice president of operations of Recycling Industries is evaluating the performance of two…

A: Since,we answer upto three sub-parts, we shall answer first three. Please resubmit a new question…

Q: Torres Company accumulates the following summary data for the year ending December 31, 2020, for its…

A: Responsibility Accounting: The management of responsibility centers by the means of pre-determined…

Q: Red Line Railroad Inc. has three regional divisions organized as profit centers. The chief executive…

A: The divisional performances need to be computed by adding all the departmental revenues and…

Q: Divisional Performance Analysis and Evaluation The vice president of operations of Free Ride Bike…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. If you want…

Q: Sunland Corporation recently announced a bonus plan to reward the manager of its most profitable…

A: The question is based on the concept of Cost Accounting.

Q: The sales, income from operations, and invested assets for each division of Grosbeak Company are as…

A: SOLUTION- RATIO ANALYSIS- IT IS A QUANTITATIVE METHOD OF GAINING INSIGHT IN TO COMPANYS…

Q: Selected sales and operating data for three divisions of different structural engineering firms are…

A: Margin :— It is the ratio of net operating income and sales. Turnover :— It is the ratio of sales…

Q: Red Line Railroad Inc. has three regional divisions organized as profit centers. The chief executive…

A: The performance of each division and its managers is necessary to measure on a timely basis to…

Q: Divisional Performance Analysis and Evaluation The vice president of operations of Free Ride Bike…

A: 1.Prepare condensed divisional income statements for the year ended December 31, 20Y7, assuming that…

Q: Rocky Mountain Airlines Inc. has two divisions organized as profit centers, the Passenger Division…

A: Part 1: The divisional income statement's operating income is incorrect since the amount of…

Q: he operating income and the amount of invested assets in each division of Conley Industries are as…

A: a. Retail division Commercial division Internet division Operating division 9600000 12100000…

Q: Carry On Freight Inc. has three regional divisions organized as profit centers. The chief executive…

A: Income statement shows all expenses and all incomes of the business and at the end it shows net…

Q: Selected sales and operating data for three divisions of different structural engineering firms are…

A: (1) (2) The calculation of margin, turnover, return on investments and residual income is as…

Q: Selected sales and operating data for three divisions of different structural engineering firms are…

A: In order to determine the margin, the net operating income is required to be divided by the net…

Q: Hardin Company is a division of a major corporation. The following data are for the latest year of…

A: Introduction:- The following formula used to calculate Residual income as follows under:- Residual…

Q: The income from operations and the amount of invested assets in each division of Shiner Industries…

A: Formula: Return on investments = ( Income from operations / Invested Assets ) x 100 Division of…

Q: Prepare condensed divisional income statements for the year ended December 31, 20Y7, assuming that…

A: Prepare :- 1.Income from operations 2.ROI 3. Residual Income 4. Which division is more profitable

Q: Commercial Retail Division Division Sales 945,000 966,000 Cost of Goods Sold 504,000 559,300 Selling…

A: Formula: Gross profit = Sales - cost of goods sold

Q: The Height of Fashion Corporation evaluates the performance of the divisions of the company based on…

A: Return on investment represents the return earned on the money invested by the company. The ROI is…

Q: Return on Investment B. Commercial Division, Internet Division, Retail Division

A: Compute the return on investment:

Q: The centralized computer technology department of Lee Company has expenses of $264,000. The…

A: As posted multiple independent questions we are answering only first question kindly repost the…

Q: Return on Investment The income from operations and the amount of invested assets in each division…

A: Formula to compute the return on investment.

Q: Selected sales and operating data for three divisions of different structural engineering firms are…

A: Ratio Analysis: Ratio analysis is a process of determining the relationship between accounting…

Q: Carter Company reported the following financial numbers for one of its divisions for the year;…

A: Residual income = Operating income - (Average invested assets*Minimum required rate of return)…

Q: Selected sales and operating data for three divisions of different structural engineering firms are…

A: Residual income is the difference between actual operating income and required operating income. The…

Q: Selected sales and operating data for three divisions of different structural engineering firms are…

A: 1. Compute the margin as follows:

Q: Return on investment The operating income and the amount of invested assets in each division of…

A: Return on Investment = Operating Income/Invested Assets Higher the ROI more the Profitable a…

Q: The vice president of operations of Moab Bike Company is evaluating the performance of two divisions…

A:

Q: The vice president of operations of Recycling Industries is evaluating the performance of two…

