hen valuing ending inventory under a perpetual inventory system, the O A. valuation using the FIFO assumption is the same as under the periodic inventory system. O B. moving average requires that a new average be computed after every sale. O C. valuation using the average-cost assumption is the same as the valuation using the average-

hen valuing ending inventory under a perpetual inventory system, the O A. valuation using the FIFO assumption is the same as under the periodic inventory system. O B. moving average requires that a new average be computed after every sale. O C. valuation using the average-cost assumption is the same as the valuation using the average-

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 44E: Perpetual and Periodic Inventory Systems Below is a list of inventory systems options. a. Perpetual...

Related questions

Topic Video

Question

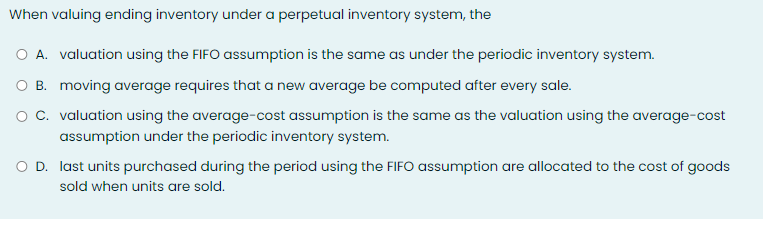

Transcribed Image Text:When valuing ending inventory under a perpetual inventory system, the

O A. valuation using the FIFO assumption is the same as under the periodic inventory system.

O B. moving average requires that a new average be computed after every sale.

O C. valuation using the average-cost assumption is the same as the valuation using the average-cost

assumption under the periodic inventory system.

O D. last units purchased during the period using the FIFO assumption are allocated to the cost of goods

sold when units are sold.

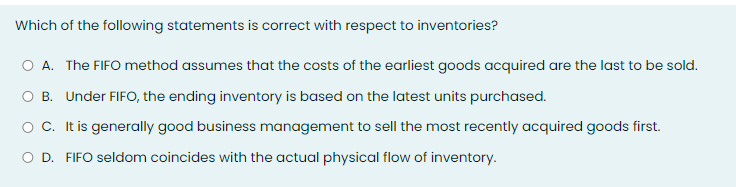

Transcribed Image Text:Which of the following statements is correct with respect to inventories?

A. The FIFO method assumes that the costs of the earliest goods acquired are the last to be sold.

B. Under FIFO, the ending inventory is based on the latest units purchased.

OC. It is generally good business management to sell the most recently acquired goods first.

O D. FIFO seldom coincides with the actual physical flow of inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College