Financial & Managerial Accounting

13th Edition

ISBN: 9781285866307

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 23, Problem 23.3CP

Evaluating divisional performance

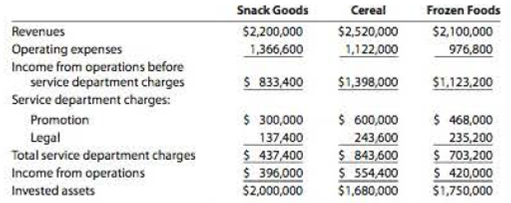

The three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year:

- 1. Which division is making the best use of invested assets and should be given priority for future capital investments?

- 2. Assuming that the minimum acceptable

rate of return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? - 3. Can you identify opportunities for improving the company’s financial performance?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Evaluating Divisional Performance

The three divisions of Delicious Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year:

Which division is making the best use of invested assets and should be given priority for future capital investments?

Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain.

Identify opportunities for improving the company's financial performance.

Requirements:

I- TITLE OF THE CASE

II - TIME CONTEXT

(The approximate time when the case happened. Consider only this time period when you analyze the case.)

III - VIEWPOINT

(Consider always the point of view by the concerned officer/s based on the course being undertaken example: Marketing Director if the subject is marketing management, CEO if business Policy/…

Evaluating Divisional Performance

The three divisions of Delicious Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year:

Which division is making the best use of invested assets and should be given priority for future capital investments?

Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain.

Identify opportunities for improving the company's financial performance.

Requirements:

V-STATEMENT OF THE PROBLEM

Based on the areas of consideration come up with central problem of the case. Or you can enumerate the problems you find and arrange them in order of significance in order to be able to identify the central problem.

Always write one-line statement of the problem either a declarative statement form or question form.

VI -…

a. Compute the rate of return on investment for each division. b. Which division is the most profitable per dollar invested?

Assume that management has established a 10% minimum acceptable rate of return for invested assets.

c. Determine the residual income for each division. d. Which division has the most residual income?

Chapter 23 Solutions

Financial & Managerial Accounting

Ch. 23 - Prob. 1DQCh. 23 - Differentiate between a profit center and an...Ch. 23 - Weyerhaeuser developed a system that assigns...Ch. 23 - What is the major shortcoming of using income from...Ch. 23 - In a decentralized company in which the divisions...Ch. 23 - How does using the return on investment facilitate...Ch. 23 - Why would a firm use a balanced scorecard in...Ch. 23 - Prob. 8DQCh. 23 - When is the negotiated price approach preferred...Ch. 23 - When using the negotiated price approach to...

Ch. 23 - Prob. 23.1APECh. 23 - Prob. 23.1BPECh. 23 - Service department charges The centralized...Ch. 23 - Service department charges The centralized...Ch. 23 - Income from operations for profit center Using the...Ch. 23 - Prob. 23.3BPECh. 23 - Prob. 23.4APECh. 23 - Profit margin, investment turnover, and ROI Briggs...Ch. 23 - Residual income The Consumer Division of Hernandez...Ch. 23 - Prob. 23.5BPECh. 23 - Transfer pricing The materials used by tile North...Ch. 23 - Transfer pricing The materials used by the...Ch. 23 - Budget performance reports for cost centers...Ch. 23 - Divisional income statements The following data...Ch. 23 - Service department charges and activity bases For...Ch. 23 - Prob. 23.4EXCh. 23 - Service department charges In divisional income...Ch. 23 - Service department charges and activity bases...Ch. 23 - Divisional income statements with service...Ch. 23 - Prob. 23.8EXCh. 23 - Prob. 23.9EXCh. 23 - Rate of return on investment The income from...Ch. 23 - Residual income Based on the data in Exercise...Ch. 23 - Determining missing items in return on investment...Ch. 23 - Prob. 23.13EXCh. 23 - Prob. 23.14EXCh. 23 - Prob. 23.15EXCh. 23 - Determining missing items from computations Data...Ch. 23 - Prob. 23.17EXCh. 23 - Prob. 23.18EXCh. 23 - Building a balanced scorecard Hit-n-Run Inc. owns...Ch. 23 - Decision on transfer pricing Materials used by the...Ch. 23 - Prob. 23.21EXCh. 23 - Budget performance report for a cost center...Ch. 23 - Prob. 23.2APRCh. 23 - Divisional income statements and rate of return on...Ch. 23 - Effect of proposals on divisional performance A...Ch. 23 - Prob. 23.5APRCh. 23 - Prob. 23.6APRCh. 23 - Prob. 23.1BPRCh. 23 - Prob. 23.2BPRCh. 23 - Prob. 23.3BPRCh. 23 - Prob. 23.4BPRCh. 23 - Prob. 23.5BPRCh. 23 - Prob. 23.6BPRCh. 23 - Prob. 23.1CPCh. 23 - Prob. 23.2CPCh. 23 - Evaluating divisional performance The three...Ch. 23 - Evaluating division performance over time The...Ch. 23 - Evaluating division performance Last Resort...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Divisional performance analysis and evaluation The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Instructions 1. Prepare condensed divisional income statements for the year ended December 31, 20Y7, assuming that there were no support department allocations. 2. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each division. Round percentages and the investment turnover to one decimal place. 3. If managements minimum acceptable return on investment is 10%, determine the residual income for each division. 4. Discuss the evaluation of the two divisions, using the performance measures determined in parts (1), (2), and (3).arrow_forwardCommunication The Norse Division of Gridiron Concepts Inc. experienced significant revenue and profit growth from 20Y4 to 20Y6 as shown in the following divisional income statements: There are no support department allocations, and the division operates as an investment center that must maintain a 15% return on invested assets. Determine the profit margin, investment turnover, and return on investment for the Norse Division for 20Y420Y6. Based on your computations, write a brief memo to the president of Gridiron Concepts Inc., Knute Holz, evaluating the divisions performance.arrow_forwardDivisional income statements and return on investment analysis E.F. Lynch Company is a diversified investment company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 20Y8, are as follows: The management of E.F. Lynch Company is evaluating each division as a basis for planning a future expansion of operations. Instructions 1. Prepare condensed divisional income statements for the three divisions, assuming that there were no support department allocations. 2. Using the DuPont formula for return on investment, compute the profit margin, investment turnover, and return on investment for each division. Round percentages and the investment turnover to one decimal place. 3. If available funds permit the expansion of operations of only one division, which of the divisions would you recommend for expansion, based on parts (1) and (2)? Explain.arrow_forward

- Use the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-32 Residual Income Refer to the information for Washington Company above. In addition, Washington Companys top management has set a minimum acceptable rate of return equal to 8%. Required: 1. Calculate the residual income for the Adams Division. 2. Calculate the residual income for the Jefferson Division.arrow_forwardEffect of proposals on divisional performance A condensed income statement for the Commercial Division of Maxell Manufacturing Inc. for the year ended December 31, 20Y9, is as follows: Assume that the Commercial Division received no allocations from support departments. The president of Maxell Manufacturing has indicated that the divisions return on a 2,500,000 investment must be increased to at least 21% by the end of the next year if operations are to continue. The division manager is considering the following three proposals: Proposal 1: Transfer equipment with a book value of 312,500 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by 105,000. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by 560,000 after considering the effects of depreciation expense on the new equipment. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional 1,875,000 for the year. Proposal 3: Reduce invested assets by discontinuing a product line. This action would eliminate sales of 595,000, reduce cost of goods sold by 406,700, and reduce operating expenses by 175,000. Assets of 1,338,000 would be transferred to other divisions at no gain or loss. Instructions 1. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for the Commercial Division for the past year. 2. Prepare condensed estimated income statements and compute the invested assets for each proposal. 3. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each proposal. Round the investment turnover and return on investment to one decimal place. 4. Which of the three proposals would meet the required 21% return on investment? 5. If the Commercial Division were in an industry where the profit margin could not be increased, how much would the investment turnover have to increase to meet the presidents required 21% return on investment?arrow_forwardUse the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-31 Economic Value Added Refer to the information for Washington Company above. Required: 1. Calculate the EVA for the Adams Division. 2. Calculate the EVA for the Jefferson Division. 3. CONCEPTUAL CONNECTION Is each division creating or destroying wealth? 4. CONCEPTUAL CONNECTION Describe generally the types of actions that Washingtons management team could take to increase Jefferson Divisions EVA?arrow_forward

- Profit center responsibility reporting for a service company Red Line Railroad Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance, using operating income as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31: The company operates three support departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department is the companys point of contact for new service, complaints, and requests for repair. The department believes that the number of customer contacts is a cost driver for this work. The Legal Department provides legal services for division management. The department believes that the number of hours billed is a cost driver for this work. The following additional information has been gathered: Instructions 1. Prepare quarterly income statements showing operating income for the three divisions. Use three column headings: East, West, and Central. 2. Identify the most successful division according to the profit margin. Round to the nearest whole percent. 3. Provide a recommendation to the CEO for a better method for evaluating the performance of the divisions. In your recommendation, identify the major weakness of the present method.arrow_forwardDantrell Palmer has just been appointed manager of Kirchner Glass Products Division. He has two years to make the division profitable. If the division is still showing a loss after two years, it will be eliminated, and Dantrell will be reassigned as an assistant divisional manager in another division. The divisional income statement for the most recent year is as follows: Upon arriving at the division, Dantrell requested the following data on the divisions three products: He also gathered data on a proposed new product (Product D). If this product is added, it would displace one of the current products; the quantity that could be produced and sold would equal the quantity sold of the product it displaces, although demand limits the maximum quantity that could be sold to 20,000 units. Because of specialized production equipment, it is not possible for the new product to displace part of the production of a second product. The information on Product D is as follows: Required: 1. Prepare segmented income statements for Products A, B, and C. 2. Determine the products that Dantrell should produce for the coming year. Prepare segmented income statements that prove your combination is the best for the division. By how much will profits improve given the combination that you selected? (Hint: Your combination may include one, two, or three products.)arrow_forwardDivisional Performance Analysis and Evaluation The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Road Bike Division Mountain Bike Division Sales $1,728,000 $1,760,000 Cost of goods sold 1,380,000 1,400,000 Operating expenses 175,200 236,800 Invested assets 1,440,000 800,000 Required: 1. Prepare condensed divisional income statements for the year ended December 31, 20Y7, assuming that there were no support department allocations. Free Ride Bike Company Divisional Income Statements For the Year Ended December 31, 20Y7 Road Bike Division Mountain Bike Division Sales $ $ Cost of goods sold Gross profit $ $ Operating expenses Operating income $ $ 2. Using the DuPont formula for return on investment, determine the…arrow_forward

- Divisional Performance Analysis and Evaluation The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Road Bike Division Mountain Bike Division Sales $1,728,000 $1,760,000 Cost of goods sold 1,380,000 1,400,000 Operating expenses 175,200 236,800 Invested assets 1,440,000 800,000 Required: 1. Prepare condensed divisional income statements for the year ended December 31, 20Y7, assuming that there were no service department charges. Free Ride Bike Company Divisional Income Statements For the Year Ended December 31, 20Y7 Road Bike Division Mountain Bike Division Sales $ $ Cost of goods sold Gross profit $ $ Operating expenses Income from operations $ $ 2. Using the DuPont formula for return on investment, determine the…arrow_forwardDivisional Performance Analysis and Evaluation The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Road Bike Division Mountain Bike Division Sales $ 3,190,000 $ 3,360,000 Cost of goods sold 1,404,000 1,579,000 Operating expenses 1,275,600 1,344,200 Invested assets 2,900,000 2,400,000 Required: 1. Prepare condensed divisional income statements for the year ended December 31, 20Y7, assuming that there were no service department charges. Free Ride Bike Company Divisional Income Statements For the Year Ended December 31, 20Y7 Road Bike Division Mountain Bike Division Sales $fill in the blank 747434fe2fcbfee_1 $fill in the blank 747434fe2fcbfee_2 Cost of goods sold fill in the blank 747434fe2fcbfee_3 fill in the blank 747434fe2fcbfee_4 Gross…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

GE McKinsey Matrix for SBU Strategies; Author: Wolters World;https://www.youtube.com/watch?v=FffD1Ze76JQ;License: Standard Youtube License