He was in Montego Bay on special assignment for 3 days and spent an average of $20,000 per day, which he paid using the company's credit card. He gets a housing allowance of $60,000 monthly. Required Compute his gross emoluments for the month of July. State your assumptions for the computation.

He was in Montego Bay on special assignment for 3 days and spent an average of $20,000 per day, which he paid using the company's credit card. He gets a housing allowance of $60,000 monthly. Required Compute his gross emoluments for the month of July. State your assumptions for the computation.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 30CE: LO.2 In 2019, Chaya Corporation, an accrual basis, calendar year taxpayer, provided services to...

Related questions

Question

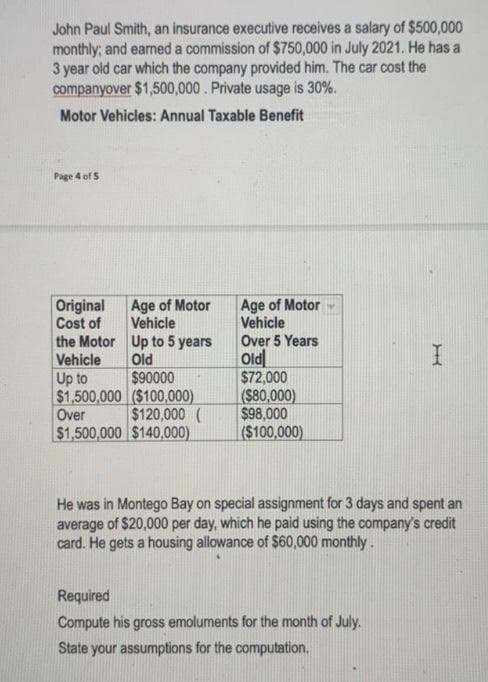

Transcribed Image Text:John Paul Smith, an insurance executive receives a salary of $500,000

monthly; and earned a commission of $750,000 in July 2021. He has a

3 year old car which the company provided him. The car cost the

companyover $1,500,000. Private usage is 30%.

Motor Vehicles: Annual Taxable Benefit

Page 4 ofS

Age of Motor

Vehicle

Age of Motor

Vehicle

the Motor Up to 5 years

Old

$90000

$1,500,000 ($100,000)

$120,000 (

$1,500,000 $140,000)

Original

Cost of

Over 5 Years

Old

$72,000

Vehicle

Up to

(S80,000)

$98,000

($100,000)

Over

He was in Montego Bay on special assignment for 3 days and spent an

average of $20,000 per day, which he paid using the company's credit

card. He gets a housing allowance of $60,000 monthly.

Required

Compute his gross emoluments for the month of July.

State your assumptions for the computation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT