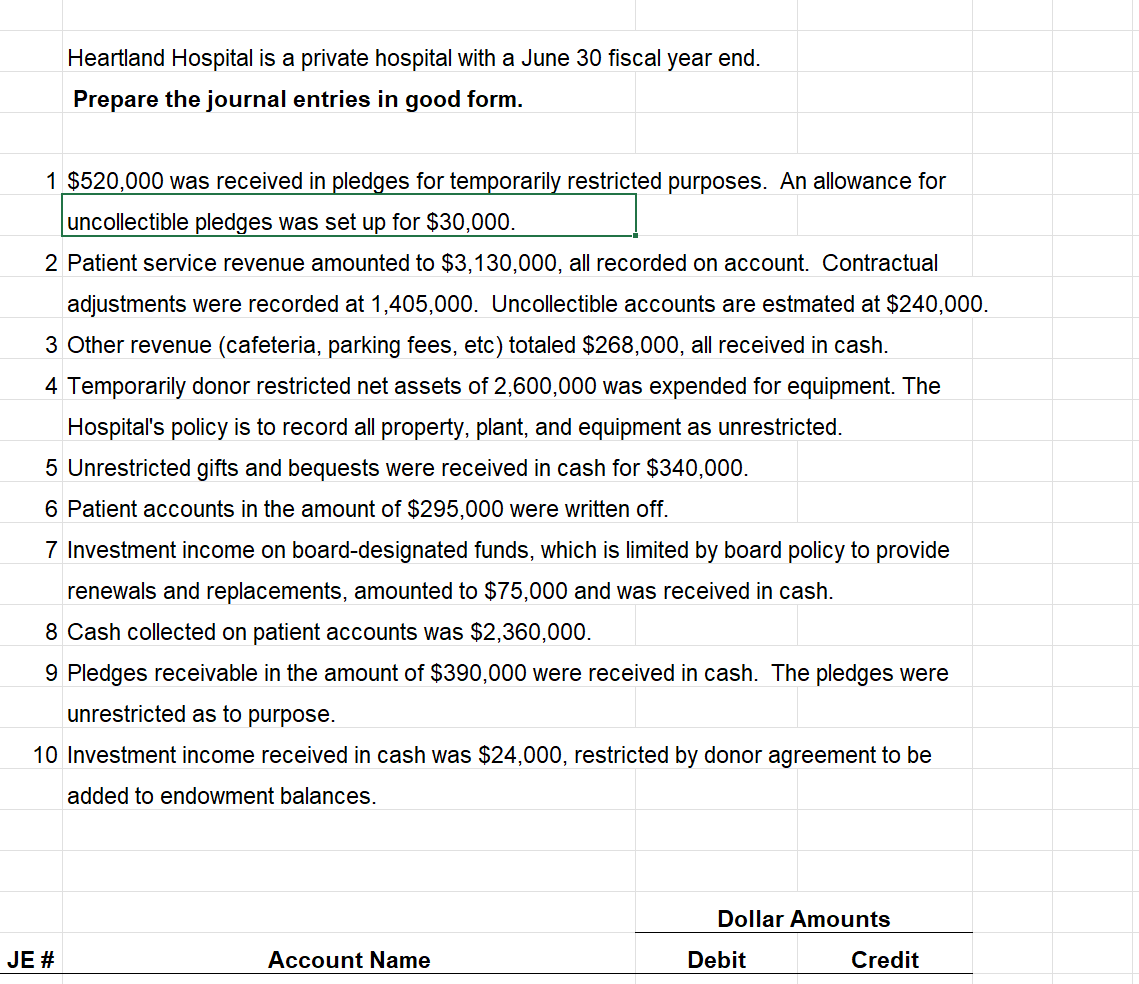

Heartland Hospital is a private hospital with a June 30 fiscal year end. Prepare the journal entries in good form. 1 $520,000 was received in pledges for temporarily restricted purposes. An allowance for uncollectible pledges was set up for $30,000. 2 Patient service revenue amounted to $3,130,000, all recorded on account. Contractual adjustments were recorded at 1,405,000. Uncollectible accounts are estmated at $240,000. 3 Other revenue (cafeteria, parking fees, etc) totaled $268,000, all received in cash. 4 Temporarily donor restricted net assets of 2,600,000 was expended for equipment. The Hospital's policy is to record all property, plant, and equipment as unrestricted. 5 Unrestricted gifts and bequests were received in cash for $340,000. 6 Patient accounts in the amount of $295,000 were written off. 7 Investment income on board-designated funds, which is limited by board policy to provide renewals and replacements, amounted to $75,000 and was received in cash. 8 Cash collected on patient accounts was $2,360,000. 9 Pledges receivable in the amount of $390,000 were received in cash. The pledges were unrestricted as to purpose. 10 Investment income received in cash was $24,000, restricted by donor agreement to be added to endowment balances.

Heartland Hospital is a private hospital with a June 30 fiscal year end. Prepare the journal entries in good form. 1 $520,000 was received in pledges for temporarily restricted purposes. An allowance for uncollectible pledges was set up for $30,000. 2 Patient service revenue amounted to $3,130,000, all recorded on account. Contractual adjustments were recorded at 1,405,000. Uncollectible accounts are estmated at $240,000. 3 Other revenue (cafeteria, parking fees, etc) totaled $268,000, all received in cash. 4 Temporarily donor restricted net assets of 2,600,000 was expended for equipment. The Hospital's policy is to record all property, plant, and equipment as unrestricted. 5 Unrestricted gifts and bequests were received in cash for $340,000. 6 Patient accounts in the amount of $295,000 were written off. 7 Investment income on board-designated funds, which is limited by board policy to provide renewals and replacements, amounted to $75,000 and was received in cash. 8 Cash collected on patient accounts was $2,360,000. 9 Pledges receivable in the amount of $390,000 were received in cash. The pledges were unrestricted as to purpose. 10 Investment income received in cash was $24,000, restricted by donor agreement to be added to endowment balances.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 4RE

Related questions

Question

Transcribed Image Text:Heartland Hospital is a private hospital with a June 30 fiscal year end.

Prepare the journal entries in good form.

1 $520,000 was received in pledges for temporarily restricted purposes. An allowance for

uncollectible pledges was set up for $30,000.

2 Patient service revenue amounted to $3,130,000, all recorded on account. Contractual

adjustments were recorded at 1,405,000. Uncollectible accounts are estmated at $240,000.

3 Other revenue (cafeteria, parking fees, etc) totaled $268,000, all received in cash.

4 Temporarily donor restricted net assets of 2,600,000 was expended for equipment. The

Hospital's policy is to record all property, plant, and equipment as unrestricted.

5 Unrestricted gifts and bequests were received in cash for $340,000.

6 Patient accounts in the amount of $295,000 were written off.

7 Investment income on board-designated funds, which is limited by board policy to provide

renewals and replacements, amounted to $75,000 and was received in cash.

8 Cash collected on patient accounts was $2,360,000.

9 Pledges receivable in the amount of $390,000 were received in cash. The pledges were

unrestricted as to purpose.

10 Investment income received in cash was $24,000, restricted by donor agreement to be

added to endowment balances.

Dollar Amounts

JE #

Account Name

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning