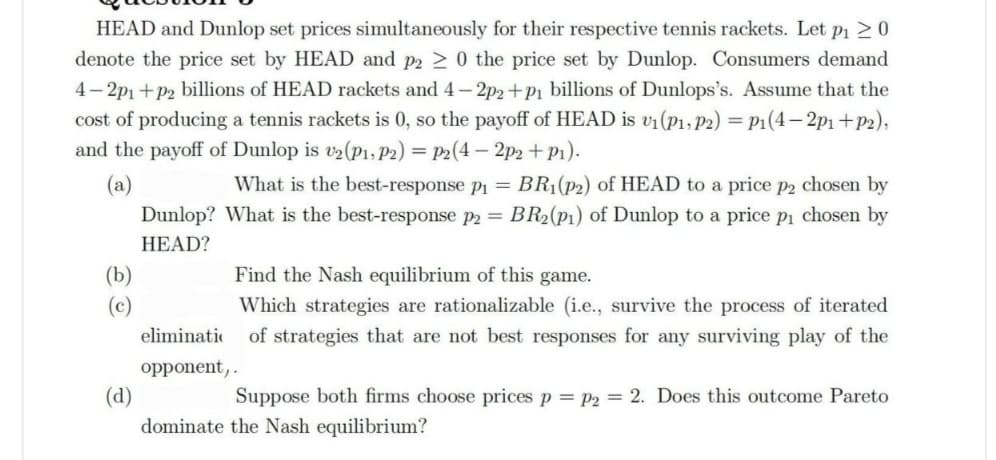

HEAD and Dunlop set prices simultaneously for their respective tennis rackets. Let p₁ ≥ 0 denote the price set by HEAD and p220 the price set by Dunlop. Consumers demand 4-2p1+p2 billions of HEAD rackets and 4-2p2+P₁ billions of Dunlops's. Assume that the cost of producing a tennis rackets is 0, so the payoff of HEAD is v₁ (P1, P2) = P₁(4-2p₁+P₂), and the payoff of Dunlop is v2 (P1, P2) = P2(4-2p2+P1). (a) What is the best-response p₁ = BR1(p2) of HEAD to a price p2 chosen by What is the best-response p2 = BR₂(p1) of Dunlop to a price p₁ chosen by Dunlop? HEAD? Find the Nash equilibrium of game (b)

HEAD and Dunlop set prices simultaneously for their respective tennis rackets. Let p₁ ≥ 0 denote the price set by HEAD and p220 the price set by Dunlop. Consumers demand 4-2p1+p2 billions of HEAD rackets and 4-2p2+P₁ billions of Dunlops's. Assume that the cost of producing a tennis rackets is 0, so the payoff of HEAD is v₁ (P1, P2) = P₁(4-2p₁+P₂), and the payoff of Dunlop is v2 (P1, P2) = P2(4-2p2+P1). (a) What is the best-response p₁ = BR1(p2) of HEAD to a price p2 chosen by What is the best-response p2 = BR₂(p1) of Dunlop to a price p₁ chosen by Dunlop? HEAD? Find the Nash equilibrium of game (b)

Chapter15: Imperfect Competition

Section: Chapter Questions

Problem 15.12P

Related questions

Question

Transcribed Image Text:HEAD and Dunlop set prices simultaneously for their respective tennis rackets. Let p₁ ≥ 0

denote the price set by HEAD and p2 ≥ 0 the price set by Dunlop. Consumers demand

4-2p1+p2 billions of HEAD rackets and 4-2p2+p₁ billions of Dunlops's. Assume that the

cost of producing a tennis rackets is 0, so the payoff of HEAD is v₁ (P₁, P2) = P1(4-2p₁+P2),

and the payoff of Dunlop is v2 (P1, P2) = P2(4-2p2 +P₁).

(a)

What is the best-response p₁ = BR₁(p2) of HEAD to a price p2 chosen by

What is the best-response p2 = . BR₂ (p1) of Dunlop to a price p₁ chosen by

Dunlop?

HEAD?

Find the Nash equilibrium of this game.

Which strategies are rationalizable (i.e., survive the process of iterated

of strategies that are not best responses for any surviving play of the

eliminatio

opponent,.

(d)

Suppose both firms choose prices p = P2 = 2. Does this outcome Pareto

dominate the Nash equilibrium?

(b)

(c)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you