A: Solution 1: Condensed Divisional Income Statement Particulars Business Consumer Particulars…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Effect of proposals on divisional performance A condensed income statement for the Electronics Division of Gihbli Industries Inc. for live year ended December 31 is as follows: Sales 1.575,000 Cost of goods sold 891,000 Gross profit 684,000 Operating expenses 558,000 Income from operations 126,000 Invested assets 1,050,000 Assume that the Electronics Division received no charges from service departments. The president of Gihbli Industries Inc. has indicated that the divisions return on a 1,050,000 investment must be increased to at least 20% by the end of tin- next year if operations are to continue. The division manager is considering the following three proposals: Proposal 1: Transfer equipment with a book value of 300,000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would be less than the amount of depreciation expense on the old equipment by 31,400. This decrease in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Reduce invested assets by discontinuing a product line. This action would eliminate sales of 180,000, reduce cost of goods sold by 119,550, and reduce operating expenses by 60,000. Assets of 112,500 would be transferred to other divisions at no gain or loss. Proposal 3: Purchase new and more efficient machinery and thereby reduce the cost of goods sold by 189,000 after considering the effects of depreciation expense on the new equipment. Sales would remain unchanged, and the old machinery, which has no remaining book value, would be scrapped at no gain or loss. The new machinery would increase invested assets by 918,750 for the year. Instructions 1. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for the Electronics Division for the past year. Round percentages and the investment turnover to one decimal place. 2. Prepare condensed estimated income statements and compute the invested assets for each proposal. 3. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each proposal. Round percentages and the investment turnover to one decimal place. 4. Which of the three proposals would meet the required 20% return on investment? 5. If the Electronics Division were in an industry where the profit margin could not be increased, how much would the investment turnover have to increase to meet the president's required 20% return on investment? Round to one decimal place.Divisional income statements and return on investment analysis E.F. Lynch Company is a diversified investment company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 20Y8, are as follows: The management of E.F. Lynch Company is evaluating each division as a basis for planning a future expansion of operations. Instructions 1. Prepare condensed divisional income statements for the three divisions, assuming that there were no service department charges. 2. Using the DuPont formula for return on investment, compute the profit margin, investment turnover, and return on investment for each division. Round percentages and the investment turnover to one decimal place. 3. If available funds permit the expansion of operations of only one division, which of the divisions would you recommend for expansion, based on parts (1) and (2)? Explain.Evaluating divisional performance The three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for tile prior year: Snack Goods Cereal Frozen Foods Revenues 2,200,000 2,520,000 2,100,000 Operating expenses 1,366,600 1,122,000 976,800 Income from operations before service department charges 833,400 1,398,000 1,123,200 Service department charges: Promotion 300,000 600,000 468,000 Legal 137,400 243,600 235,200 Total service department charges 437,400 843.600 703,200 Income from operations 396,000 554,400 420,000 Invested assets 2,000,000 1,680,000 1,750,000 1.Which division is making the best use of invested assets and should be given priority for future capital investments? 2.Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain. 3.Identify opportunities for improving the companys financial performance

- Effect of proposals on divisional performance A condensed income statement for the Commercial Division of Maxell Manufacturing Inc. for the year ended December 31 is as follows: Sales 3,500,000 Cost of goods sold 2,480,000 Gross profit 1,020,000 Operating expenses 600,000 Income from operations 420,000 Invested assets 2,500,000 Assume that the Commercial Division received no charges from service departments. The president of Maxell Manufacturing has indicated that the divisions return on a 2,500,000 investment must be increased to at least 21% by the end of the next year if operations are to continue. The division manager is considering tin- following three proposals: Proposal 1: Transfer equipment with a hook value of 312,500 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by 105,000. This increase in expense would be- included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by 560,000 after considering the effects of depreciation expense on the new equipment. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional 1,875,000 for the year. Proposal 3: Reduce invested assets by discontinuing a product line. This action would eliminate sales of 595,000, reduce cost of goods sold by 406,700, and reduce operating expenses by 175,000. Assets of 1,338,000 would the transferred to other divisions at no gain or loss. Instructions 1. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for the Commercial Division for the past year. 2. Prepare condensed estimated income statements and compute the invested assets for each proposal. 3. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each proposal. Round percentages and the investment turnover to one decimal place. 4. Which of the three proposals would meet the required 21% return on investment? 5. If the Commercial Division were in an industry where the profit margin could not be increases, how much would the investment turnover have to increase to meet the president's required 21% return on investment? Round to one decimal place.Evaluating divisional performance The three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year: 1. Which division is making the best use of invested assets and should be given priority for future capital investments? 2. Assuming that the minimum acceptable rate of return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? 3. Can you identify opportunities for improving the companys financial performance?Evaluating divisional performance The three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for tile prior year: Snack Goods Cereal Frozen Foods Revenues 2,200,000 2,520,000 2,100,000 Operating expenses 1,366,600 1,122,000 976,800 Income from operations before service department charges 833,400 1,398,000 1,123,200 Service department charges: Promotion 300,000 600,000 468,000 Legal 137,400 243,600 235,200 Total service department charges 437,400 843.600 703,200 Income from operations 396,000 554,400 420,000 Invested assets 2,000,000 1,680,000 1,750,000 1.Which division is making the best use of invested assets and should be given priority for future capital investments? 2.Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain. 3.Identify opportunities for improving the companys financial performance

