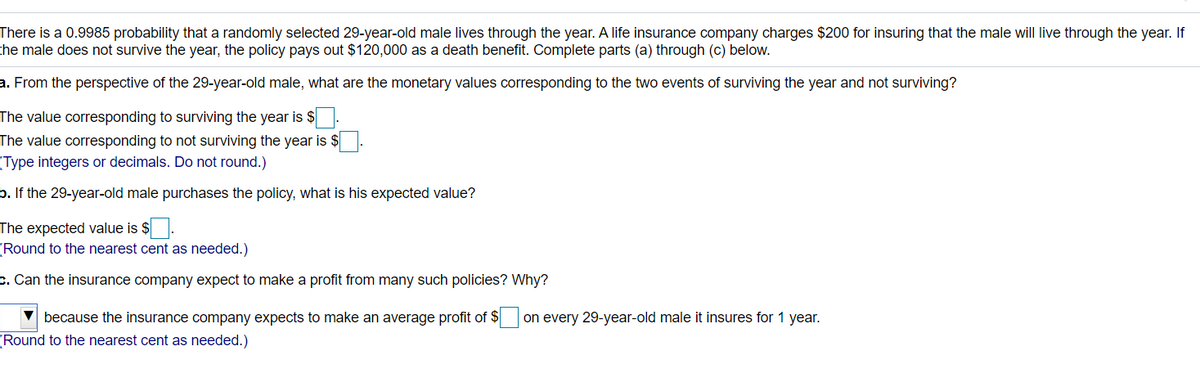

here is a 0.9985 probability that a randomly selected 29-year-old male lives through the year. A life insurance company charges $200 for insuring that the male will live through the year. he male does not survive the year, the policy pays out $120,000 as a death benefit. Complete parts (a) through (c) below. . From the perspective of the 29-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? he value corresponding to surviving the year is $. he value corresponding to not surviving the year is $[ Type integers or decimals. Do not round.) . If the 29-year-old male purchases the policy, what is his expected value? he expected value is $ Round to the nearest cent as needed.) . Can the insurance company expect to make a profit from many such policies? Why? because the insurance company expects to make an average profit of $| on every 29-year-old male it insures for 1 year. Round to the nearest cent as needed.)

Family of Curves

A family of curves is a group of curves that are each described by a parametrization in which one or more variables are parameters. In general, the parameters have more complexity on the assembly of the curve than an ordinary linear transformation. These families appear commonly in the solution of differential equations. When a constant of integration is added, it is normally modified algebraically until it no longer replicates a plain linear transformation. The order of a differential equation depends on how many uncertain variables appear in the corresponding curve. The order of the differential equation acquired is two if two unknown variables exist in an equation belonging to this family.

XZ Plane

In order to understand XZ plane, it's helpful to understand two-dimensional and three-dimensional spaces. To plot a point on a plane, two numbers are needed, and these two numbers in the plane can be represented as an ordered pair (a,b) where a and b are real numbers and a is the horizontal coordinate and b is the vertical coordinate. This type of plane is called two-dimensional and it contains two perpendicular axes, the horizontal axis, and the vertical axis.

Euclidean Geometry

Geometry is the branch of mathematics that deals with flat surfaces like lines, angles, points, two-dimensional figures, etc. In Euclidean geometry, one studies the geometrical shapes that rely on different theorems and axioms. This (pure mathematics) geometry was introduced by the Greek mathematician Euclid, and that is why it is called Euclidean geometry. Euclid explained this in his book named 'elements'. Euclid's method in Euclidean geometry involves handling a small group of innately captivate axioms and incorporating many of these other propositions. The elements written by Euclid are the fundamentals for the study of geometry from a modern mathematical perspective. Elements comprise Euclidean theories, postulates, axioms, construction, and mathematical proofs of propositions.

Lines and Angles

In a two-dimensional plane, a line is simply a figure that joins two points. Usually, lines are used for presenting objects that are straight in shape and have minimal depth or width.

a,b,c

Trending now

This is a popular solution!

Step by step

Solved in 2 steps