- Evaluating division performance Last Resort Industries Inc. is a privately held diversified company with live separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no service department charges, is as follows: Last Resort Industries Inc.Specialty Products Division Income Statement For the Year Ended December 31,20Y5 Sales 32,400,000 Cost of goods sold 24,300,000 Gross profit 8,100,000 Operating expenses 3,240,000 Income from operations 4,860,000 Invested assets 27,000,000 The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of 14,400,000. A projected income statement for the new product line is as follows: New Product Line Projected Income Statement For the Year Ended December 31,20Y6 Sales 12,960,000 Cost of goods sold 7,500,000 Gross profit 5,460,000 Operating expenses 3,127,200 Income from operations 2,332,800 The Specialty Products Division currently has 27,000,000 in invested assets, and Last Resort Industries Inc.s overall return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional return on investment. A bonus is paid, in 58,000 increments, for each whole percentage point that the divisions return on investment exceeds the company average. The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons the Specialty Products Division manager rejected the new product line. 1. Determine the return on investment for the Specialty Products Division for the past year. 2. Determine the Specialty Products Division managers bonus for the past year. 3. Determine the estimated return on investment for the new product line. Round whole percents to one decimal place and investment turnover to two decimal places. 4. Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division, and 20Y6 actual operating results were similar to those of 20Y5. 5. Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.Effect of proposals on divisional performance A condensed income statement for the Electronics Division of Gihbli Industries Inc. for live year ended December 31 is as follows: Sales 1.575,000 Cost of goods sold 891,000 Gross profit 684,000 Operating expenses 558,000 Income from operations 126,000 Invested assets 1,050,000 Assume that the Electronics Division received no charges from service departments. The president of Gihbli Industries Inc. has indicated that the divisions return on a 1,050,000 investment must be increased to at least 20% by the end of tin- next year if operations are to continue. The division manager is considering the following three proposals: Proposal 1: Transfer equipment with a book value of 300,000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would be less than the amount of depreciation expense on the old equipment by 31,400. This decrease in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Reduce invested assets by discontinuing a product line. This action would eliminate sales of 180,000, reduce cost of goods sold by 119,550, and reduce operating expenses by 60,000. Assets of 112,500 would be transferred to other divisions at no gain or loss. Proposal 3: Purchase new and more efficient machinery and thereby reduce the cost of goods sold by 189,000 after considering the effects of depreciation expense on the new equipment. Sales would remain unchanged, and the old machinery, which has no remaining book value, would be scrapped at no gain or loss. The new machinery would increase invested assets by 918,750 for the year. Instructions 1. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for the Electronics Division for the past year. Round percentages and the investment turnover to one decimal place. 2. Prepare condensed estimated income statements and compute the invested assets for each proposal. 3. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each proposal. Round percentages and the investment turnover to one decimal place. 4. Which of the three proposals would meet the required 20% return on investment? 5. If the Electronics Division were in an industry where the profit margin could not be increased, how much would the investment turnover have to increase to meet the president's required 20% return on investment? Round to one decimal place.Evaluating division performance Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no Service department charges, is as follows: The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of 14,400,000. A projected income statement for the new product line is as follows: The Specialty Products Division currently has 27.000.000 in invested assets, and Last Resort Industries Inc.s overall rate of return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional rate of return all investment A bonus is paid, in 8.000 increments, for each whole percentage point that the divisions rate of return on investment exceeds the company average. The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons why the Specialty Products Division manager rejected the new product line. 1. Determine the rate of return on investment for the Specialty Products Division for the past year. 2. Determine the Specialty Products Division managers bonus for the past year. 3. Determine the estimated rate of return on investment for the new product line. Round whole percents to one decimal place and investment turnover to two decimal places. 4. - Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected rate of return all investment for 2016, assuming that the new product line was launched in the Specialty Products Division, and 2016 actual operating results were similar to those of 2015. 5. Can you suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and rate of return on investment?

- Effect of proposals on divisional performance A condensed income statement for the Commercial Division of Maxell Manufacturing Inc. for the year ended December 31 is as follows: Sales 3,500,000 Cost of goods sold 2,480,000 Gross profit 1,020,000 Operating expenses 600,000 Income from operations 420,000 Invested assets 2,500,000 Assume that the Commercial Division received no charges from service departments. The president of Maxell Manufacturing has indicated that the divisions return on a 2,500,000 investment must be increased to at least 21% by the end of the next year if operations are to continue. The division manager is considering tin- following three proposals: Proposal 1: Transfer equipment with a hook value of 312,500 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by 105,000. This increase in expense would be- included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by 560,000 after considering the effects of depreciation expense on the new equipment. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional 1,875,000 for the year. Proposal 3: Reduce invested assets by discontinuing a product line. This action would eliminate sales of 595,000, reduce cost of goods sold by 406,700, and reduce operating expenses by 175,000. Assets of 1,338,000 would the transferred to other divisions at no gain or loss. Instructions 1. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for the Commercial Division for the past year. 2. Prepare condensed estimated income statements and compute the invested assets for each proposal. 3. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each proposal. Round percentages and the investment turnover to one decimal place. 4. Which of the three proposals would meet the required 21% return on investment? 5. If the Commercial Division were in an industry where the profit margin could not be increases, how much would the investment turnover have to increase to meet the president's required 21% return on investment? Round to one decimal place.Evaluating division performance Last Resort Industries Inc. is a privately held diversified company with live separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no service department charges, is as follows: Last Resort Industries Inc.Specialty Products Division Income Statement For the Year Ended December 31,20Y5 Sales 32,400,000 Cost of goods sold 24,300,000 Gross profit 8,100,000 Operating expenses 3,240,000 Income from operations 4,860,000 Invested assets 27,000,000 The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of 14,400,000. A projected income statement for the new product line is as follows: New Product Line Projected Income Statement For the Year Ended December 31,20Y6 Sales 12,960,000 Cost of goods sold 7,500,000 Gross profit 5,460,000 Operating expenses 3,127,200 Income from operations 2,332,800 The Specialty Products Division currently has 27,000,000 in invested assets, and Last Resort Industries Inc.s overall return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional return on investment. A bonus is paid, in 58,000 increments, for each whole percentage point that the divisions return on investment exceeds the company average. The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons the Specialty Products Division manager rejected the new product line. 1. Determine the return on investment for the Specialty Products Division for the past year. 2. Determine the Specialty Products Division managers bonus for the past year. 3. Determine the estimated return on investment for the new product line. Round whole percents to one decimal place and investment turnover to two decimal places. 4. Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division, and 20Y6 actual operating results were similar to those of 20Y5. 5. Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.Effect of proposals on divisional performance A condensed income Statement for the Commercial Division of Maxell Manufacturing Inc. for the year ended December 31, 2016, is as follows: Sales 3,500,000 Cost of goods sold 2,480,000 Gross profit 1,020,000 Operating expenses 600,000 Income from operations 420,000 Invested assets 2,500,000 Assume that the Commercial Division received no charges from Service departments. The president of Maxell Manufacturing has indicated that the divisions rate of return on a 2,500,000 investment must be increased to at least 21% by the end of the next year if operations are to continue. The division manager is considering the following three proposals: Proposal 1: Transfer equipment with a book value of 312,500 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depredation expense on the old equipment by 105,000. This increase in expense would be included as pan of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by 560,000 after considering the effects of depredation expense on the new equipment Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional 1,875,000 for the year. Proposal .3: Reduce invested assets by discontinuing a product line. This action would eliminate sales of 595,000, reduce cost of goods sold by 406,700, and reduce operating expenses by 175,000. Assets of 1,338,000 would be transferred to other divisions at no gain or loss. Instructions 1. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for the Commercial Division for the past year 2. Prepare condensed estimated income statements and compute the invested assets for each proposal. 3. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for each proposal. 4. Which of the three proposals would meet the required 21% rate of return on investment? 5. If the Commercial Division were in an industry where the profit margin could not be increased, how much would the investment turnover have to increase to meet the presidents required 21% rate of return on investment? Round to one decimal place.